Generally, I opt for wide-reaching index funds that mimic the market, such as the Vanguard S&P 500 ETF (VOO at 0.65%). This exchange-traded fund (ETF) closely follows the stocks of the well-known S&P 500 (^GSPC at 0.54%) index, delivering a powerful blend of strong long-term gains and extensive diversification.

If you’re seeking a swift introduction to the AI revolution without devoting extensive time and resources on selecting specific stocks, there are various ETFs (Exchange Traded Funds) designed for this purpose. Among them, one particularly catches my attention as a potential investment opportunity at present.

Meet the Global X AI fund

Allow me to present the Global X Robotics and Artificial Intelligence Exchange-Traded Fund, commonly known as Global X AI for short. It currently stands at 2.03%.

It’s common for AI-focused ETFs to resemble the standard S&P 500 quite a bit. This is because a significant portion of the market value in the S&P 500 is held by companies leading in AI technology. If you were to label nine out of the top ten largest companies in the S&P 500 as AI-related today, it wouldn’t be surprising. Since these large companies dominate the market cap, they tend to significantly influence the performance of the index and any ETFs that mimic its structure.

But the Global X AI marches to a different drum.

A refreshingly different AI portfolio

The similarity between this fund and the S&P 500 is quite minimal. Nvidia, which currently stands at a 1.06% increase, is the sole company from Global X AI’s top ten holdings that also figures in the top 10 heavyweights within the market index.

Nvidia makes up a significant portion in the Global X AI portfolio, accounting for 11.5%, which is more than double its representation among S&P 500 companies at 7.4%. However, the top ten stocks in this portfolio are distinctly diverse compared to the S&P 500. The same diversity applies to the other 98 components of the Global X AI portfolio as well.

Among the top 20 Global X AI stocks, just Nvidia and Intuitive Surgical are part of the S&P 500. There are nine stocks from exchanges in Japan, Sweden, and South Korea as well, adding a good mix of geographical diversity. In this list, UiPath, a process automation specialist, holds a 2.4% share, while SoundHound AI, an intriguing voice command company, makes up 1.7%. (UiPath: 2.4%, SoundHound AI: 1.7%)

Here’s my take: Instead of the usual suspects when it comes to AI, I’ve compiled a unique collection – a carefully selected group of companies poised for significant growth as they embrace and optimize the use of robotics and artificial intelligence.

Why this AI fund looks tasty right now

This Global X AI fund introduces a fresh perspective for investors focused on Artificial Intelligence. Unlike many similar funds, it employs an unconventional selection of AI-related stocks. So, what makes me suggest this particular ETF right now?

The Global X AI fund offers a unique angle for AI investors as it chooses a distinct set of AI stocks that differ from those typically found in similar funds. But, why do I think this ETF is worth considering at the present time?

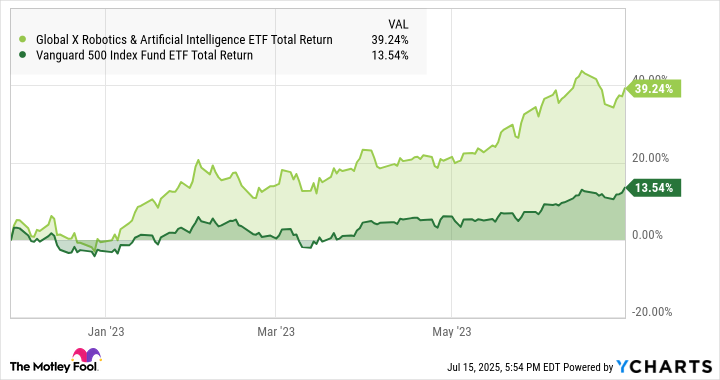

It’s worth noting that this investment fund tends to perform exceptionally well during periods when the AI market is thriving. For instance, it managed to triple the returns of the S&P 500 within the initial months following the introduction of ChatGPT in November 2022, demonstrating a remarkable growth trajectory.

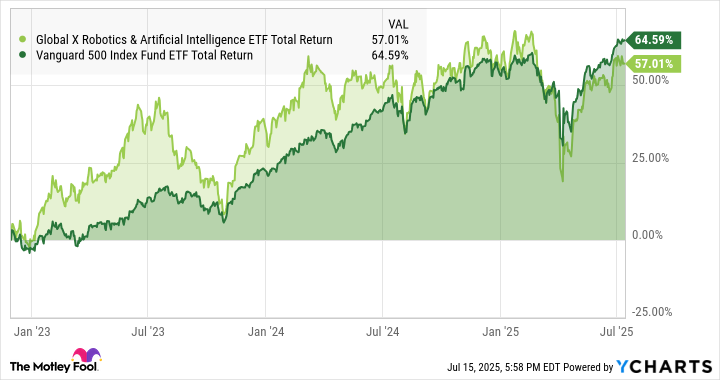

Over the past two years, it has fallen behind the general market, releasing steam as it were. To be precise, the S&P 500 has now matched the performance of Global X AI since ChatGPT gained popularity. If we consider Global X AI as a stock that was highly favored in the market two years ago, it has experienced a significant decline in recent months.

If you’re concerned that the current value of the S&P 500 seems high due to excessive market worth derived from risky profits of a few early AI frontrunners, now might be an opportunity for you to place your wagers on an alternative investment group instead.

While I can’t promise that this Global X AI ETF will surpass the Vanguard S&P 500 ETF or any other fund in the long term, it’s often said that buying low and selling high is a key to success. That’s the potential I see in the Global X AI ETF right now.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-18 01:39