Despite my preference for long-term investments, I find myself just as drawn to growth stocks as many others. These types of stocks are excellent picks to enhance your portfolio and outperform broader market indices such as the S&P 500, Nasdaq Composite, and Dow Jones Industrial Average. However, unlike some investors who aim to capitalize on short-term market fluctuations, I’m not interested in timing the market or chasing after fleeting growth stocks that may plummet just as swiftly as they climb.

Rather than focusing on existing brands, I am drawn more towards names that offer ample scope for expansion over the long term. What I seek are businesses that boast robust business structures, a significant advantage in their market niche (competitive edge), and crucially, a clear trajectory to maintain this momentum for the coming decade.

Among the top choices that meet all necessary criteria, we have three standouts: Meta Platforms (META), Taiwan Semiconductor Manufacturing (TSM), and Netflix (NFLX).

1. Meta Platforms

The company Meta Platforms, which oversees Facebook, Instagram, Messenger, Threads, and WhatsApp, holds a significant control over the social media landscape. According to their reports, more than 3.4 billion individuals worldwide utilize at least one of these platforms on a daily basis – a figure that represents a 6% increase compared to last year.

I’ve noticed that Meta is skillfully capitalizing on its user base. Leveraging artificial intelligence (AI) and the trove of personal data provided voluntarily by users, they managed to boost ad impressions by 5% compared to last year during the first quarter. Furthermore, the cost per ad jumped by a significant 10%.

For the initial three months, the income stood at approximately $42.3 billion, marking a 16% increase compared to the same period last year. Moreover, earnings per share climbed by 37%, amounting to $6.43.

I’m quite certain that Meta will maintain its rapid pace, as indicated by CEO Mark Zuckerberg, who mentioned that Meta intends to acquire approximately 1.3 million graphics processing units (GPUs) this year. These GPUs will fuel Meta’s AI endeavors, such as the development of its AI-driven assistant and its Meta AI generative AI system. Furthermore, Meta is prepared to invest up to $65 billion in capital expenditures.

Meta stock is definitely booming, up 22% so far in 2025.

2. Taiwan Semiconductor

Companies like Meta aren’t the only ones snapping up GPUs rapidly; Mordor Intelligence predicts the GPU market will reach an astounding $86.7 billion in 2021 and expand to a whopping $352.5 billion by 2030, reflecting a robust compound annual growth rate of 33.6%. This growth spurt is fantastic news for investors in Taiwan Semiconductor Manufacturing Company Ltd., commonly referred to as TSMC, since it manufactures the majority of these products. As per Statista, TSMC currently holds about 53% of the global foundry market share.

TSMC is widely recognized as a reliable fabricator due to its policy of not producing chips in-house, thereby avoiding potential misuse of another company’s confidential information. Notably, TSMC manufactures approximately a quarter of the chips used by Apple, and counts significant clients such as Advanced Micro Devices, Qualcomm, and Nvidia among its customer base. Additionally, TSMC is investing $165 billion in constructing manufacturing facilities in Arizona, an endeavor aimed at insulating the company from long-term tariff implications or trade friction between Beijing and Washington.

In the last three months, our earnings reached approximately $30.07 billion, marking a 44% increase compared to the corresponding period of the previous year. Shares of TSMC have seen an almost 20% rise this year (2025).

3. Netflix

In the past, I had a less than favorable opinion about Netflix. Writing for another publication, I expressed concerns that Netflix might follow the fate of Blockbuster, a company they almost put out of business, if they didn’t adjust to the evolving and dynamic competitive environment.

It turns out I greatly undervalued CEO Reed Hastings and his dynamic team, as Netflix indeed managed to transform and solidify its position as the undisputed ruler in the realm of streaming entertainment. This dominance isn’t likely to wane anytime soon. As an ardent fan, I stand in awe of their remarkable resilience and innovative spirit.

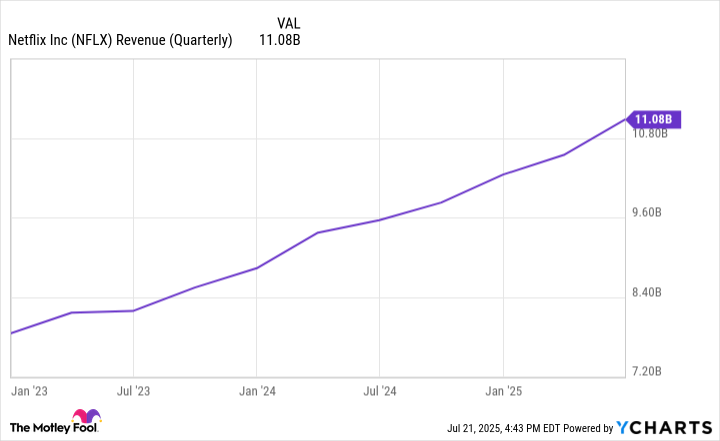

Initially, Netflix altered its business approach significantly. For quite some time, they had been tolerant of password sharing, but in 2023, they implemented a new strategy that involved charging an additional $8 for any account holder who allowed access to their account from outside their household. This move proved transformative, as Netflix’s income saw a swift increase. Since the change, quarterly revenue has surged by 41%.

Moreover, Netflix expanded its scope to include more live events and sports programming. This includes significant boxing championships, the renowned Monday Night Raw broadcast, and certain National Football League (NFL) games.

In the second quarter of this year, Netflix earned approximately $11.08 billion in revenue, marking a nearly 16% increase compared to the same period last year. What’s worth noting is that their ad-supported subscription tier, which includes ads during all live events, has now been subscribed to by over 94 million users – more than double the number from a year ago.

This year, the value of Netflix stocks has skyrocketed by an impressive 36%, indicating there’s still significant potential growth for investors who plan to hold their investments for the long term.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2025-07-25 14:57