As a seasoned analyst with years of experience navigating financial markets, I find myself bracing for an exhilarating week ahead. The upcoming US macroeconomic data has the potential to significantly influence Bitcoin sentiment and the broader crypto market.

This week holds several major economic occurrences that may substantially impact the cryptocurrency market. These significant economic figures are being released just as investors prepare for the rush towards the end-of-year festivities.

At present, Bitcoin (BTC) maintains its position over the $100,000 level, as market participants look forward to potential price increases during the expected holiday surge.

US Macroeconomic Data That Could Influence Bitcoin Sentiment This Week

This week, various players in the cryptocurrency sphere – including traders, investors, and enthusiasts – will keep a close eye on several key U.S. economic figures to understand their potential impact on prices.

S&P Flash Services and Manufacturing PMI Data

The week begins with the release of the S&P Flash Services and Manufacturing Purchasing Managers’ Indices (PMI) on Monday. PMI data, derived from monthly business surveys, serve as key indicators of economic health, often used to predict market trends and assess business conditions.

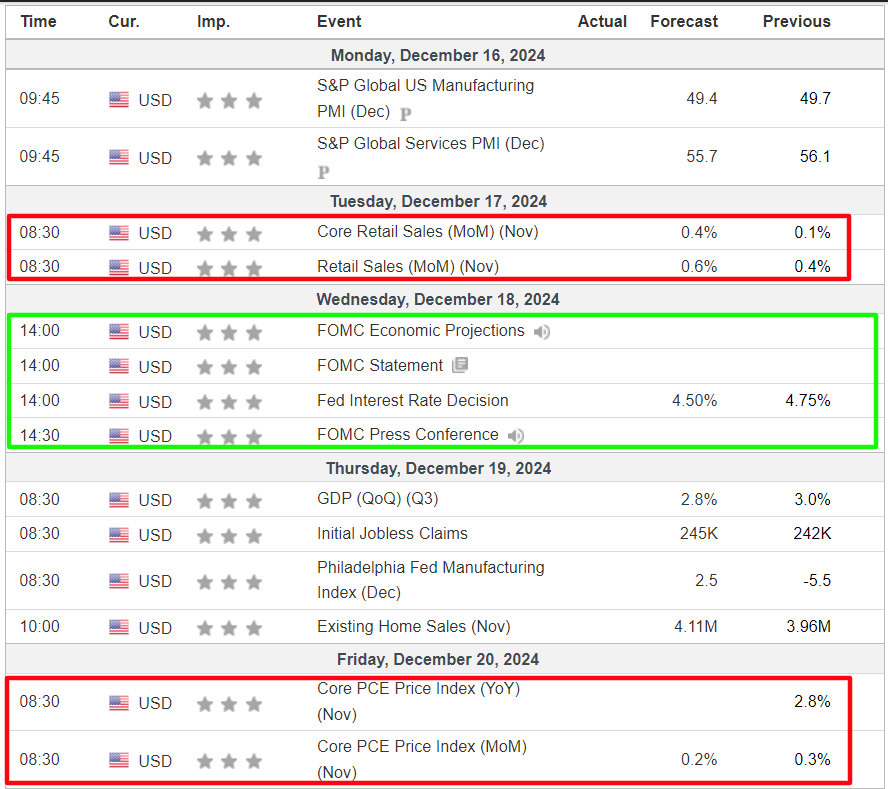

For November, the PMI (Purchasing Manager’s Index) stood at 56.1, and it’s predicted to decrease slightly to 55.3 in December. On the other hand, the manufacturing PMI, which was 49.7 in November, is expected to drop a bit more to 49.6 in December. A PMI value greater than 50 indicates economic growth, while a figure less than 50 suggests contraction.

Should the data indicate robust performance in service and production industries, it might boost general economic assurance. This positive sentiment might stimulate investor interest in riskier investments, such as cryptocurrencies. Still, economists exercise caution due to lingering worries about the larger economic landscape.

Currently, the U.S. economy is experiencing significant challenges. For nearly a year, we’ve seen an inverted yield curve and an ISM Manufacturing PMI below 50. Historically, an inversion in the yield curve has been a reliable indicator of upcoming recessions, as it was before the COVID-19 pandemic and the 2008 financial crisis when the ISM Manufacturing PMI also stayed under 50.

Retail Sales Data

This week, crypto market followers might find intriguing the upcoming US retail sales figures. Following a 0.4% figure in October, experts predict a 0.6% increase for November. These retail sales numbers offer valuable insights about consumer spending habits and overall consumer sentiment.

A robust performance in retail sales, suggesting an increase in consumer spending, might be interpreted as a favorable economic indicator. Such optimism among consumers could boost investor confidence within conventional financial sectors. This surge of trust could potentially extend to the cryptocurrency market too.

Data from retail sales may likewise impact assumptions about inflation. A robust retail sales trend might suggest growing demand, which could lead to increased inflation in the future. Given that digital currencies such as Bitcoin are frequently seen as a safeguard against inflation, any signs of rising prices could prompt investors to move towards cryptocurrencies.

“Strong sales = bullish markets, weak = risk-off,” popular analyst Mark Cullen said.

Fed Interest Rate Decision (FOMC)

This upcoming week’s economic data in the U.S., particularly significant, centers around the Federal Reserve’s (Fed) decision regarding interest rates, set for Wednesday. The crypto market is preparing for potential market fluctuations as investors anxiously wait to see if the Fed plans to raise or lower rates.

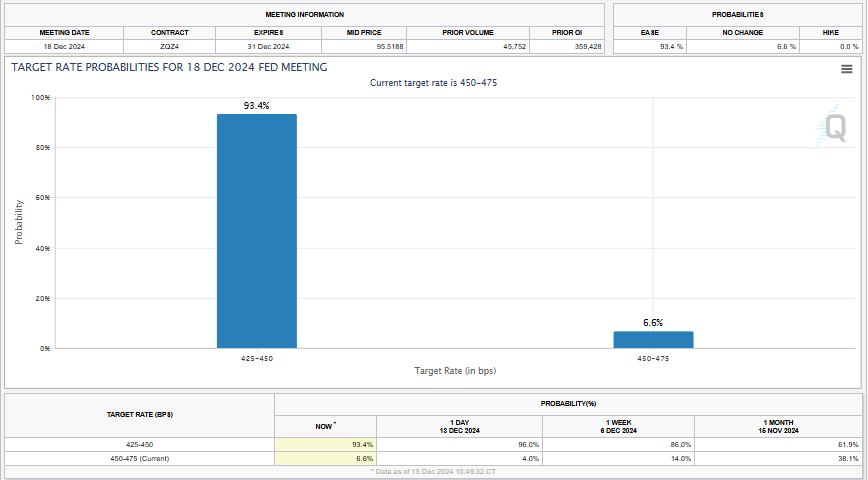

Based on the CME FedWatch Tool, it seems that markets are expecting a small reduction in interest rates by 0.25% on Wednesday. In contrast, there’s a lower chance of about 6.6% for the Federal Reserve to reduce rates by 0.5%.

This implies that it’s likely the Federal Reserve might take a more conservative approach to reducing interest rates next year, given that progress in reducing inflation to the 2% target seems to have slowed down. In this context, investors will also keep an eye on the Fed’s dot plot to determine if there’s a shift towards a more hawkish perspective in the Federal Reserve’s outlook.

Immediately following the Federal Open Market Committee (FOMC) meeting, Jerome Powell, the Fed chairman, is scheduled to address a press conference. This event promises intrigue for those involved in the cryptocurrency market.

Users on platform X are keeping a close eye for any hints of potential tightening or soft remarks. An unexpected twist in this regard might spark substantial shifts throughout various markets, particularly in sectors influenced by interest rates.

Last week’s publication of the U.S. Consumer Price Index (CPI) and Producer Price Index (PPI) suggest that the Federal Reserve may reduce the speed at which it decreases interest rates in the coming year. Notably, CPI continued to rise, while Core CPI failed to decline. Simultaneously, the unemployment rate has been on a slow upward trend.

In light of the current circumstances, it’s expected that the Federal Reserve might lower interest rates further, specifically by 0.25%, as they anticipate this to be a short-term condition. They hope that inflation and joblessness will keep declining in the near future.

Q3 2024 GDP Data

On this coming Thursday, the United States Bureau of Economic Analysis (BEA) is set to publish the second update on the economic growth during the third quarter (Q3) of the year. This revised GDP data will provide valuable information about the overall economic condition as we draw closer to the end of the year.

It’s worth mentioning that this indicator significantly reflects the strength of the U.S. economy. Economists predict a median growth of 2.9% following the initial 2.8%. In other words, the U.S. GDP expanded at an annual pace of 2.8% during Q3 2024. Market participants will closely monitor if this positive trend persists.

PCE Inflation Data

On this week’s wrap-up, we’ll see the release of the November Personal Consumption Expenditure (PCE) inflation figures on Friday. This index represents consumer spending and encompasses all items purchased by American households, making it a crucial indicator. If there are any unexpected changes in this data, it could significantly influence the Federal Reserve’s future policy decisions and investor sentiment.

As per The Kobeissi Letter’s analysis of worldwide financial markets, the one-month equivalent annualized core PCE inflation currently stands at around 3.5%, with traders keeping a close eye on data due out at the end of the week for November figures. Moreover, the one-month rate, three-month rate, and six-month rate for annualized core PCE inflation are all showing signs of increase as we speak.

In simpler terms, the monthly rate for Supercore PCE inflation is almost at a staggering 5%, while the overall Supercore PCE inflation exceeds 3.5% and is again climbing up. Collectively, this suggests that consumers are once more experiencing high inflation levels across various product groups.

According to the information given, this upcoming week could be quite dynamic, potentially featuring increased market fluctuations near these specific events. As I’m typing this, Bitcoin is being traded at approximately $104,991, representing a mild 2% growth compared to the start of Monday’s trading session.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- PENGU PREDICTION. PENGU cryptocurrency

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- All 6 ‘Final Destination’ Movies in Order

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- 30 Best Couple/Wife Swap Movies You Need to See

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

2024-12-16 10:03