After a modest uptick in trading activity across the crypto market yesterday, momentum appears to be cooling off slightly today, much like the enthusiasm of a village fair on a rainy day.

With Bitcoin and several altcoins trading sideways or posting modest losses, here are three U.S.-listed crypto stocks to watch, each with its own peculiar charm and a dash of pre-market movement that might just be the spark of a new adventure.

Bit Digital (BTBT)

Bit Digital shares are trading sharply higher, as if they’ve just discovered a secret stash of gold in the attic, after the company announced a successful $172 million public equity raise and a strategic pivot from Bitcoin to Ethereum.

The move marks a major shift in corporate crypto strategy, akin to a farmer deciding to plant roses instead of potatoes. Bit Digital sold approximately 280 BTC to expand its ETH holdings further, now totaling 100,603 ETH, up from 24,434 ETH at the end of Q1 2025.

BTBT trades at $3.78 during today’s pre-market trading session. If demand climbs at market open, the stock could hit $3.92, a price that might make even the most skeptical investor crack a smile.

Conversely, a pullback could push it below $3.44, a price that might make one wonder if the roses were worth the trouble after all.

IREN Limited (IREN)

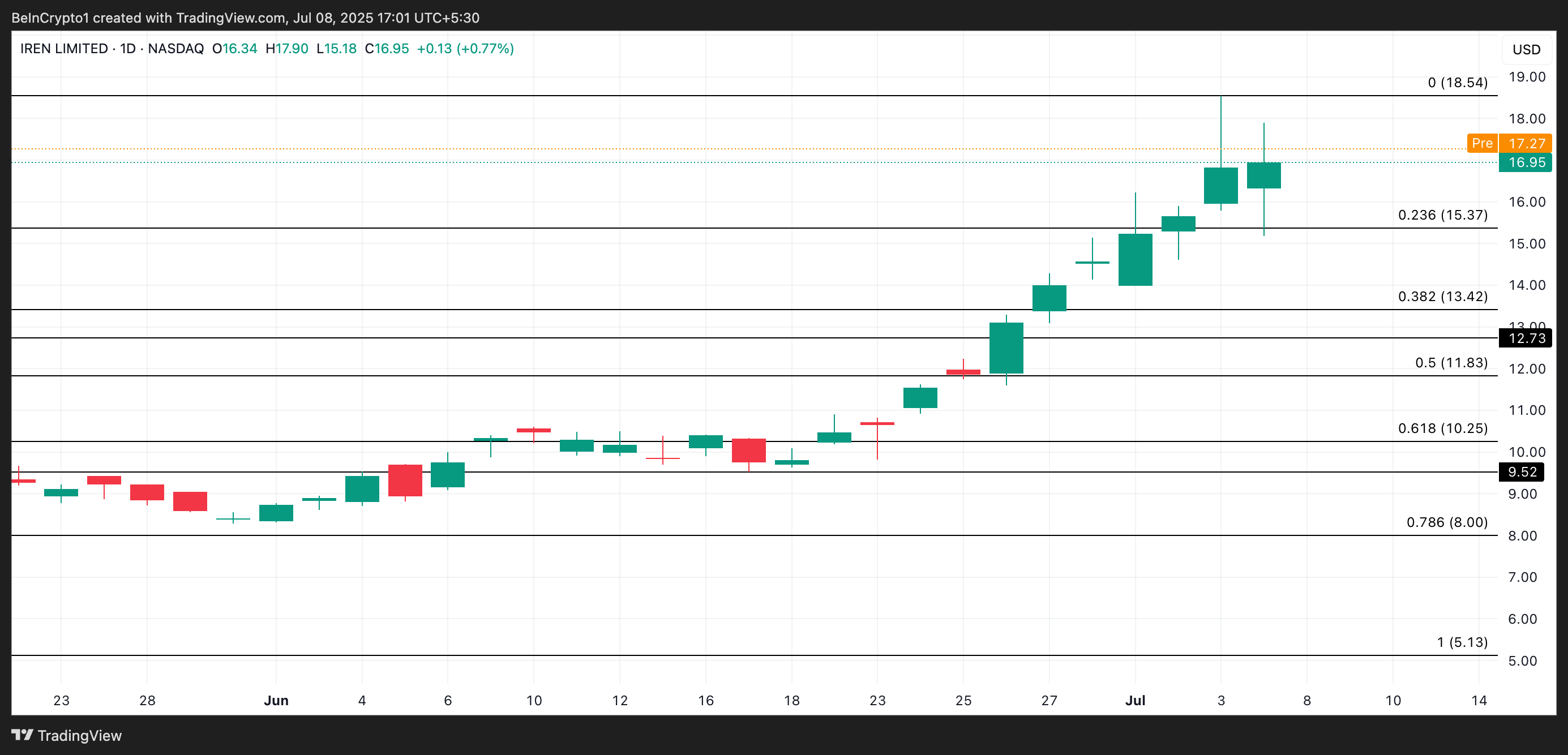

Yesterday, IREN Limited released its June 2025 update, a document as thick as a village ledger, reporting monthly revenue and hardware profit, hitting a 50 EH/s Bitcoin hashrate milestone, and announcing the expansion of its AI Cloud unit with ~2,400 NVIDIA Blackwell GPUs.

In June, IREN mined 620 BTC at an improved revenue rate of $105,730 per Bitcoin, with hardware profit rising to $49.2 million—up from $47.8 million in May. Hardware profit margins stood at 75% for its Bitcoin mining operations and a staggering 98% in AI Cloud Services, a figure that might make even the most stoic accountant blush.

During pre-market trading today, IREN shares have climbed to $17.39, up from a previous close of $17.03. If buying continues when the market opens, the price could reach $18.54, a price that might just be the envy of the village.

However, if momentum fades, a pullback below $15.37 remains possible, a price that might make one reconsider the value of all those GPUs.

Greenidge Generation Holdings Inc. (GREE)

Greenidge Generation recently announced early results from its tender and exchange offers for its outstanding 8.5% Senior Notes due 2026, a process as complex as a village council meeting. The company also increased its cash payment limit for the tender option, signaling stronger-than-expected participation.

//beincrypto.com/wp-content/uploads/2025/07/GREE_2025-07-08_13-03-40.png”/>

GREE could test resistance at $1.71 if demand surges at the market open, a price that might just be the highlight of the week. However, weak follow-through could see the price dip below $1.54, a price that might make one question the wisdom of village meetings.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Gay Actors Who Are Notoriously Private About Their Lives

- ETH PREDICTION. ETH cryptocurrency

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- The Best Actors Who Have Played Hamlet, Ranked

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

2025-07-08 17:41