As an analyst with over two decades of experience in the crypto market, I’ve seen my fair share of price breakthroughs and trends. The surge of ADA above the $1 mark is certainly one worth noting, given its significance in terms of investor sentiment and potential profitability for holders.

For the first time in two years, ADA, the cryptocurrency associated with the Cardano blockchain, has breached the $1 barrier. At present, it is trading at $1.09, a price point not seen since April 2022.

For the last day, the price of ADA has skyrocketed by a whopping 24%. At the same time, its trading volume has surged by an impressive 131%. This strong buying trend suggests that the upward momentum for Cardano coins might persist.

Cardano Holders See Green

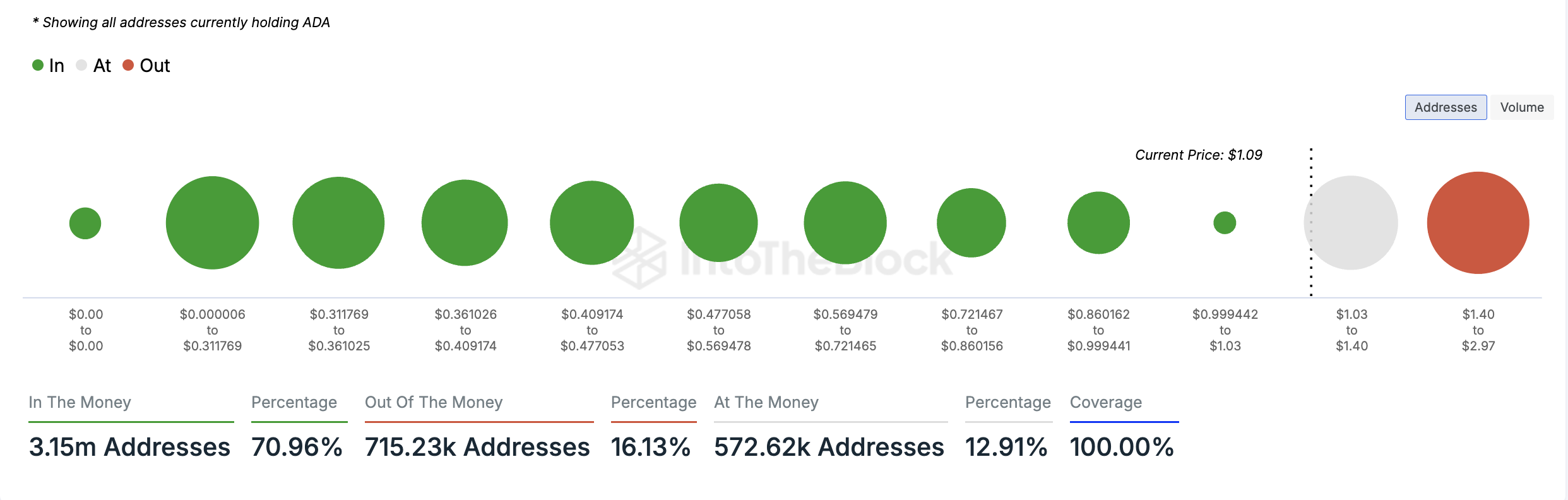

Reaching prices above $1 for Cardano has made many of its owners financially successful, as shown by IntoTheBlock’s Global In/Out of Money tracker. It indicates that about 3.15 million wallets, accounting for 71% of all ADA holders, now find themselves in a profitable position.

A location is considered “profit-making” when the value of the assets it contains is presently more than the typical price at which those assets were initially purchased. This implies that if the owner decides to sell their assets at the current market price, they would make a profit.

On the contrary, approximately 715,230 ADA address holders, representing around 16% of the total, are currently “underwater.” This means they would suffer a loss if they were to sell at the current price, as these investors bought their coins when ADA was trading above $1.40, according to IntoTheBlock’s data.

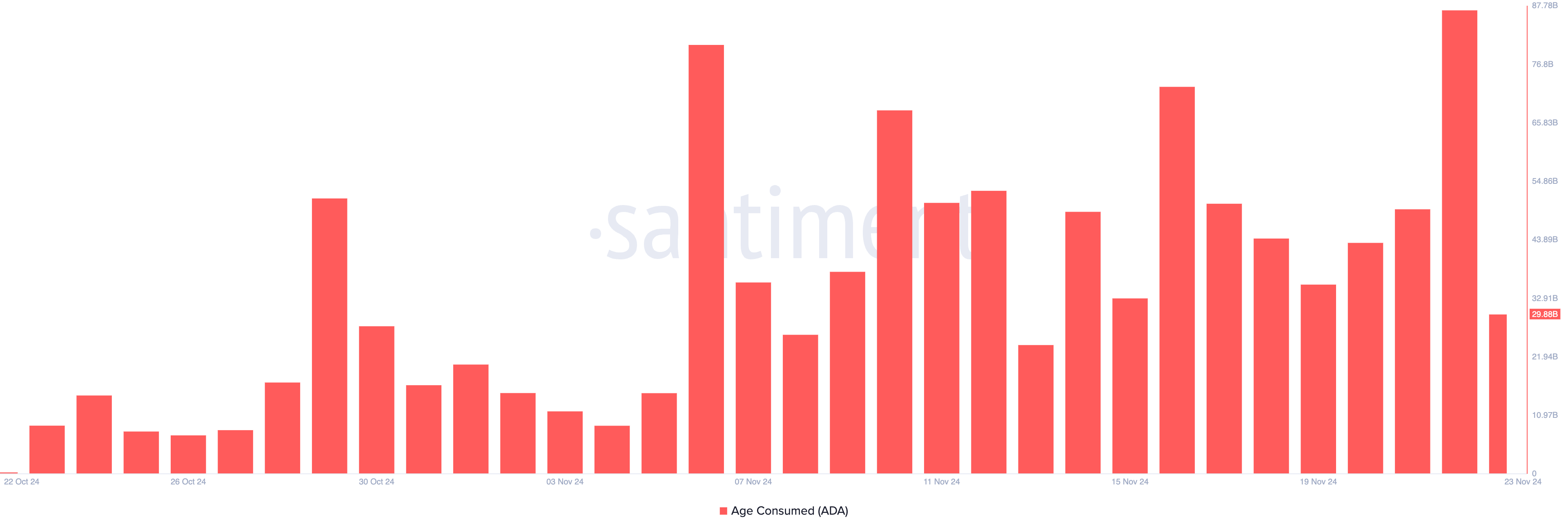

It’s worth noting that as more addresses have unrealized profits, long-term holders (LTHs) of ADA are adjusting their positions, possibly to maximize their earnings. This shift is evident in the surge of ADA’s age-consumed metric, which, according to Santiment’s data, reached a peak of 86.91 billion on November 22, marking the start of an upward trend.

This notable increase in activity stands out due to the fact that long-term investors usually keep their coins stationary. Moving them indicates a potential change in market dynamics. For instance, if ADA experiences a peak along with an uptick in trading activity and favorable price movements, it’s a sign that long-term holders might be cashing out. This could lead to more upward price movements as new investors jump on board, fueling the market further.

ADA Price Prediction: The Upward Trend Is Strong

On the daily graph, the Aroon Up Line for ADA shows 100%. This means the Aroon indicator, which gauges the power and direction of a market movement, suggests an extremely strong uptrend. At 100%, it implies that the price has recently reached a peak and there could be further bullish momentum ahead.

If these conditions persist and the demand keeps increasing, it’s likely that the price of Cardano coins will surge again towards approximately $1.24 – a level it attained back in March 2022.

However, if selling increases more than buying, the price of ADA could drop back towards its support at $1. If that level can’t prevent a fall, it would signal a downward trend, driving the price of ADA down to approximately $0.85.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- USD ILS PREDICTION

- 30 Best Couple/Wife Swap Movies You Need to See

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- Everything We Know About DOCTOR WHO Season 2

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Tyla’s New Breath Me Music Video Explores the Depths of Romantic Connection

2024-11-23 11:29