The standout characteristic of Annaly Capital Management‘s (NLY) shares is their dividend yield exceeding 14%. This makes it an appealing option to consider investing in, given its status as a mortgage real estate investment trust (REIT). However, income investors should be mindful of certain factors before making a hasty purchase. Here are three reasons for favoring Annaly and one significant reason to exercise caution when buying this stock.

What does Annaly Capital Management do?

It’s worth mentioning that Annaly is a distinctive player within the real estate investment trust (REIT) industry. Unlike traditional REITs that purchase and lease physical properties, Annaly acquires mortgage-backed securities, which are more akin to bonds than tangible properties. These securities are affected by factors such as interest rates, housing market trends, and mortgage repayment patterns, making it challenging for many investors to monitor this specific business.

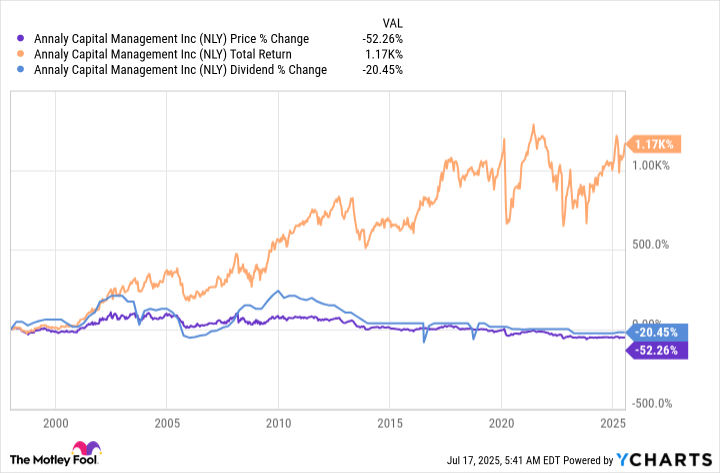

It can be said that Annaly has done an exceptional job in generating value for its investors consistently. Importantly, the overall return on their stock has mirrored the total return of the S&P 500 index (^GSPC) over a prolonged period. Furthermore, Annaly’s stock performance has shown significant deviation compared to the S&P 500 index, indicating that investing in Annaly could bring appealing diversification advantages to an investment portfolio. In essence, these two factors make a compelling argument for investors to consider buying this stock enthusiastically.

The second point is that Annaly boosted its dividend at the beginning of 2025. A common belief among income-focused investors is that the most secure dividends are those that have recently been raised. At a minimum, this increase in dividend indicates that Annaly’s current business performance appears to be strong.

One reason to consider investing in Annaly’s stock is the expectation that interest rates will decrease before they increase again. This prediction is becoming more probable. Notably, Annaly mainly possesses a collection of mortgage bonds as its primary asset. In scenarios where interest rates decline, the worth of these bonds usually increases. Therefore, a reduction in interest rates could potentially generate value within this portfolio.

The dividend yield is the reason to stay away from Annaly

It appears that Annaly’s high dividend yield of 14% or more is missing from the list provided. This might seem surprising given the recent increase in its dividend and the impressive overall return it offers. However, it’s worth looking at its past to understand this better. As you can see in the chart below, Annaly’s dividend has been quite volatile over time, with a significant period where it was gradually decreased. Yet, despite these fluctuations, it still manages to deliver a strong total return performance.

To get a substantial overall return, it’s crucial that investors re-invest the dividends they receive. However, those expecting to live off the dividends from Annaly Capital investments would have found it disappointing due to the typical volatility of mortgage REITs. Since this pattern is common for such companies, it’s unlikely to alter in the future.

Investing in Annaly Capital might not be ideal for many dividend-focused investors seeking consistent growth in their dividends. However, this stock could appeal to investors concentrating on asset allocation, as it offers exposure to a distinct asset class that tends to behave differently from the general equities market. It’s essential to note that while the high dividend yield is attractive, it may not be the key aspect to consider in this case.

Make sure you understand what you are buying with Annaly

The challenge lies in the fact that some income investors focus on yield without fully understanding Annaly’s business structure. Consequently, they may not receive what they were expecting, leading to a discrepancy between their desires and actual returns. While Annaly is a reliable company, it might not deliver outstanding dividends for income-focused investors. However, if you are an asset allocator, this total return stock could be an intriguing investment opportunity at present.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Macaulay Culkin Finally Returns as Kevin in ‘Home Alone’ Revival

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Solel Partners’ $29.6 Million Bet on First American: A Deep Dive into Housing’s Unseen Forces

- Where to Change Hair Color in Where Winds Meet

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Brent Oil Forecast

2025-07-23 03:25