Every investment comes with its own set of pros and cons; it’s all about finding the right balance. High-growth investments tend to be more risky, but lower-risk options like income-generating assets might not offer significant capital growth.

If you’re an investor seeking or requiring a steady monthly income stream to meet your living costs, the JPMorgan Equity Premium Intrerest ETF (JEPI 0.28%) might be worth considering. Its trailing yield currently sits at a notable 8.6%, and it invests in stocks that may potentially deliver some growth.

The question is, is it the right choice for you?

Comparing and contrasting

To set the record straight, it’s worth noting that you may secure higher returns with Exchange-Traded Funds (ETFs) that offer monthly dividends. For example, the Global X SuperDividend ETF currently provides a yield of 9.9%, and the Invesco KBW High Dividend Yield Financial ETF has an impressive dividend yield of 12.5%.

However, it’s important to note that there is a balance to consider. The Global X Fund holds a significant number of smaller foreign stocks, which can exhibit unstable and sometimes poor performance due to their inherent volatility. Consequently, this ETF has significantly lagged behind the S&P 500 since its establishment in 2011. Despite the dividends paid out during this period, they have never managed to compensate for the underperformance over this timeframe.

The Invesco fund has outperformed somewhat, yet it doesn’t represent a straightforward investment in the overall market. Its substantial focus on real estate investment trusts (REITs) and related assets management investments restricts its potential gains, primarily because of the current economic climate.

To clarify, what sets the JPMorgan Equity Premium Income ETF apart is its slightly more even distribution of holdings compared to the S&P 500. While they share many of the same stocks, the S&P 500 tends to have a heavier concentration in its top holdings. However, it’s important to note that this ETF may offer advantages due to its focus on income generation and potential risk management strategies.

I’ve noticed an interesting aspect about this Exchange-Traded Fund (ETF). Unlike most, its managers frequently sell call options based on the fund’s stock holdings. This practice yields them regular income. Remarkably, this income is subsequently utilized to distribute the ETF’s monthly dividend.

Great, you say, but what’s a call option? Keep reading.

How the JPMorgan Equity Premium Income ETF works

A call option represents a positive prediction about a stock or index, specifically that its value will increase to or surpass a certain amount before or on a given date. Experienced traders and financial institutions can place this optimistic wager, but they also need to find someone (the counterparty) who’s willing to make an opposing bet – that the stock or index won’t reach that price level by the specified date. This type of betting is structured so efficiently that these options are traded on exchanges and their prices continuously adjust throughout the day, much like stocks themselves.

Essentially, JPMorgan is employing a strategy known as a covered call with JEPI. This approach involves accumulating funds from investors in exchange for agreeing to sell, or “bet on,” the bearish side of options that others are buying through call options. The bank uses its own stock portfolio as security for these bets. If necessary, they can fulfill their obligation to sell or deliver a stock according to the call option’s conditions. This strategy is called a covered call because JPMorgan has its underlying stocks “covered” as collateral.

If the stock mentioned increases in value as suggested by the other party, JPMorgan could potentially be forced to sell some of its S&P 500 stocks from the fund it manages. This isn’t their preferred scenario since they aim to keep all of the fund’s stock holdings consistently.

JPMorgan could potentially sell the asset at a gain, which is good news. Even if they are required to transfer the shares due to certain circumstances, they would still retain the initial premium received from the covered call. This scenario isn’t catastrophic by any means.

In an ideal situation, the call option we’re discussing never gets exercised by its owner, allowing JPMorgan to avoid potential risks associated with that option. This frees them to engage in more similar investment opportunities repeatedly, should they choose to do so.

Using covered calls as a strategy can be a smart method for regularly generating income from your long-term investments. However, it’s important to note that there are some potential pitfalls. In fact, there are more than one issues to consider.

The trade-off

From my perspective, I’ve observed that every investment comes with a compromise, and JEPI is no different. The primary compromise when employing covered calls for continuous income generation is quite evident: on a net basis, this strategy tends to underperform its most relevant benchmark index.

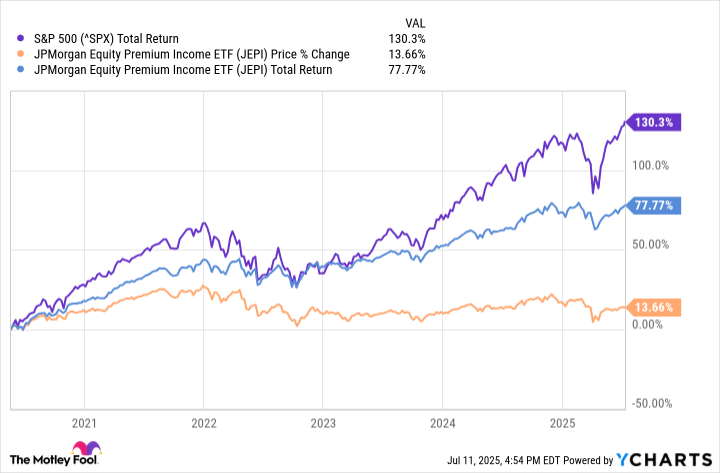

Since the launch of the JPMorgan Equity Premium Income ETF in mid-2020, it has consistently lagged behind the total returns of the S&P 500, even when considering its dividend payments derived from covered call sales.

Attributing it to the inherent nature of the covered call strategy, one observes that the market tends to limit the prolonged success of any trader, regardless of their intellect. In fact, it frequently reprimands such endeavors by delivering underwhelming results.

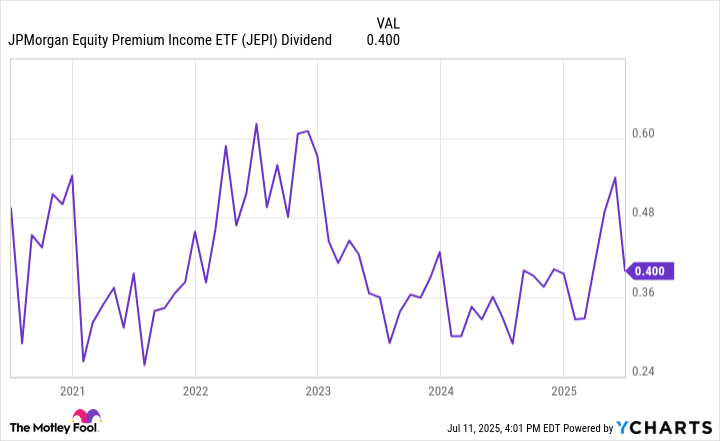

While the high trailing dividend yield of 8.6% is tempting, the dividend paid out isn’t consistently steady. For example, the per-share payment in early July was slightly over $0.40, which is significantly lower compared to the June payment of approximately $0.54 per share. At the beginning of this year, the monthly payment even dropped to around $0.32. If you rely on this income to cover your expenses, investing in this fund might cause financial strain.

In this scenario, it’s important to understand that the value of call and put options can fluctuate due to various unforeseen factors like market volatility, interest rates, and overall market direction. Because these elements are often hard to predict, sellers of these options might not always secure a favorable price.

To buy, or not to buy?

If you’re considering JEPI as a monthly dividend investment, it might not be the best choice all the time. However, its high yield of 8.6% is still appealing, although it may fluctuate. To counteract its inconsistent payments, it would be wise to also invest in other income-generating assets that provide smaller yields but are more consistent with their payouts.

With this ETF’s approach, there’s a possibility for growth in capital, but it may not reach the levels you might find with investing in the SPDR S&P 500 ETF Trust. However, unlike the S&P 500 ETF, you won’t receive dividends as substantial with the JPMorgan Equity Premium Income ETF. Instead, you can expect more long-term profits from this fund compared to interest-bearing bonds. Keep in mind, there are always trade-offs when making investment decisions.

Essentially, when considering investing in this Exchange-Traded Fund (ETF), remember to take into account your specific investment goals and risk appetite. Then, evaluate if it aligns well with your existing investments. It might turn out that the ETF named JEPI could be a suitable addition to your portfolio.

Read More

- The 11 Elden Ring: Nightreign DLC features that would surprise and delight the biggest FromSoftware fans

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- 10 Hulu Originals You’re Missing Out On

- TON PREDICTION. TON cryptocurrency

- 39th Developer Notes: 2.5th Anniversary Update

- Bitcoin and XRP Dips: Normal Corrections or Market Fatigue?

- The Timeless Allure of Dividend Stocks for Millennial Investors

- 15 Western TV Series That Flip the Genre on Its Head

- Is T-Mobile’s Dividend Dream Too Good to Be True?

2025-07-16 21:56