In the year 2025, Nebius Group (NBIS) has been among the most vibrant stocks, soaring an impressive 92% as of July 16. It appears that this cloud computing company’s scorching upward trend is set to persist, fueled by a vast potential market and favorable opinions from Wall Street analysts.

The Dutch company specializes in offering cloud-based artificial intelligence (AI) systems to clients. Their comprehensive AI platform enables programmers and users to lease high-performance graphics processing units (GPUs), such as those from Nvidia (NVDA 0.85%), on an hourly basis. This allows them to train, refine models, perform inference tasks, and develop custom AI solutions using third-party tools.

Let’s dive deeper into the actions of Nebius, and explore the reasons behind its anticipated continued rise as an AI stock, given its impressive growth already achieved in 2025.

Nebius is growing rapidly, and it can sustain its momentum

Nebius users have the flexibility to grow from a single GPU setup to vast multi-cluster systems depending on their needs. They can also leverage renowned large language models (LLMs) like those from DeepSeek, Microsoft, Meta Platforms, Stability AI, and more for application development. The company is recognized for providing premium Nvidia GPUs such as the H100 and H200, and they boast that their customers will be among the pioneers to access NVIDIA’s upcoming Blackwell platform.

It’s noteworthy to mention that Nvidia is among the investors in Nebulus, a company providing AI cloud infrastructure. Last December, they announced a private placement financing totaling $700 million. Nvidia participated in this strategic funding round, which Nebulus states is intended to speed up the deployment of its comprehensive infrastructure system.

Indeed, Nvidia and Nebius have a tight collaboration, which seems promising for Nebius given Nvidia’s global expansion of AI infrastructure. Notably, Nebius is swiftly establishing itself as a significant player in the burgeoning cloud AI infrastructure-as-a-service sector, as demonstrated by its impressive results.

In the initial quarter of 2025, Nebius’s revenue skyrocketed nearly five times compared to the same period the previous year, reaching an impressive $55.3 million. What’s noteworthy is that Nebius is only just beginning, yet it’s swiftly creating a robust system for generating income. The company boasts that its annualized run-rate revenue (ARR) soared by 684% in Q1 to an astounding $249 million, significantly outpacing the growth in total sales.

Looking forward, Nebius management expresses optimism about reaching an Annual Recurring Revenue (ARR) between $750 million and $1 billion by the close of 2025, as they continue expanding their cloud capacity. The company has grown rapidly, going from a single location to operating five data center locations within three quarters, and it is currently investigating potential new sites in both the United States and internationally.

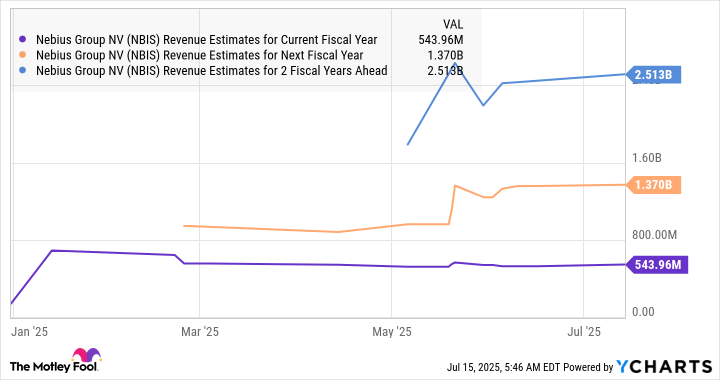

Nebius emphasizes that its strong financial position, boasting more than $1.4 billion in cash and just $187 million in debt, enables it to expand its data center capacity to 100 megawatts (MW) by the end of 2025, with further growth expected in 2026. This expansion strategy is what underpins the company’s projection of generating revenue between $500 million and $700 million in 2025. Remarkably, even at the lower end of this estimate, this projected revenue would represent a substantial leap compared to last year’s total income of $117 million.

It is anticipated that Nebius’ remarkable growth will persist for a few more years. This prediction isn’t shocking given the $400 billion potential in the cloud artificial intelligence infrastructure market.

It’s clear why Goldman Sachs anticipates Nebius’ AI stock to continue soaring, even after its strong performance in recent times. The investment bank thinks that Nebius is still underestimated due to the exceptional growth it’s experiencing. Goldman recommends buying Nebius and predicts a $68 price for the stock within the next year.

Implies approximately a 30% increase from the present values, but keep in mind that shares of Nebius surged by 17% in just one trading day post Goldman’s evaluation. Now, potential investors might question whether purchasing Nebius is advisable after its recent growth spurt.

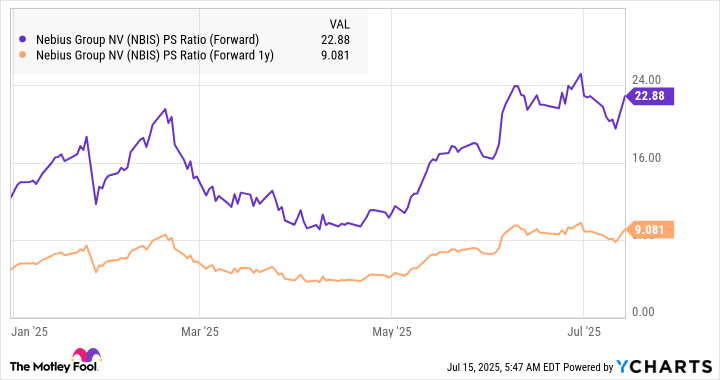

The stock is expensive, but there’s more to it than the valuation

Currently, Nebius’ stock is being traded at a high 68 times its sales, given its remarkable surge in 2025. However, it’s essential for investors to remember that this rapid expansion explains its elevated valuation. It’s worth noting that Goldman Sachas sees Nebius as potentially undervalued when considering its growth prospects.

In fact, the stock’s forward sales multiple is way lower than the trailing one.

It seems that Nebius could be a great choice for investors focusing on growth at the moment. Given its remarkable growth trajectory, there’s a strong possibility of further gains in the stock market, much as Goldman Sachs forecasts.

Read More

- TON PREDICTION. TON cryptocurrency

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- 10 Hulu Originals You’re Missing Out On

- 17 Black Voice Actors Who Saved Games With One Line Delivery

- Is T-Mobile’s Dividend Dream Too Good to Be True?

- The Gambler’s Dilemma: A Trillion-Dollar Riddle of Fate and Fortune

- Walmart: The Galactic Grocery Giant and Its Dividend Delights

- Gold Rate Forecast

- ‘A Charlie Brown Thanksgiving’ Tops Apple TV+’s Top 10 Most-Watched Movies List This Week

2025-07-17 17:49