Cathie Wood is often known for her outspoken enthusiasm towards advanced technologies such as AI, robotics, and self-driving cars on Wall Street. Her company, Ark Invest, manages a group of investment funds that put money into businesses active within these technology sectors.

This year, Ark published their annual “Big Ideas” report for 2025, showcasing revised projections for several investment themes they favor. In the section discussing the future of logistics, the company projected a potential revenue opportunity worth $860 billion by 2030 from autonomous delivery robots, drones, and trucks.

A relatively small company, Serve Robotics (valued at approximately $600 million), is making waves in the last-mile logistics sector by developing autonomous food delivery robots. They’ve secured a significant contract with Uber Technologies to roll out 2,000 of these robots this year, and if predictions from Ark are on point, this could be just the beginning. However, one might wonder whether it’s wise to invest now?

Breaking down the opportunity

Ark’s projected $860 billion total includes separate segments: $160 billion earmarked for food delivery, $280 billion for parcel delivery, and a whopping $420 billion for larger freight to be transported by self-driving trucks. Initially, Serve focused on food delivery using autonomous robots that navigate sidewalks, but they’re now branching out into drones and other innovative last-mile solutions, potentially extending their service to parcel deliveries as well.

The newest Gen3 robots from our company are powered by Nvidia’s Jetson Orin platform, offering the necessary computing capabilities for self-operation. These Gen3 robots function autonomously in specified zones on the sidewalks, reaching level 4 autonomy – a state where they can navigate without human assistance.

Exploiting the projected $160 billion market for autonomous food delivery by 2030 might necessitate deploying millions of robots globally. The 2,000 new Gen3 models that Serve is set to release this year under its partnership with Uber Eats will serve as a testament to its business strategy and prepare the ground for broader implementation. Approximately 250 of these models are expected to be operational in the first quarter of 2025, with around 700 more joining by the end of Q3, followed by the remaining units becoming active before year-end.

This year, the implementation of new robotic systems allowed Serv to broaden its service offerings to both Miami and Dallas, while also launching operations in Atlanta as of June.

Serve’s revenue could soar, but it’s losing truckloads of money

Currently, our company’s income is experiencing some irregular fluctuations, which is common for businesses in the expansion phase. In the first quarter alone, revenue dropped by 53% compared to the same period last year, amounting to $440,465. This significant decrease, however, can be attributed to the fact that we’re comparing it to a time last year when our revenue was boosted by an unusual licensing payment of $850,000 from our partner, Magna International.

Additionally, Serve saw a significant 150% increase in its first-quarter earnings compared to the previous three months, excluding any abnormal payments. This growth indicates that its delivery business is gaining steady traction. As per Wall Street’s forecast (as reported by Yahoo! Finance), Serve’s revenue for 2025 is projected to reach an impressive $6.8 million, representing a substantial 275% rise compared to the expected 2024 figures.

By the year 2026, experts anticipate that Serves’ revenue will significantly increase by approximately 648%, amounting to an estimated $50.6 million, with even more of their robots being deployed for use.

However, it’s clear there’s a significant challenge: Growing an autonomous robotics business can be costly, as evidenced by Serve’s loss of $13.2 million in just one quarter of 2025. This puts the company on course to surpass its 2024 net loss of $39.2 million substantially. Even if Serve manages to generate $6.8 million in revenue this year, it won’t come close to covering expenses like research and development costs.

The business currently holds approximately $197 million in cash, allowing it to sustain current financial losses for several more years. However, it must map out a route towards profitability relatively soon to avoid needing another round of investment. Failing to do so could lead to the need for additional capital, which might dilute existing shareholders and potentially reduce their future profits.

Serve stock isn’t cheap, but should investors buy it anyway?

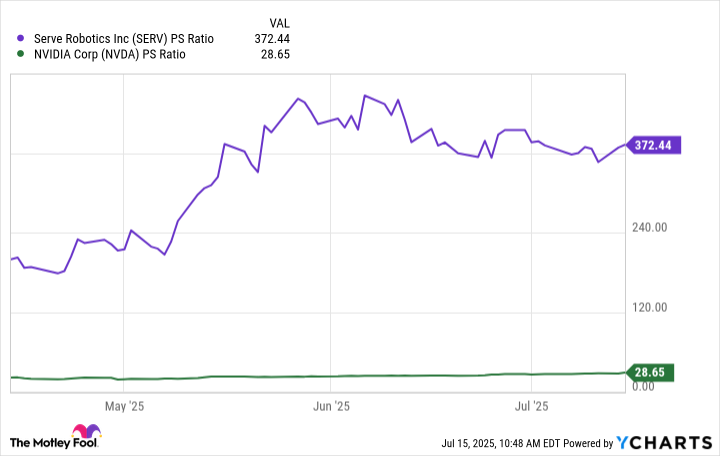

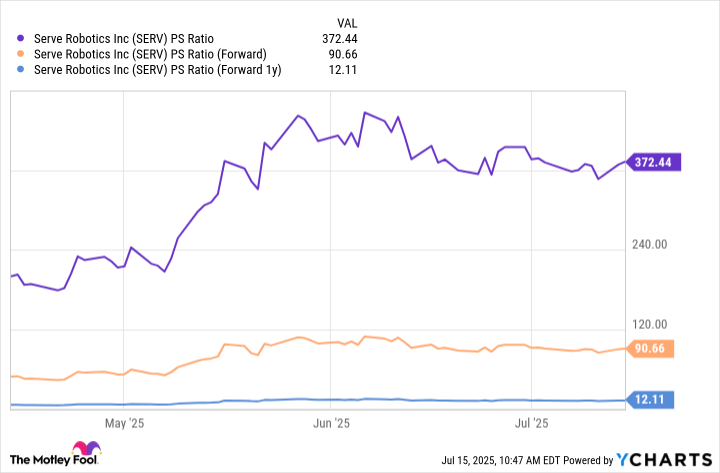

In simpler terms, as of July 15, Serves stocks are being sold at an extremely high price-to-sales ratio of 368, which is over 13 times more expensive than Nvidia using this metric. To put it bluntly, given its current valuation, I find it hard to justify purchasing Serves stock at this time.

A more reasonable assessment of the stock can be made by evaluating it based on projected future revenue instead. If we suppose that the firm generates $6.8 million in revenue this year as predicted, its forward P/S ratio becomes 89.6 – still pricey but less absurdly so. Conversely, if we base its valuation on Wall Street’s forecasted revenue for 2026 of $50.6 million, it yields a 1-year forward P/S ratio of just 12. This might even be deemed inexpensive for a company experiencing such rapid growth.

However, there’s uncertainty about whether Serve will generate the projected revenue in the upcoming years as predicted by Wall Street. Consequently, it might be prudent for short- and medium-term investors to exercise caution when making their investment decisions.

If Ark’s predictions for the autonomous logistics industry in 2030 turn out to be correct, investing in Serve stocks today and keeping them until at least the next five years might be profitable, even with its currently high price tag.

Read More

- TON PREDICTION. TON cryptocurrency

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- 10 Hulu Originals You’re Missing Out On

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Is Kalshi the New Polymarket? 🤔💡

- Unlocking Neural Network Secrets: A System for Automated Code Discovery

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Brad Pitt Rumored For The Batman – Part II

2025-07-17 19:57