![]()

Over the past three years, the advancement of artificial intelligence (AI) has been a frequent topic on Wall Street. The possibility of AI-driven software and systems making instant decisions without human supervision is seen as a significant shift by analysts at PwC. They estimate that this could potentially boost the global economy by a staggering $15.7 trillion by the end of the next decade.

No company has profited as significantly from the advancement of AI as Nvidia (NVDA). Starting from 2023, Nvidia has transitioned from a minor player in tech to becoming the most valuable publicly traded company, worth over $4 trillion.

Nvidia’s rise is evident in the fact that its AI-focused graphic processing units (GPUs) are highly sought after by companies running high-compute data centers, making them top-tier in the industry. The demand for Nvidia’s Hopper (H100) and Grace Hopper (Blackwell) GPUs has been so great that there is a significant backlog of orders, enabling Nvidia to command a premium price for its hardware, with triple-digit increases compared to other market competitors.

As an onlooker, it’s evident that CEO Jensen Huang is diligently working to keep his company at the forefront of artificial intelligence computation. He’s strategically planning to introduce a cutting-edge AI chip every year, with Blackwell Ultra (2025), Vera Rubin (2026), and Vera Rubin Ultra (2027) being the upcoming releases. Remarkably, the latter two are expected to run on the innovative Vera processor.

In summary, Nvidia’s CUDA software platform serves as the binding agent for all components. Essentially, this tool enables developers to fully utilize the computational capabilities of their Nvidia equipment. In essence, it’s a key factor that keeps consumers devoted to Nvidia’s technological environment.

On August 27th, Nvidia’s fiscal second-quarter operating results will be announced (their fiscal year concludes in late January). For Wall Street and investors alike, this outcome is arguably their top priority. While the majority of analysts anticipate another impressive performance, there are at least five factors that could potentially disrupt the positive trend for Nvidia, often referred to as the pioneer of AI technology.

1. Internal competition begins pressuring margins

Investors generally perceive external competitors as the biggest risk to Nvidia’s leadership in AI-GPU market. Major contenders in this field are companies such as Advanced Micro Devices and Huawei (China), with other competitors also in the picture.

While more GPUs are entering the market from rival companies every quarter, it’s not this competition that investors should fear most. Instead, the greatest danger for Nvidia lies internally.

I notice that several of Nvidia’s major clients, often referred to as the “Magnificent Seven,” are actively designing AI-GPUs for deployment within their data centers. Although these chips may not pose direct competition in the open market with Nvidia’s hardware, they could potentially hinder Nvidia’s expansion for several reasons:

1. Market Share: If these clients succeed in establishing a strong presence in the market with their AI-GPUs, it could gradually erode Nvidia’s dominant position.

2. Intellectual Property Threat: The development of similar technology by key customers may pose a threat to Nvidia’s intellectual property and proprietary techniques.

3. Pricing Pressure: As more competitors enter the market with comparable products, there might be increased pricing pressure, affecting Nvidia’s profit margins.

4. Innovation Risk: If these clients invest heavily in research and development, they could potentially innovate faster than Nvidia, posing a risk to Nvidia’s technological leadership.

- They’re reducing AI-GPU scarcity, which Nvidia has used to pump up its pricing power and boost its gross margin.

- They’re notably cheaper than Nvidia’s hardware, which can provide additional downside pressure on Nvidia’s pricing power.

- Unlike Nvidia’s GPUs, they aren’t going to be backlogged. This can slow upgrade cycles, which would weaken Nvidia’s future growth forecasts.

2. President Trump’s reciprocal tariffs introduce forecast uncertainty

One potential obstacle that might slow down the progress of the AI revolution could be the tariff and trade policies implemented by President Donald Trump.

Here’s another way to put it: The AI revolution may encounter a setback due to the tariff and trade policies enacted under President Donald Trump.

And here’s one more for variety: An impediment that might delay the advancement of the AI revolution could be the tariff and trade strategies of President Donald Trump.

Starting on August 8, I’m thrilled about the imminent implementation of a 10% global tariff, alongside reciprocal tariffs on numerous countries identified for their unfavorable trade surpluses with the USA. These reciprocal tariff rates were temporarily halted for 90 days back in April, and then extended again until now through an executive order. Now, a week from today, they’re set to resume their effect!

The concern about Trump’s tariff and trade policy lies in its introduction of unpredictability for companies like Nvidia, where they have factored in precision and openness. If there are no trade agreements reached, potential consequences such as retaliatory tariffs, supply chain disruptions, and increased costs that negatively affect profits, could all arise.

As it currently stands on July 22, the outlook for Nvidia’s growth remains uncertain.

3. Jensen Huang’s innovation cycle begins to ruffle feathers

Another potential factor that could unsettle Wall Street and potentially dethrone Nvidia from its lofty position is the pace at which the company innovates.

Normally, generous investment in technology development is richly appreciated by investors. However, it’s crucial to strike a balance between technological progress and maintaining a gross margin of over 70%, achieved by pricing products at premium triple-digit rates compared to external competitors.

Huang’s aim of releasing a fresh AI-GPU each year could lead to a quick decrease in the worth of previous models. If the price of Hopper GPUs drops sharply, those who bought large quantities of these GPUs, as well as data centers renting out computing power, might be reluctant to upgrade to newer chips.

Another possibility could be that since Nvidia launches more rapid and expensive GPUs, businesses might choose older models instead, given their lower prices. This trend could potentially lead to a less optimistic outlook on the company’s gross margin predictions.

4. The Trump administration flip-flops on export restrictions

From October 2022 onwards, both the Joe Biden and Donald Trump administrations have prohibited exports of advanced AI chips and associated technology to China. This includes Nvidia’s specially designed lower-powered versions of its top-tier AI chips, preventing them from being exported to China, which is the second largest economy globally.

A positive development is that the Trump administration has recently lifted its export ban, enabling Nvidia to sell its less-powerful H20 chip to China. This announcement boosted Nvidia’s stock price significantly, but it’s uncertain if the Trump administration will change its mind about this policy.

While U.S. Commerce Secretary Howard Lutnick proposes that permitting AI chip sales to China could tie businesses to American tech, President Trump and his team have modified tariff and trade policies numerous times over the past six months instead of reaching an agreement with China. It’s still uncertain whether Nvidia’s technology might be utilized as a negotiating tool by Trump to secure his desired outcomes.

5. History finally catches up with Nvidia’s premium valuation

On August 27, the fifth and last possible cause for the party to conclude for Nvidia could be if the market finally adjusts its high evaluation to match historical trends.

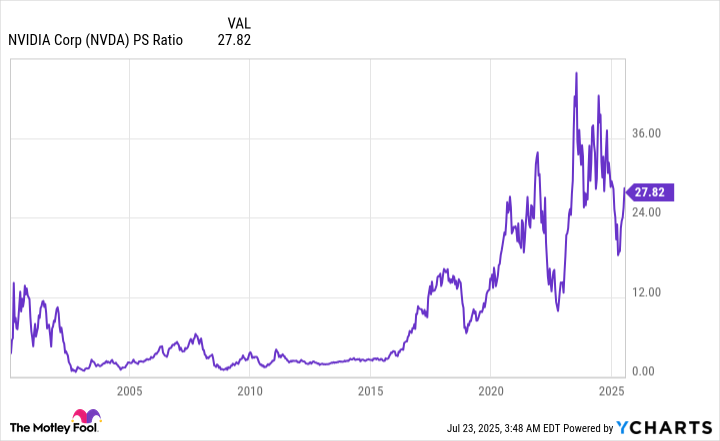

I strongly support the idea that companies with robust competitive advantages and almost monopolistic market positions should command a higher valuation… up to a certain extent. Last summer, Nvidia’s stock reached a price-to-sales (P/S) ratio of 42, which is quite comparable to the peak trailing-12-month (TTM) P/S ratios of top businesses on Wall Street before the dot-com bubble burst. This suggests that even companies with strong competitive advantages should not be overvalued excessively.

Even though Nvidia’s sales have significantly increased over the past two years, its Price-to-Sales (P/S) ratio, calculated on a trailing twelve months (TTM) basis, is currently 28 as of July 22. Historically, no market-leading company has been able to maintain such a high premium for an extended timeframe. This implies that Nvidia operates with minimal room for error and its stock may experience negative consequences if it misses expectations or encounters any perceived uncertainties.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-07-25 10:25