2025 saw tough times for investors in Nvidia (NVDA) during the initial months, with a dip in their market capitalization to approximately $2.3 trillion in April. This represented a significant drop of 37% compared to the high it had attained merely three months prior.

There were a number of factors that influenced Nvidia’s sell-off.

Initially, a Chinese startup known as DeepSeek emerged, boasting the development of their advanced R1 artificial intelligence (AI) model using older Nvidia graphics cards. This revelation sparked concerns among some investors that Nvidia’s latest, costly chipsets might no longer be essential for sustaining the expanding AI infrastructure globally.

Apart from DeepSeek, investors had additional concerns about how fresh U.S. tariff regulations might influence Nvidia’s expansion possibilities abroad. Moreover, stiff competition from Advanced Micro Devices, along with investments in custom silicon by tech giants like Microsoft, Amazon, and Alphabet, hinted at the possibility that Nvidia’s most prosperous periods could be in the past.

After a positive earnings report in May that boosted investor sentiment, there appears to be a growing belief among investors now that earlier concerns were exaggerated. As of July 11, Nvidia’s market capitalization surpasses $4 trillion, making it the most valuable company globally once more.

Checking out Nvidia’s valuation changes could be beneficial now, as its share prices are climbing, to decide if the stock is still a wise investment or if perhaps some investors might have already jumped on board too early.

Analyzing Nvidia’s valuation multiples

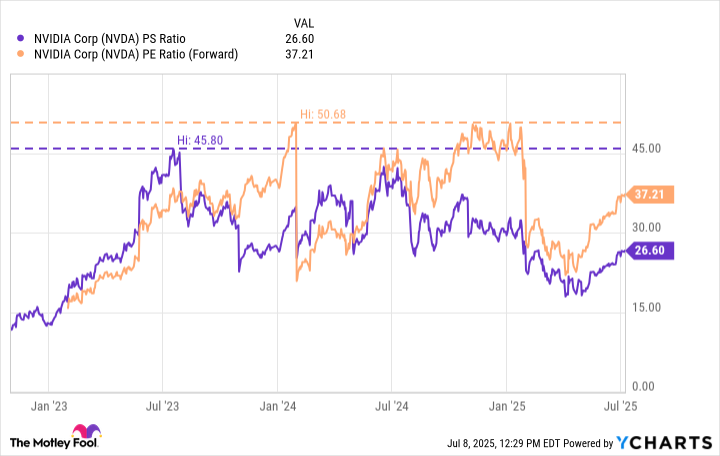

The graph you see shows the ratio of Nvidia’s stock price to its sales (price-to-sales, or P/S) and the ratio of its predicted earnings per share to its current stock price (forward price-to-earnings, or P/E) for the past few years.

It’s evident that Nvidia’s Price-to-Sales (P/S) and Price-to-Earnings (P/E) ratios are currently lower than their peaks during the AI revolution. However, it doesn’t automatically imply that Nvidia will reach or surpass its previous P/S of 46 and forward earnings multiple of 51.

In other words, it’s not always required for a company like Nvidia to grow its multiples for an increase in value. Instead, its future worth is primarily tied to its growth prospects.

Let’s delve into potential triggers that might stimulate significant expansion for Nvidia during the upcoming years.

What catalysts does Nvidia have?

Over the past several years, most of Nvidia’s expansion can be attributed to its data center division. This sector specializes in creating cutting-edge GPUs, which are utilized by major corporations worldwide for developing advanced artificial intelligence capabilities with a focus on generation.

It’s worth noting that the company also has several promising prospects beyond AI data centers, which some investors might not yet be fully aware of.

Initially, firms like Tesla and Alphabet have spent billions on researching autonomous driving technology. Notably, Nvidia is also involved in the self-driving car sector. In the first quarter alone, it garnered $567 million from its automotive services, marking a 72% increase compared to the previous year. This surge propels the segment’s annual revenue run rate to an impressive $2.3 billion. To provide some context, Nvidia’s data center business earns well above $100 billion in sales annually.

Though the automotive industry might not reach the same magnitude as the data center market, I am optimistic that Nvidia has significant potential for expansion in this sector, given the ongoing advancements in autonomous vehicle technology. With strategic partnerships with companies like General Motors, Toyota Motor, Mercedes-Benz, Volvo, Rivian Automotive, BYD, and numerous others, Nvidia is well-positioned to capitalize on the growing trend of self-driving cars. This makes the company a neutral recipient, profiting from the overall expansion of autonomous vehicles.

An additional relevant development is the growth of automated robotics powered by artificial intelligence. Companies like Tesla and Figure AI are constructing humanoid robots designed to aid workforces in labor-heavy industries, such as warehouses. Furthermore, Amazon is incorporating various robotics-centric procedures into its distribution centers to enhance efficiency.

Nvidia holds investments in Figure AI, and their CEO, Jensen Huang, has emphasized that the field of robotics represents a potential multi-trillion dollar market within the expansive domain of artificial intelligence.

In conclusion, although IonQ and Rigetti Computing typically garner the majority of the spotlight in the realm of quantum computing, it’s essential that investors don’t overlook Nvidia.

Apart from creating hardware, Nvidia additionally designs a software platform for artificial intelligence known as CUDA. Remarkably, they have subtly tailored this architecture for various other fields, and quantum computing is one such area, achieved through the launch of the CUDA-Q platform.

Is Nvidia stock a buy right now?

One commonality linking autonomous vehicles, robotics, and quantum computing is that they are all in their infancy stages, yet to fully unfold their potential. While their commercial impact is still relatively small, each technology holds the promise of causing widespread disruption across various global industries. Interestingly, Nvidia finds itself strategically positioned as it provides both hardware and software solutions to drive these cutting-edge technologies.

As Nvidia’s valuation multiples have dropped from their highest points, some investors might view the company as entering a maturity phase. However, others might harbor concerns about Nvidia’s capacity to maintain its rapid growth pace, leading them to factor in some level of risk in their valuations.

Based on the points discussed earlier, I believe that Nvidia’s stock is likely to rise in the future. The company’s strong share performance, coupled with numerous prospects for generating additional income and earnings, gives me confidence that Nvidia will surpass its current market value over time.

Based on these factors, it seems like an opportune moment to invest in Nvidia stocks and brace yourself for the ride. It looks like the next phase of growth is about to take off.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- Silver Rate Forecast

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-17 18:03