The use of Artificial Intelligence (AI) is advancing swiftly, with businesses and administrations worldwide increasing investments in this technology. This growth not only enhances productivity and streamlines operations but also accelerates decision-making by processing data instantaneously.

It’s no wonder that the need for AI software is rapidly expanding, aiming to unleash the full power of this technology. According to ABI Research, the AI software market could experience an impressive yearly growth rate of 25%, reaching a staggering $467 billion in annual revenue by 2030. Palantir Technologies, with its ticker symbol PLTR (up 2.13%), is a company that offers investors the chance to profit from this promising sector.

As an observer, I’ve noticed a significant surge in the growth of the software specialist, largely fueled by the robust appetite for its AI solutions. Remarkably, Palantir’s stock has soared more than five times in the past year due to AI, pushing its market capitalization to an impressive $335 billion. Admittedly, the current share price is steep after such a dramatic rise, but it wouldn’t be unreasonable to anticipate another threefold increase in the next five years, potentially bringing Palantir’s market cap up to a staggering $1 trillion. Here’s why this might transpire.

Palantir’s growth rate is set to accelerate remarkably in the next three years

The surge of artificial intelligence (AI) has opened up an extraordinary chance for growth, and notably, Palantir has seized this opportunity over the past few years through its Artificial Intelligence Platform (AIP). Launched in April 2023, this platform has garnered significant attention from both governmental and commercial clients due to its ability to incorporate AI into their day-to-day business activities.

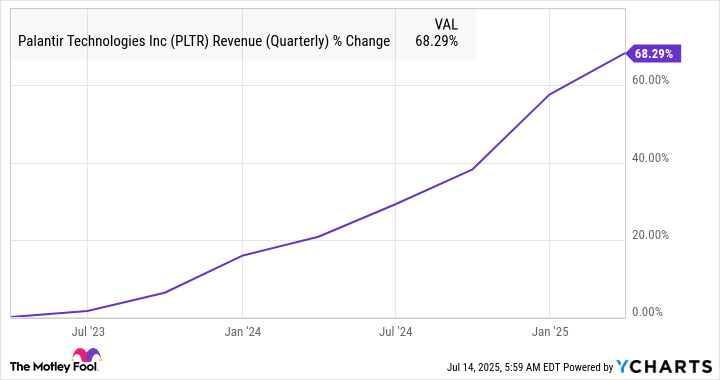

Companies of significant size and influence are leveraging Artificial Intelligence Processes (AIP) not just for automating operational tasks, but also for creating AI tools and workflows. The popularity of AIP has surged since its introduction, as demonstrated by the substantial growth in Palantir’s revenue over the past two years.

We’re only seeing the start of things here. The AI software market is projected to expand at a steady rate in the coming five years, and Palantir is growing at an even more rapid speed. In the first quarter of 2025, its revenue soared by 39% compared to the previous year, reaching $884 million. As the chart above suggests, this growth trend has been consistently climbing higher with each passing quarter.

The advancement in Artificial Intelligence (AIP) plays a pivotal role in Palantir’s expansion, as it not only draws fresh clients towards its platform but also strengthens its relationship with existing ones, leading to larger deals being sealed. Consequently, the company has been able to secure deals worth an impressive $6 billion by the end of the first quarter, which represents the total value of contracts still pending at that point – commonly known as Palantir’s Remaining Deal Value (RDV).

One key point to highlight is that Palantir’s Research & Development Value (RDV) saw a significant boost, increasing by 45% compared to the same time last year. This growth surpasses the progress made in its overall income. Consequently, it’s clear that Palantir’s growth rate currently exceeds the projected annual expansion rate of the AI software market over the next ten years. Furthermore, it’s worth mentioning that Palantir’s RDV nearly doubles the revenue it generated within the last year. This suggests that the company might maintain its rapid income growth pace and potentially capture a larger portion of the promising AI software market.

The path to a $1 trillion valuation

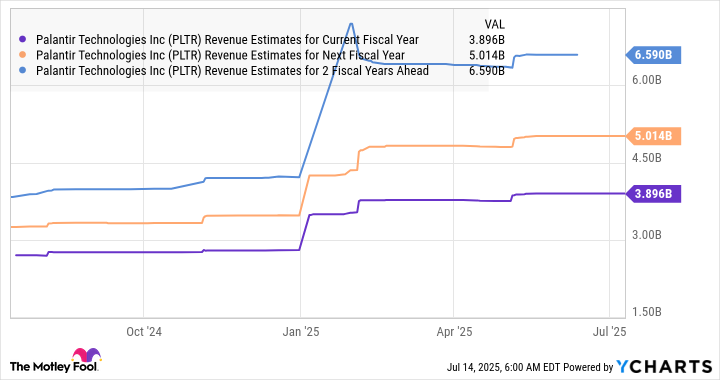

It is evident from the graph that analysts anticipate an improvement in Palantir’s rate of revenue increase.

It is possible that the swift advancement in AI software could propel Palantir beyond its projected revenue growth. Current forecasts predict a 36% surge in Palantir’s revenue by 2025, reaching $3.9 billion, as per their own expectations. The expanding customer base and Palantir’s knack for securing larger contracts from existing clients could contribute to exceeding these projections.

If Palantir manages to boost its annual income by 40% to reach $4 billion this year and sustains this growth rate over the next five years, it’s projected that the company’s revenue would reach around $28 billion in the year 2030. Currently, Palantir is priced at a staggering 113 times its sales, reflecting the market’s high valuation of the stock due to its dominant role in the AI software industry, strong customer demand for its services, and the attractive long-term prospects it presents.

If its sales multiple decreases by two-thirds over five years, which would be a significant reduction from its current levels, Palantir’s market capitalization could still surpass $1 trillion in that timeframe. Given its ability to outpace the growth rate of the AI software industry, it is reasonable to expect that Palantir will maintain a higher valuation after five years.

For those investors focused on growth, it might be worthwhile to overlook Palantir’s current valuation. The company boasts robust factors that could drive substantial growth for an extended period, potentially leading to increased returns in the market.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Here Are the Best TV Shows to Stream this Weekend on Hulu, Including ‘Fire Force’

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Banks & Shadows: A 2026 Outlook

- MicroStrategy’s $1.44B Cash Wall: Panic Room or Party Fund? 🎉💰

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-07-18 00:28