Three emerging technologies are poised to reshape our daily lives. GE Aerospace (GE) aims to revolutionize the airplane industry with a radical new engine design, Nvidia (NVDA) is leading the charge toward a new generation of more power-efficient and cost-effective data centers that will support artificial intelligence (AI)-led demand, and Tesla (TSLA) is changing the way investors perceive the automotive industry.

GE Aerospace and open fan engines

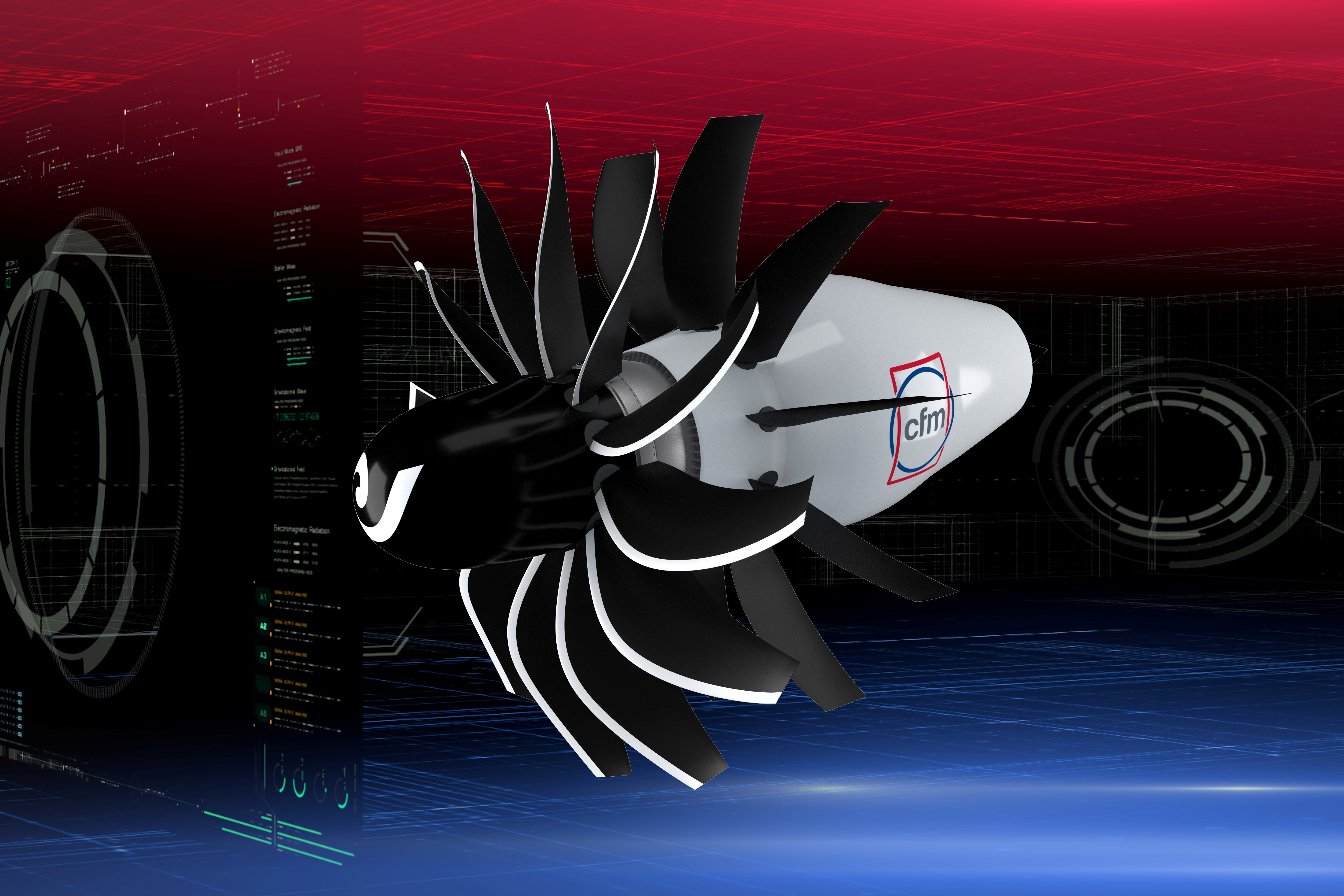

GE Aerospace’s joint venture with Safran, CFM International, is developing a technology program called Revolutionary Innovation for Sustainable Engines (RISE). CFM believes an open fan engine is “the most promising path to achieve a step change in efficiency and durability.” Imagine a bicycle with gears that suddenly become 20% more efficient-this is the kind of leap we’re talking about.

For the uninitiated, an open fan engine resembles a jet engine with a wide, exposed fan-like a propeller that’s grown up. Its higher bypass ratio (the volume of air flowing around the engine core versus through it) makes it more efficient, akin to using a large, slow-moving fan to cool a room instead of a small, high-speed one. This design could cut fuel use by 20% and work with sustainable aviation fuels, a win for airlines and the environment.

The implications for investors are clear: aircraft manufacturers adopting this tech (Airbus is testing it) could gain a significant edge over rivals, while aftermarket services might see a surge in demand. It’s the kind of innovation that makes you wonder why we didn’t think of it sooner.

Nvidia and the next generation of data centers

AI’s insatiable appetite for power is pushing data centers to their limits. Nvidia and its partners are tackling this with a 2027 launch of 800-volt high-voltage direct current (HVDC) data centers. Think of it as upgrading from a 12-volt car battery to a high-voltage grid-efficiency, heat reduction, and cost savings follow.

Traditional data centers convert grid power to low-voltage DC within racks, but Nvidia’s approach steps down 13.8 kV AC to 800 V DC at the perimeter, then to lower voltages at the rack. This high-voltage/low-current model reduces copper usage and maintenance costs by 70%, a game-changer for companies like Vertiv and ON Semiconductor. It’s the kind of engineering that makes you grateful for the people who figure these things out.

Tesla’s robotaxis

For decades, automakers sold cars to individuals who drove them for years. But electric vehicles (EVs) flip the script: upfront costs are higher, but running and maintenance expenses are lower. It’s like trading a gas-guzzling sedan for a hybrid-your monthly bills shrink, even if the initial price tag is steeper.

Here’s where Tesla’s robotaxis come in. If they work, they’ll turn EVs into profit generators, not just transportation. Imagine a car that works 24/7, charging itself and earning money while you sleep. It’s a shift as profound as the transition from horse-drawn carriages to cars-only this time, the horses are electric.

For investors, the stakes are high. As EVs scale, their cost per unit will drop, making them more accessible. And the most economical use of an EV? A robotaxi. It’s a future where owning a car feels as outdated as owning a typewriter.

These technologies aren’t just innovations-they’re tectonic shifts. As a growth investor, the question isn’t whether they’ll matter, but how quickly we’ll adapt to their momentum. 🚀

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- ETH PREDICTION. ETH cryptocurrency

- Top 15 Insanely Popular Android Games

- Games That Faced Bans in Countries Over Political Themes

- Uncovering Hidden Groups: A New Approach to Social Network Analysis

- ‘Zootopia 2’ Wins Over Critics with Strong Reviews and High Rotten Tomatoes Score

- Best Ways to Farm Prestige in Kingdom Come: Deliverance 2

2025-09-02 20:42