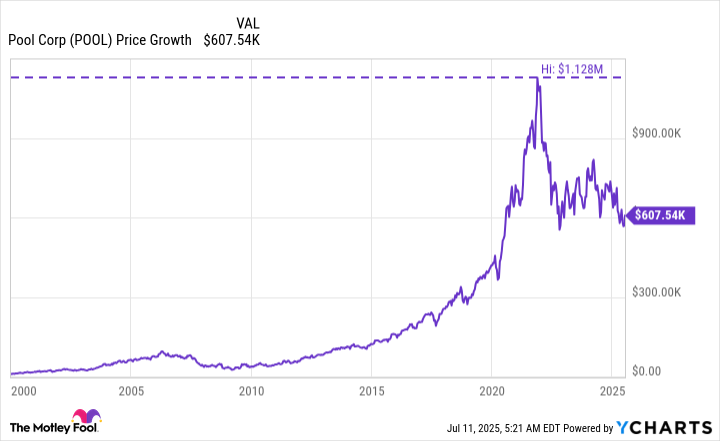

It’s plausible that Pool Corporation (POOL 2.27%) may have already made a select group of millionaires, considering an initial investment as low as $10,000 at the turn of the century. However, it subsequently suffered a loss of approximately 45% in value.

Could it be possible that additional support might be on its way? It seems that at least one notable investor – Berkshire Hathaway, which owns the stock – believes this could happen. Here’s a potential explanation for their perspective.

Pool Corp. has a growth bias

Business at Pool revolves around selling essential items for constructing, enhancing, and preserving swimming pools. While the core business might seem ordinary, there’s an intriguing factor to owning a pool that deserves attention; once built, regular maintenance is crucial to prevent your backyard oasis from transforming into an unsanitary swamp instead of a venue for enjoyable family time. This ongoing need for maintenance adds a growth-oriented aspect to Pool’s business operations.

Approximately two-thirds of Pool’s revenue comes from sales of maintenance and repair items. Each newly constructed pool adds to this part of the business by expanding our customer base, and these customers tend to remain until the pool is demolished. The remaining third of the business revolves around constructing new pools and refurbishing older ones.

Building swimming pools typically experiences peak construction during periods of strong economic growth. Consequently, economic downturns or recessions can negatively impact Pool’s business in the short term. Moreover, increased interest rates have been a challenge lately because they make it more difficult for people to afford building a pool. This trend may be contributing to the decline in Pool’s stock price.

The substantial increase in value of the initial $10,000 investment made at the beginning of 2000, surpassing $1 million, can be attributed primarily to the coronavirus pandemic. In this period, interest rates were significantly lower and, as a result, people had more spare time due to being required to stay at home. This led many individuals to invest in home improvements, such as building pools, which boosted Pool’s overall financial performance considerably.

Warren Buffett and Berkshire Hathaway buy Pool

At its highest point, Pool might have seemed a bit pricey. Yet, when it plummeted, it piqued Warren Buffett and Berkshire Hathaway’s interest. Buffett prefers purchasing well-managed companies when they seem undervalued. However, the crucial aspect is that he then likes to maintain these investments for the long haul, reaping benefits from the businesses’ growth over time.

This situation with Pool offers a captivating angle for investors, as Wall Street might have prematurely enthusiasm about the stock amidst the pandemic. With the shares experiencing such a significant drop, it appears that the underlying growth potential of the company is being disregarded. However, this doesn’t mean that Pool is free from challenges; rather, those challenges may not be sufficient to undermine the company over an extended period, thanks to the supportive foundation provided by its maintenance-focused operations.

Is it plausible that putting $10,000 into Pool now could potentially turn into a million dollars? While it’s impossible to predict such an outcome for certain, considering the type of business, it certainly appears as a feasible prospect.

In other words, much like Warren Buffett, it’s advisable to purchase and keep these investments for an extended period. It’s unlikely that you’ll see immediate profits – instead, expect gradual advancements to be the norm. However, with time, these small, consistent gains can accumulate into substantial wealth.

Follow Buffett’s lead with Pool?

It is not wise to purchase a stock solely because another investor has done so. Always ensure it aligns with your unique investment strategy. For instance, Pool may offer only a minimal dividend return of 1.7%. However, if you favor growth and have a long-term perspective, the potential growth within Pool’s business model could make this stock an intriguing option for further examination today. This applies whether you are investing $10,000 or merely $1,000.

Read More

- 39th Developer Notes: 2.5th Anniversary Update

- TON PREDICTION. TON cryptocurrency

- Gold Rate Forecast

- The Hidden Treasure in AI Stocks: Alphabet

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- If the Stock Market Crashes in 2026, There’s 1 Vanguard ETF I’ll Be Stocking Up On

- The Academy Has Reveales the Best Visual Effects Contenders Shortlist for the 2026 Oscars

- Games That Bombed Because of Controversial Developer Tweets

- Senate’s Crypto Bill: A Tale of Delay and Drama 🚨

- Lumentum: A Signal in the Static

2025-07-18 00:37