As someone captivated by the ever-evolving world of technology, I can’t help but notice the unabating surge of Artificial Intelligence (AI) as a leading investment theme. Some might harbor doubts about this trend, but let me assure you, it’s not just hype. Companies are pouring immense resources into AI, and the results are speaking for themselves – numerous companies are reaping substantial rewards from their investments in this groundbreaking technology.

A significant sector where investors can anticipate substantial expansion is data centers. These facilities are multiplying nationwide, providing space for the processing hardware necessary for artificial intelligence (AI). It’s predominantly through these infrastructure developments that businesses earn revenues stemming from AI.

In my opinion, three noteworthy investments in the AI industry are Nvidia (NVDA), Taiwan Semiconductor Manufacturing (TSM), and Digital Realty Trust (DLR). I strongly recommend considering these stocks if you’re looking to invest in artificial intelligence, as they represent a smart choice at the moment.

All three companies are critical for AI

Nvidia’s graphics processors (GPUs) fueled the AI competition since its inception. What sets these GPUs apart is their unique capability to perform numerous calculations simultaneously, which makes them exceptionally suited for demanding tasks like AI. Moreover, they can be combined into networks to enhance this advantage even more. In fact, some businesses have linked as many as 100,000 GPUs, constructing a supercomputer specifically tailored for AI applications.

Nvidia commands a strong 90% share in data center markets, consistently pushing boundaries to preserve its top position. This supremacy is clearly reflected in Nvidia’s financial performance, as its Q1 revenue surged by 69% compared to the previous year and is projected to grow another 50% in Q2. Notably, Nvidia’s leadership has a reputation for consistently surpassing their own forecasts.

Nvidia doesn’t manufacture chips on its own, instead, it designs them and sends the production to Taiwan Semiconductor Manufacturing Company (TSMC). This design-only approach, known as fabless design, is a popular strategy among significant tech companies like Apple and Broadcom, who also follow this method. These companies are TSMC’s customers, along with numerous others.

Taiwan Semiconductor has ascended to the position of the world’s leading chip maker due to its exceptional yields and relentless innovation. While its 3nm (nanometer) chip technology has been well-received by its clientele, it is set to debut a 2nm node later this year, followed by a 1.6nm node in 2026. These upcoming advancements are expected to deliver substantial improvements in power consumption, potentially lowering the energy requirements of data centers.

Digital Realty Trust is a distinctive strategy in the field of Artificial Intelligence. Essentially, it’s a real estate investment trust (REIT) that specializes in constructing data centers and leasing them to multiple clients. It stands out as an ideal platform to capitalize on the significant surge in data center construction, given its available land to develop an additional 4,300 megawatts of capacity beyond the 2,800 megawatts it has already developed.

By 2030, it’s predicted that Digital Realty will see a staggering 350% rise in data center demand due to both AI and non-AI workloads. This suggests that investing in Digital Realty could be a smart move. What’s more, this company offers an appealing 2.9% dividend return, setting it apart from many tech stocks. Notably, even tech giants like Nvidia and Taiwan Semiconductor offer a modest dividend as well.

This trio has a compelling investment case, but why are they smart buys now?

The stocks may not be cheap, but they’re not expensive for the market opportunity

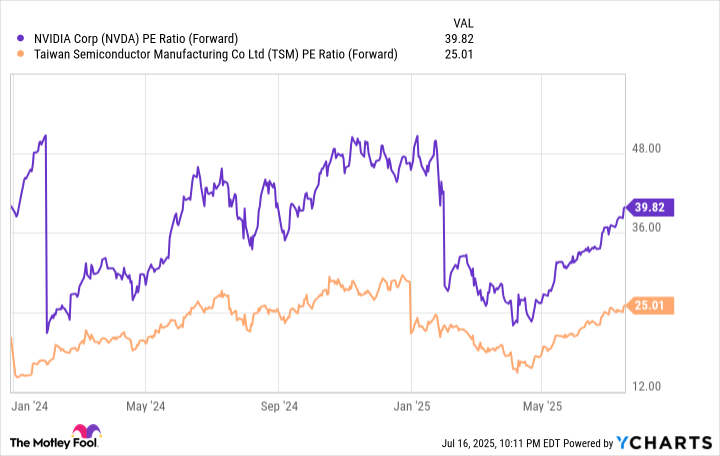

Since the market’s lowest point in April, the stocks of Nvidia and Taiwan Semiconductor Manufacturing Company have experienced a significant rebound, leading to a notable increase in their market values.

Despite currently trading below their prices from the second half of 2024, neither stock appears overly expensive when considering historical forward price-to-earnings (P/E) ratios. It’s worth noting that this valuation method examines just one year ahead. However, if the forecasted multi-year growth materializes for these two stocks, there could potentially be even greater increases in value.

Since Digital Reality Trust (REIT) experiences substantial depreciation expenses, using the Price-to-Earnings (P/E) ratio as an evaluation method is inappropriate. Instead, investors in REITs typically employ a metric called Funds From Operations (FFO) to assess stocks. Digital Realty anticipates approximately $7.10 in core FFO per share for 2025, which would give the stock a valuation of 24 times forward FFO. Although this isn’t the most affordable REIT available, considering the market potential that Digital Realty is addressing, I believe the price is justified.

All three of these stocks are excellent AI investments and make for solid stocks to buy right now.

Read More

- Top 15 Insanely Popular Android Games

- Gold Rate Forecast

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-21 13:59