The S&P 500 (SNPINDEX: ^GSPC) seems resolutely poised for an above-average year in 2025, a destiny wrought from the ashes of April’s steep sell-off. This impressive performance is not merely a stroke of luck; rather, it sits atop back-to-back gains surpassing 20% in the years preceding. Such a recovery, one might say, provides ample fodder for the ambitious investor.

In this climate of exuberance, one must exercise prudence, deliberately seeking quality companies capable of justifying their lofty valuations with not mere projections of future earnings, but actual tangible growth. In such discerning circles, the shining prospects of three equally splendid yet disparate enterprises emerge: WM (Waste Management), International Business Machines (IBM), and Delta Air Lines (DAL) present themselves as alluring dividend stocks worth doubling down on this August.

WM: The Unflinching Titan of Passive Income

Daniel Foelber (WM): The uninitiated may raise an eyebrow at the notion of WM, the erstwhile Waste Management, as a genuine growth stock. Yet the industrial behemoth has decidedly outpaced the S&P 500 over the preceding five and ten years, despite much of that index’s prosperity being anchored in the ephemeral fortunes of certain megacap technology cohorts.

The enterprise may not bask in the limelight of disruptive innovation in the realms of artificial intelligence or cloud computing, yet it has established a business model that transforms refuse into a rather lucrative venture. In pursuit of the ever-expanding needs of a burgeoning populace and economy, WM operates within a framework promising predictability and stability.

With its vertically integrated operations ensconcing the entire waste management spectrum, WM secures a measure of control and operational efficiency most endeavors can only dream of. As the undisputed leader in the U.S. market, it can seize market share through both organic expansion and tactical acquisitions.

Remarkably, it has seen gradual improvements in operating margins and free cash flow, badges of a business that refuses to stagnate. The most recent quarter revealed a staggering 29.9% margin under adjusted operating earnings, with its legacy services blossoming at 7.1% while overall revenues swelled by 19%, buoyed by its acquisition of Stericycle.

The aforementioned deal, finalized in November 2024, allows WM to tap into the ever-growing healthcare waste market-an arena far from the mundane fuss of typical residential or commercial waste. This $7.2 billion investment builds upon the $4.6 billion previously spent on Advanced Disposal in October 2020, thus extending the company’s geographical reach across the eastern U.S.

Indeed, WM trades at a somewhat inflated 29.9 times its forward earnings, coming across as rather pricey. Yet such a premium valuation is fortified by steady free cash flow, which facilitates dividends, stock repurchasing, and reinvestment.

With a glorious track record of 22 consecutive years of dividend increases, the most recent being a commendable 10%, shareholders find that at a yield of 1.5%, the stock shall not break the bank. The dividend itself consumes a mere $669 million a quarter, a modest sum against projected free cash flow of $2.8 billion to $2.9 billion by 2025.

Thus, one recognizes WM as an ultra-high-quality dividend stock, better suited for those inclined to savor a mere afterthought of passive income, rather than a gluttonous feast, all whilst supporting a compelling narrative of growth.

IBM: A Stalwart Yet Fresh Faced Amidst the AI Revolution

Scott Levine (International Business Machines): There lies a paradox-how does one regard IBM, a venerable institution founded in 1911, as a contender for growth stock status? Yet, sporting robust exposure to AI, the company may very well flourish in the years to come, providing fertile ground for unparalleled expansion that seems downright audacious for a company of its vintage.

Adding a delightful twist, the stock presents a tempting forward-yielding dividend of 2.6%, beckoning the discerning to lounge indolently whilst the AI market unfurls its petals.

Upon reporting its second-quarter 2025 financial results, IBM flaunted noteworthy achievements, none more tantalizing than its burgeoning generative-AI contracts totaling a marvelous $7.5 billion since 2023.

Moreover, research from The CORP-DEPO reveals that IBM possesses the lion’s share of generative AI patents amongst American enterprises, underscoring its pivotal role in the technological tapestry. From the watsonx suite enhancing data management to Red Hat’s foresight in generative AI, IBM proffers a kaleidoscope of AI applications, hinting at exponential growth trajectories.

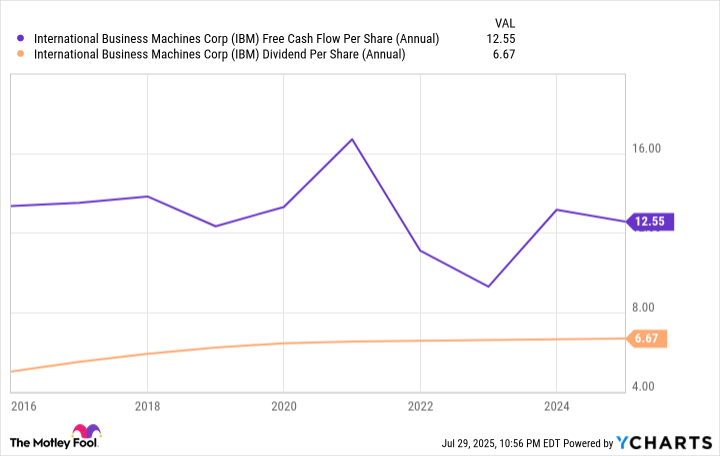

As for the dividend, a five-year average payout ratio of 156% may raise eyebrows amongst the faint-hearted. However, once one recognizes the fortitude of the company’s free cash flow, such trepidations swiftly dissipate.

For the audacious investor keen on bolstering their AI portfolio with a steadfast dividend, IBM emerges as an enticing prospect.

Delta Air Lines: An Unlikely Elegy of Growth and Dividends

Lee Samaha (Delta Air Lines): Prepare for a revelation! Not only does Delta Air Lines distribute a dividend (current yield: 1.4%), but it also stands as a credible player destined for growth in a balanced portfolio.

The surprise of a dividend might bemuse many, as airlines are often branded as cyclical businesses, notorious for plummeting earnings amid economic downturns. Yet, the landscape is shifting, and Delta’s pursuit of sustainable premium cabin revenue, alongside robust loyalty programs and profits from co-brand credit cards through American Express, mitigates earnings cyclicality.

Equally startling is the notion of Delta as a growth stock. Yet, while the characterization seems to bear the weight of historical cycles, one must acknowledge that the long-term trajectory bends favorably upward for Delta, buoyed by the aforementioned factors.

Furthermore, large network operators like Delta maintain a strategic advantage in managing escalating airport costs, which constitute only a fraction of their overall business-a welcome setup as they gracefully navigate the cyclical tides, exhibiting a newfound discipline historically absent in their predecessors.

In summation, amidst the chaos of our modern economy, Delta Air Lines emerges as an unexpected haven for growth investors seeking refuge while reveling in the dividends that continue to grace their portfolios.

🚀

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Banks & Shadows: A 2026 Outlook

2025-08-09 13:22