Investing in stocks related to cybersecurity could be one of your best decisions at the moment. Statista predicts that this year, cybersecurity spending will amount to approximately $196.51 billion, and it is expected to rise to around $262.29 billion by 2030. This translates to a compound annual growth rate (CAGR) of nearly 6%.

Businesses and organizations are bolstering their cybersecurity defenses due to the escalating risk of state-backed cyber assaults. Furthermore, there’s a rising trend among both companies and individuals to leverage technology for safeguarding confidential data like banking details, medical history, and personal identification data.

When considering cybersecurity investments, it’s not only smart to explore the well-known options but also beneficial to cast a wider net. In my opinion, a well-rounded portfolio in this sector could include tech giants like IBM and Microsoft, as well as emerging players such as CrowdStrike.

Explore further to discover how these firms are dominating the cybersecurity industry, making them excellent choices for long-term investments.

1. International Business Machines

Known worldwide by its acronym IBM, this company is a leading player in the global computer industry. Its roots go back to the early 20th century, where it started with data processing machines using punched card tabulators. In the 1980s, IBM played a significant role in popularizing personal computers. Moreover, it was among the pioneers in artificial intelligence, demonstrating this through its Deep Blue supercomputer that beat chess champion Garry Kasparov in 1997.

Currently, IBM’s primary areas of concentration include cybersecurity, cloud computing, and consulting. They offer a variety of tools to assist businesses in defending against cyber threats, including AI-enhanced cybersecurity solutions and security consulting services. In addition, they hold an impressive 81% market share in the mainframe sector, which is often preferred by Fortune 500 companies due to its robust protection against cyberattacks. Notably, even if a part of the mainframe fails, the rest of the system can continue running, ensuring business continuity.

2. Microsoft

Microsoft might not be solely focused on cybersecurity, but its diversified product portfolio is appealing. Investing in Microsoft stock offers you an entry point into the cybersecurity sector, alongside access to a myriad of other innovative offerings such as Azure cloud services, Microsoft 365 suite, Windows operating system, Xbox gaming platform, and much more.

However, this move is a significant stride into the realm of cybersecurity. By 2024, Microsoft is projected to generate $20 billion in cybersecurity earnings, an amount that’s almost equivalent to the sum total of five leading cybersecurity-focused firms.

In simpler terms, Microsoft’s AI-enhanced security tools function based on a zero-trust approach, where all actions are viewed as potential risks and scrutinized accordingly. This means that every time a user initiates a request within the platform, Microsoft’s security system will double-check the user to ensure the action isn’t malicious or harmful.

The items are seamlessly incorporated into Microsoft’s Azure and Microsoft 365 collection of office tools, effectively making Microsoft an essential part of a business’s cybersecurity strategy. This is a fortification (or ‘moat’) that many other companies aspire to possess.

3. CrowdStrike

Among the listed stocks, this one stands alone as a dedicated cybersecurity company. Its most recognized product is the Falcon platform, an AI-powered tool that safeguards laptops, servers, and mobile devices by thwarting potential threats.

The strength of CrowdStrike’s business strategy lies in its modular design. They offer 30 different modules on their Falcon platform, allowing clients to tailor a solution specifically for their cybersecurity requirements. Once a company becomes accustomed to using one of these modules, it’s simple for them to expand and adopt additional ones that might prove beneficial. This product is incredibly sticky, making it hard for companies to detach themselves once they become heavily dependent on the Falcon platform.

Approximately half of CrowdStrike’s client base employs over six different modules, while a significant portion, around 22%, utilize eight or more.

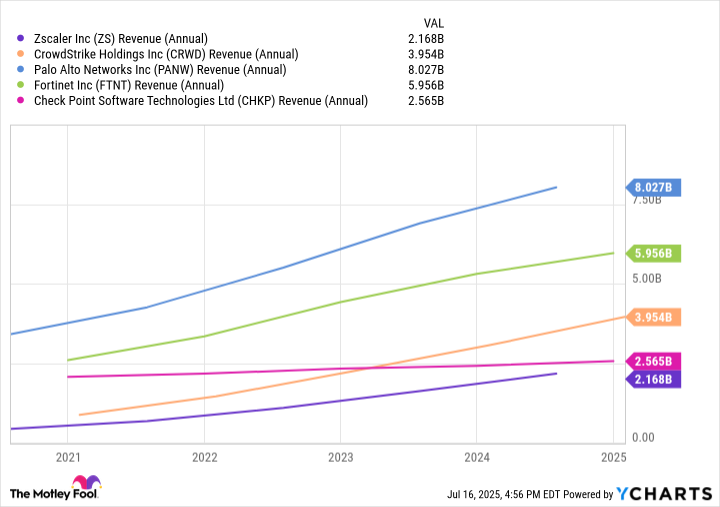

I’m thrilled to share some exciting insights about CrowdStrike! This remarkable company estimates that its platform’s total addressable market is a staggering $116 billion this year, with projections soaring to an astounding $250 billion by 2029! Here’s the kicker: Last year, CrowdStrike brought in only $4 billion in revenue. This gap between potential and reality presents a massive, unparalleled growth opportunity for this innovative company.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Silver Rate Forecast

- EUR UAH PREDICTION

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

2025-07-21 04:39