5 December 2024 will be etched in my memory as a bittersweet day in the rollercoaster ride that is crypto investing. As I watched Bitcoin (BTC) surge past $100,000 for the first time ever, I couldn’t help but feel a sense of exhilaration – but also a twinge of frustration. You see, I’ve been an XRP investor for quite some time now, and I’ve seen its incredible potential. But today, as Bitcoin and Ethereum rallied while XRP struggled, I couldn’t help but wonder if I’d ever catch a break.

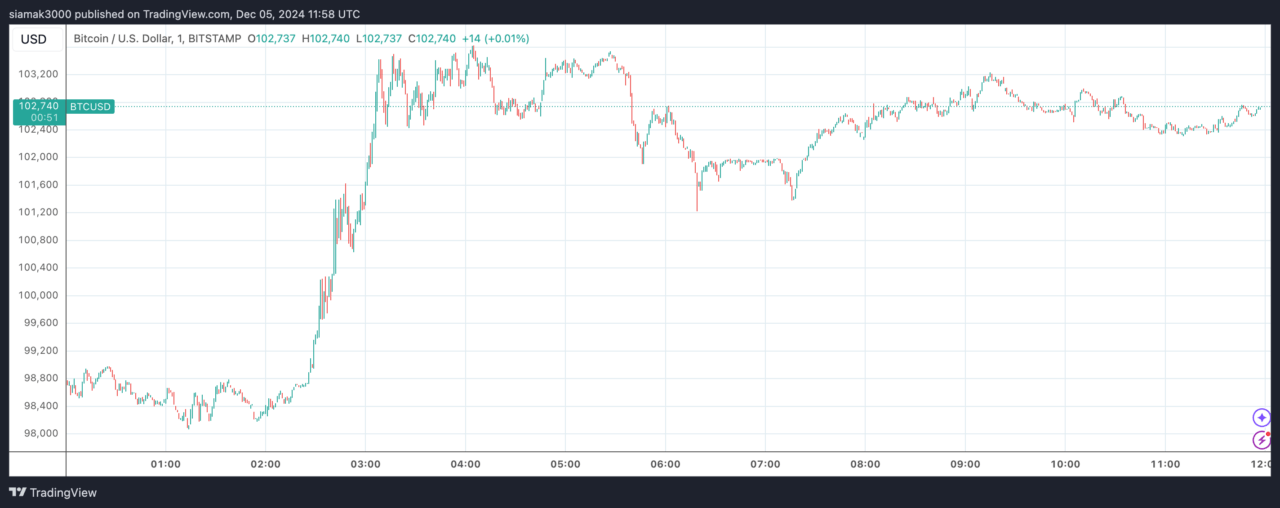

On the 5th of December, 2024, will be remembered as a significant day in the annals of cryptocurrency. At approximately 2:33 a.m. (Coordinated Universal Time), Bitcoin (BTC) broke through the $100,000 barrier for the very first time.

Just over ten hours following Donald Trump’s announcement of Paul Atkins, a supporter of cryptocurrency and ex-SEC commissioner, as his pick for the upcoming SEC Chair, there was a significant surge in the market. Ethereum (ETH) saw an increase of 5.4%, sparking enthusiasm throughout the crypto sector.

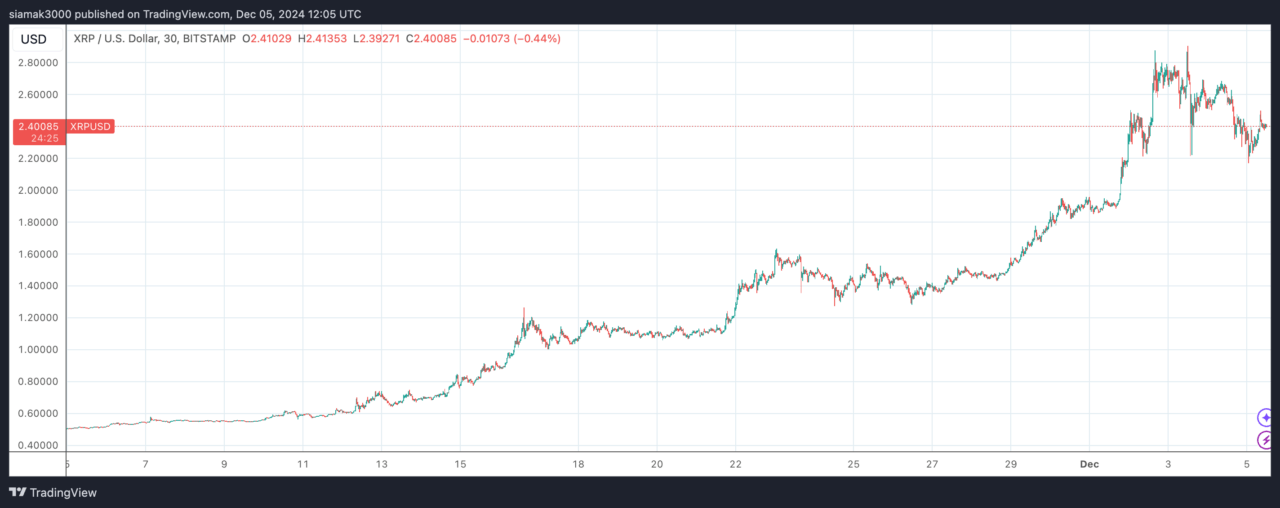

However, unlike other top cryptocurrencies that saw impressive gains in November, XRP hasn’t been part of the celebration. Instead, it has experienced a decline of 9.3% over the past day, making it the poorest performer among the top 10 digital currencies.

This surprising divergence has left XRP investors wondering: Why is XRP struggling while Bitcoin and Ethereum rally?

Here are five key reasons that explain today’s puzzling price action.

Bitcoin’s Historic $100K Breakout Has Shifted Market Focus

Around 2:33 a.m. UTC on December 4, 2024, Bitcoin broke through the $100,000 mark for the first time, reaching this historic milestone. This significant event was due to optimism about Trump’s selection of Paul Atkins as the next SEC Chair, which investors saw as a potential sign of clearer regulations for cryptocurrencies in the future. As a result, there were substantial investments made into Bitcoin and Ethereum.

In the last day, the trading activity for Bitcoin increased by a massive 108.84%, and Ethereum followed closely with a rise of 63.30%. However, the trading volume for XRP decreased by 34.5%, suggesting less activity as investors shifted their funds towards Bitcoin and Ethereum. This trend has temporarily pushed coins like XRP to the side, as more attention is currently focused on Bitcoin and Ethereum.

Long Liquidations Amplified XRP’s Price Drop

Over the last day, there was a substantial surge in XRP position closures. As reported by CoinGlass, a total of approximately 55.92 million dollars’ worth of XRP trades were forcibly closed, with around 39.45 million dollars originating from long positions.

It seems that numerous traders had taken on substantial borrowed funds (leverage) to wager on XRP’s continued surge from November. As the value of XRP started to drop, these leveraged bets were forcibly liquidated, which in turn intensified the decline and caused a domino effect that drove the price lower still.

Unlike Bitcoin and Ethereum, both of which experienced significant increases in investment, XRP’s decreased trading activity left it more vulnerable to the recent liquidation incidents.

Profit-Taking After XRP’s Massive November Rally

In November, XRP experienced a 65.6% surge, primarily fueled by optimism stemming from Ripple‘s growing partnership network and its application in cross-border transactions. This significant upward trend paved the way for profit-taking, particularly as XRP neared prices close to $2.80 earlier this week.

1) In the last day, open interest for XRP decreased by 4.25%, suggesting that traders are closing their positions instead of opening new ones. The significant drop in trading volume (34.5%) also implies that some investors are withdrawing after realizing profits. This type of profit-taking is often observed following substantial gains, and it can cause temporary price adjustments as seen today.

Ripple’s Legal Battle Casts a Shadow Over XRP

The announcement of Paul Atkins as a potential pro-cryptocurrency chair for the SEC has brought enthusiasm throughout the market. Yet, some XRP investors may remain apprehensive, given that Ripple is currently engaged in a legal dispute with the SEC.

Even with a crypto-friendly SEC Chair, there’s no guarantee that the case will be resolved quickly.

On October 2nd, 2024, the Securities and Exchange Commission (SEC) took their disagreement further by lodging an appeal on certain points of Judge Torres’ decision from July 2023. This action focuses on two main issues: the categorization of XRP transactions on digital marketplaces and the way Ripple distributed tokens to its workforce. Importantly, the SEC doesn’t object to the court’s view that XRP is not classified as a security overall.

Moving forward, the situation is shaping up for a prolonged legal process. By January 15, 2025, the SEC will present its initial arguments, marking the start of a sequence of legal interactions that could continue until mid-2025. In autumn 2025, it’s predicted that the appellate court will listen to oral arguments, with a potential decision expected in early 2026. At the core of this appeal, the SEC aims to overturn the court’s decisions regarding certain XRP transactions, while Ripple is trying to reduce the $125 million penalty imposed in August 2024.

Negative Sentiment in Derivatives Markets

As a crypto investor, I’ve noticed that the bearish sentiment in the derivatives markets of XRP is contributing to today’s dip. According to CoinGlass, the funding rate for XRP stands at -0.0885%. This means that short sellers are actually paying long-term investors, suggesting a high demand for short positions. This trend mirrors a broader pessimism about XRP’s near future and could potentially indicate a challenging time ahead for the cryptocurrency.

Moreover, there was a decrease of 4.25% in open interest for XRP derivative contracts, indicating reduced optimism among traders. This pessimistic outlook mirrors the liquidation data, strengthening the bearish influence on XRP prices.

Read More

2024-12-05 15:54