In the summer of 2025, the stock market is experiencing a flourish, even amidst economic uncertainty. Notably, the major stock indexes are consistently reaching new peaks. Specifically, the S&P 500 (SNPINDEX: ^GSPC) has seen a 19% increase in the past quarter, while the more turbulent Nasdaq-100 has surged by 26%.

Even within the technology sector, there are many hidden gems with substantial values that have yet to receive their due recognition. Some exceptional growth stocks may not have received the notice about skyrocketing in 2025. When you consider their unassuming stock charts alongside strong long-term business prospects and reasonable valuations, it’s definitely worth reevaluating these overlooked growth stocks.

Allow me to present to you three dynamic technology companies: Nice Systems, Alarm.com, and GoDaddy. Each of these swiftly expanding firms represents an excellent investment opportunity with affordable share prices currently available.

What these tech stocks have in common (besides being a bargain)

These stocks have a few things in common:

- They have cloud-based business models, selling software and services with long-term contracts or monthly subscription plans.

- Client lists are primarily in the business world, ranging from GoDaddy’s 20 million small businesses to NICE’s nearly exclusive focus on enterprise-scale clients.

- Many of their products are mission-critical tools for data security or physical safety monitoring. Once your company signs a deal with one of these companies, you’re pretty likely to stay committed for the long haul.

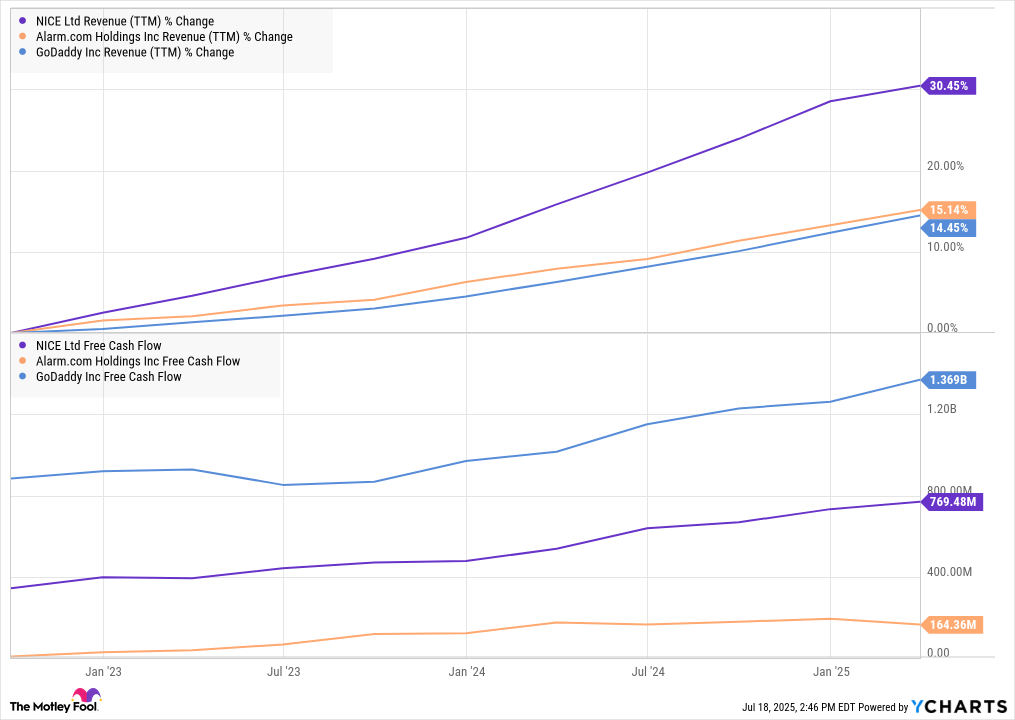

- Their lucrative business models have driven strong revenue growth and robust free cash flows in the last three years:

…and here are the bargains

Despite impressive business details and financial performance that typically warrant high valuation multiples, companies like Nice, Alarm.com, and GoDaddy have experienced decreases in their stock prices so far this year. Contrary to many other “Magnificent Seven” stocks trading at over 50 times free cash flow and double-digit price-to-sales ratios, these three stocks offer a refreshingly affordable investment opportunity.

| Stock | Price to Free Cash Flow (TTM) | Price to Sales (TTM) | Market Cap |

|---|---|---|---|

| GoDaddy | 17.5 | 5.2 | $24.0 billion |

| Nice | 11.6 | 3.5 | $9.7 billion |

| Alarm.com | 16.4 | 2.9 | $2.8 billion |

Why I’m excited about these tech stocks right now

Indeed, I’m referring to three dynamic growth stocks that are currently undervalued in terms of their valuation multiples. These companies operate within vast, worldwide markets, consistently delivering impressive business outcomes.

These shares might double or even triple in worth and still seem affordable relative to the elite group known as the Magnificent Seven. I’m not suggesting any of them will achieve such growth immediately, as it frequently takes time for market analysts to recognize the exceptional performance of a rapidly expanding software company. However, investing is generally a long-term endeavor, so I’m prepared to be patient for a substantial return in the future.

Over the years, as someone who’s deeply immersed in tech and has relied on cloud-based ventures, I’ve trusted GoDaddy for their robust security and data management solutions. I may not have a personal affiliation with Nice or Alarm.com, but they are both renowned for offering cutting-edge services that would undoubtedly appeal to me if I were running a large business requiring advanced call center and security surveillance systems.

Over an extended period, the key to enhancing shareholder worth lies in creating exceptional solutions. As a result, the financial benefits are bound to emerge. Eventually, one can anticipate that the stock prices will align with this success.

For the time being, it might be worthwhile to explore purchasing some shares of Alarm.com, GoDaddy, or Nice Systems. As of July 2025, these technology stocks appear to be quite affordable.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2025-07-20 22:41