The quantum computing era has come earlier than expected, transforming what was once considered a work of science fiction into actual calculations performed in research facilities and data centers globally. This development hasn’t gone unnoticed by investors; since the end of 2024, stocks related to quantum computing have seen significant growth.

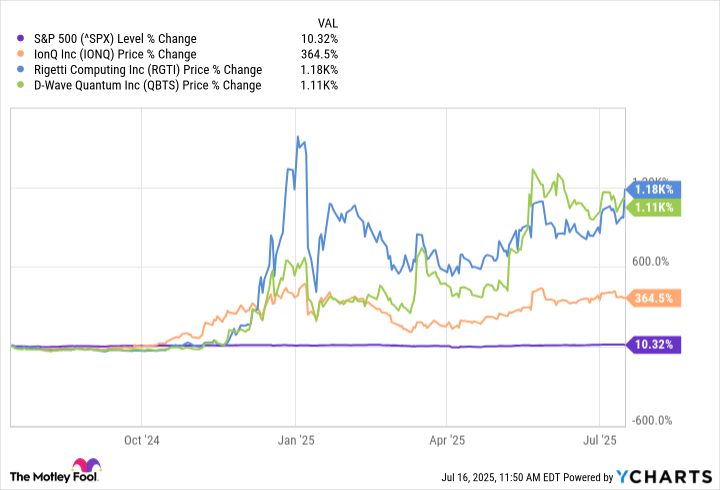

Quantum computing companies, such as IonQ, Rigetti Computing (RGTI), and D-Wave Quantum, have surpassed the S&P 500 in performance over the last year. This momentum is a sign of a significant change: Recent advancements in quantum technology are compressing the timeline for achieving commercial quantum advantage from several decades to just a few years.

While not every quantum stock might be worthy of your investment, following yesterday’s significant revelation, one enterprise stands out as an attractive competitor in the quest for practical quantum computing.

When progress is measured in decimal points

Rigetti Computing has made significant strides in quantum computing, managing to attain a 99.5% median accuracy for two-qubit gates on its latest 36-qubit modular system. This impressive achievement marks a double reduction in errors compared to their previous best results. This advancement brings them closer to the 99.9% threshold often mentioned by experts as a crucial milestone towards fault-tolerant quantum computing.

Yesterday, the company showcased the industry’s most substantial multichip quantum computer, constructed from four interconnected 9-qubit chiplets. This modular design is significant because it provides a viable route for expansion beyond the fabrication boundaries that hinder single-chip designs. Notably, Rigetti’s implementation of this modular strategy sets it apart, as IBM (IBM at 0.22%) and other competitors are also investigating similar architectures. However, Rigetti’s execution in this area is particularly noteworthy.

Gate speeds remain a key advantage

Rigetti’s superconducting qubits function significantly quicker compared to rival technologies such as ion traps and neutral atoms in the field of quantum computing. Speed is crucial here because it means we can perform more calculations before quantum states degrade, which is vital for tackling intricate problems effectively.

The business aims to debut its 36-quantum processor on August 15th. Furthermore, they aim to develop a more advanced, over 100-quantum chiplet system that maintains the same exceptional 99.5% accuracy by the end of 2025. Such goals are challenging in an industry often marked by setbacks.

Government contracts signal confidence, not dominance

In Q1 of 2025, Rigetti’s financial results showed an increase in government attention towards their innovative methods. The company successfully landed several research partnerships: a potential $1 million deal with DARPA’s Quantum Benchmarking Initiative, leading a $5.48 million consortium for the Air Force Office of Scientific Research, and a £3.5 million grant from the U.K.’s Quantum Mission.

When the Department of Defense and the U.K. government pour millions into your technological development, it shows they have faith in your methods. While these are research and development agreements instead of complete commercial rollouts, they endorse Rigetti’s technological strategy.

Building strategic alliances boosts credibility. Rigetti collaborates with Nvidia on mixed quantum-classical processes, implying that Nvidia, the chip titan, recognizes potential in Rigetti’s system. Moreover, Quanta Computer sealed a $35 million investment deal in April, contributing manufacturing know-how to their partnership.

The balance sheet provides runway, not immunity

In June, Rigetti successfully closed a $350 million stock sale, boosting their cash reserves to roughly $575 million, all while maintaining a debt-free status. This substantial financial reserve allows for ongoing operations, alleviating any immediate worries about dilution.

The first quarter earnings of 2025 totaled $1.5 million, which is relatively low for a company given its current valuation. Although developing revolutionary technology usually doesn’t generate revenue initially, it’s crucial for investors to pay close attention to the rate at which cash is being spent (cash burn). The quarterly operating expenses of approximately $22.1 million imply that, if these costs continue at their current pace, the company would have enough funds to operate for around six years.

This organization runs quantum computers via the cloud, offers on-site systems for national research facilities, and produces chips at Fab-1 – the pioneering quantum device manufacturing plant in the industry. However, these resources have yet to produce substantial income.

The path to quantum advantage remains challenging

Embracing quantum computing feels like stepping into a new era, akin to grasping the power of transistors or experiencing the dawn of the internet. The possibilities it unveils – from revolutionizing drug research and materials science to fortifying cryptography and refining financial modeling – could potentially reap trillions in value!

Rigetti’s modular design offers a practical route for expansion by connecting smaller units called chiplets to form larger systems. This method allows the company to utilize semiconductor industry practices while navigating certain physical limitations. However, the risk of implementation is significant, and companies like IonQ have greater valuations and more market momentum in this field.

Reality check for quantum investors

It is generally believed that true quantum advantage, where quantum computers can solve significant business problems quicker than traditional systems, will become a reality somewhere between 2026 and 2028. Rigetti’s achievement of 99.5% fidelity signifies substantial progress, but overcoming the last technical challenges is often the most challenging part.

As an onlooker, I can’t help but notice Rigetti Computing, a company that invites those ready for considerable risk to tap into the colossal growth potential of quantum computing. This innovative firm boasts robust technology, secure financial backing, and reputable collaborations, making it an intriguing proposition for forward-thinking investors.

However, since we’re dealing with an industry where companies like IonQ, IBM, Alphabet, and many others are in intense competition, predicting the victor is more of a gamble than a certainty. Therefore, it’s crucial to focus on the appropriate allocation of positions when considering this name at present.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- TON PREDICTION. TON cryptocurrency

- 10 Hulu Originals You’re Missing Out On

- MP Materials Stock: A Gonzo Trader’s Take on the Monday Mayhem

- IonQ: A Quantum Flutter, 2026

- The QQQ & The Illusion of Wealth

- Here Are the Best Movies to Stream this Weekend on Disney+, Including This Week’s Hottest Movie

- American Bitcoin’s Bold Dip Dive: Riches or Ruin? You Decide!

- Altria: A Comedy of Errors

- Actresses Who Don’t Support Drinking Alcohol

2025-07-17 17:06