In the realm of investing, the wisdom lies in seeking out companies that not only stand tall in the market but also hold their ground through the storms of time. The noise of daily fluctuations may entice the faint-hearted, yet those who are resolute, those who are willing to let their investments mature like fine wine, often find themselves rewarded.

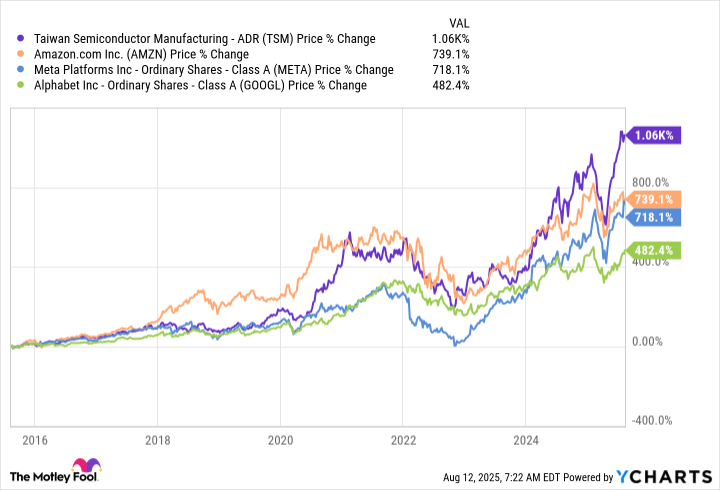

When we gaze into the past decade, illuminating our path forward, we find shimmering gems such as Nvidia (NVDA), Taiwan Semiconductor Manufacturing (TSM), Amazon (AMZN), Meta Platforms (META), and Alphabet (GOOG) (GOOGL). Intriguingly, Nvidia, with a staggering rise of over 30,000%, stands at the apex and has been excised from the chart below, lest its brilliance overshadow the remarkable journeys of its peers.

Consider the “poorest” among these titans: Alphabet, which has nevertheless elevated its stock nearly fivefold, a testimony to perseverance in a world fraught with uncertainty.

While these companies may have enjoyed remarkable triumphs, their prospects for the next decade shine even brighter, chiefly because of the inexorable march of artificial intelligence (AI). It is with unwavering faith that I embrace them as part of a prudent investment portfolio, one that attempts to navigate the upcoming decade with cautious optimism.

Nvidia and Taiwan Semiconductor: Powering the AI Engine

Each of these enterprises is intricately woven into the tapestry of the burgeoning AI landscape, enriching their fortunes through innovation.

Nvidia, with its mastery in crafting graphics processing units (GPUs), reigns supreme; its hardware has become the favored backbone for AI’s training processes and model execution. As the demand for computing power swells like the rising tide, Nvidia’s hold on this crucial domain fortifies its position. This burgeoning wave suggests a promising horizon for long-term investors willing to stand firm.

Taiwan Semiconductor (TSMC), a bastion of chip manufacturing, serves as the engine for many AI giants, including the illustrious Nvidia itself. In a world where chip production capabilities are sparse among the honchos of the industry, TSMC’s reputation shines through continuous innovation and unwavering precision, allowing it to maintain a stronghold over its market. This dominance shines brightly in the forecasted trajectories over the coming years.

Both Nvidia and TSMC currently stand as stalwarts in the face of burgeoning demands, yet they are not alone. The next trio-noble benefactors of this AI revolution-find themselves poised for ascension, ready to carve their own destinies in the corporate arena.

The AI Horizon: A New Dawn for Diverse Applications

At first glance, Amazon might not exude an aura of an AI powerhouse. However, lurking within its sprawling cloud services, Amazon Web Services (AWS)-the titan of cloud computing-lies its secret weapon. The insatiable appetite for computational capacity to fuel AI endeavors has set the stage for AWS to flourish. As profitability swells from this burgeoning demand, Amazon’s stock prepares to soar to untold heights.

Meta Platforms takes the stage next, concocting its own generative AI model known as Llama, a venture aimed at retaining its throne atop the social media domain. With masters of interaction at its command-Facebook and Instagram-Meta possesses a lucrative revenue stream. The integration of AI tools into advertising services rekindles interest and engagement among users, suggesting that as generative AI evolves, Meta too shall rise with the tide.

Lastly, we meet Alphabet. Life is often painted in shades of uncertainty; many predict its obsolescence as AI disrupts the very fabric of its revenue model attuned chiefly to Google Search. But herein lies the paradox-Google Search not only survives but thrives, its revenues climbing by 12% in recent quarters. Indeed, the advent of Search Overviews-an intricate fusion of traditional search functionalities with generative AI-might well be the buoy that keeps Google’s ship afloat amidst treacherous waters.

As we venture into this labyrinth of investment, it is clear that these five stocks-each a beacon in their domain-represent not just financial opportunities, but our collective progress as we embrace the future. Investing wisely amid technology’s challenges and triumphs might indeed carry a weight of responsibility, yet it also presents an avenue for hope. May we all navigate these waters with the courage and wisdom of the working class. 🌱

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- Games That Faced Bans in Countries Over Political Themes

- ‘Zootopia+’ Tops Disney+’s Top 10 Most-Watched Shows List of the Week

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

2025-08-17 01:47