Rivian (RIVN) is a captivating investment tale, and it seems to improve daily. However, it’s essential to note that this is a high-risk venture, appealing only to those with a growth-focused investment mindset. Before diving in, here are some key points to consider about Rivian:

1. The potential for further positive news could propel the shares upward gradually.

2. Given its current downtrend, now might be an opportune moment to invest as if there’s no tomorrow.

What does Rivian do?

Rivian manufactures all-electric trucks, designed for both commercial purposes (delivery vehicles) and personal use (pickups). Although the company is currently expanding its operations, it’s still experiencing significant losses at the moment. However, during the last quarter of 2024 and the first quarter of 2025, Rivian managed to achieve a gross profit, meaning that the revenue generated from selling its trucks exceeded the costs associated with their production. This is a significant milestone in the journey towards earning an overall profit.

If you’re considering Rivian now, it might be because you hope to capture some of the electric spark that Tesla (TSLA) ignited. The electric vehicle market has evolved significantly since Tesla pioneered it, making competition much more intense. However, Rivian seems to be shaping up as a potential winner. Here are three compelling reasons for investing in its stock.

1. Rivian has big partners

Instead of going solo to validate electric vehicles (EVs) as a viable product, like Tesla did, Rivian is opting for a collaborative strategy. It’s joining forces with prominent corporations to boost its operations and enter the automotive industry. In the initial stages, it formed an alliance with Amazon (AMZN), working together to develop delivery trucks. This collaboration served as a financial foundation for Rivian’s growth. More recently, it has partnered with Volkswagen, which is providing funds in return for the privilege of using Rivian’s technology in their own vehicles.

In essence, these connections offer Rivian crucial resources – both funding and customer base. Such assets serve as a robust framework for expanding its business in the long run. Consequently, despite being a startup, this venture seems to have a more substantial foundation than one might initially perceive.

2. Rivian has already scaled up

Entering the automotive industry is challenging, in part due to its capital-heavy operations. To put it another way, setting up a car manufacturing plant requires substantial financial resources. Even after construction, the intricacy of producing a vehicle adds to the challenge. However, Rivian has demonstrated its ability to establish a large auto factory, aiming to produce as many as 46,000 vehicles by 2025.

Currently, our primary concern is enhancing the manufacturing workflow. This necessitates pausing the expansion of production for a moment, but by reducing costs and optimizing our processes, Rivian has managed to achieve a gross profit. The insights gleaned from this endeavor will prove beneficial as we scale up our production in the future.

3. Rivian is working on a mass market truck

Speaking more casually, we move on to discussing the upcoming R2 truck by Rivian, planned for release in the early half of 2026. Currently, Rivian’s consumer trucks are quite pricey, restricting potential buyers. However, the R2 is designed to be budget-friendly, with the intention of appealing to a broader, mass market audience.

Just as Tesla paved the way with its cars by targeting a broad market segment, which significantly boosted its growth, so too could Rivian experience similar success by following suit. It appears that the moment for them to take off might be just around the corner.

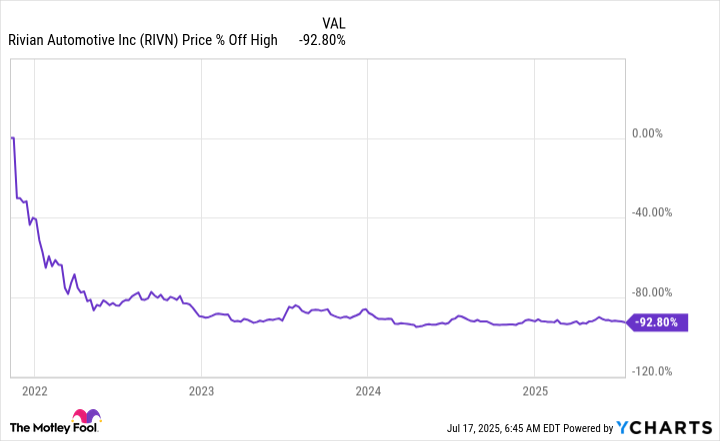

Rivian is still well off its highs

2021 saw Rivian’s stock soaring following its initial public offering, reaching impressive highs. However, in the grand scheme of things, I find myself reflecting on how much it’s dipped – around 90% to be exact! It seems that the fervor for EV stocks has cooled down a bit lately. But hey, as an enthusiastic investor, I can’t help but view this shift as an intriguing opportunity.

Many other EV companies have faced challenges and faltered, but Rivian remains resilient, pushing on. While the market may be less heated now, it’s moments like these that could offer a chance for the bold investors out there to seize opportunities and support innovative companies like Rivian in their journey.

It appears more and more likely that Rivian will continue to thrive due to its substantial partnerships, impressive size, and upcoming significant vehicle launch. If you’re prepared to invest in a promising newcomer within a cutthroat industry, Rivian could be an excellent addition to your portfolio.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- When Wizards Buy Dragons: A Contrarian’s Guide to TDIV ETF

- Here Are the Best TV Shows to Stream this Weekend on Paramount+, Including ‘48 Hours’

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- The Labyrinth of Leveraged ETFs: A Direxion Dilemma

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

2025-07-22 20:34