Okay, look. It’s 2026. We’ve survived another January, which, let’s be honest, is a minor miracle. The market is doing that thing where it pretends to have a plan, and I’m here to tell you which stocks might actually deliver before we all get distracted by the next viral cat video. I’m not talking about “to the moon” nonsense, I’m talking about solid companies that could actually, you know, increase your portfolio, and maybe, just maybe, allow you to afford a decent cup of coffee. I’ve been staring at spreadsheets so long I’m starting to see Fibonacci sequences in my oatmeal. So, here are three I’m cautiously optimistic about, mostly because I need something to distract me from the existential dread.

Nvidia

Nvidia. Honestly, at this point, it’s less a company and more a force of nature. They make the chips that run everything, including my smart toaster (which, by the way, keeps burning my bagels). They’re the reason AI isn’t just a plot device in bad sci-fi movies, it’s a real thing that’s slowly taking over the world. And they’re sold out. Like, completely. That’s a good sign, unless you’re a data center looking for GPUs. They’re basically the Beyoncé of semiconductors – everyone wants a piece. The fact that they’re not even factoring in potential Chinese sales is…well, it’s either genius or reckless. I’m leaning toward genius. They report earnings on February 25th, and if the guidance is even remotely positive, expect the hype train to leave the station. It’s still early days for AI, and Nvidia is currently the only viable way to get in on the ground floor. Unless you have a time machine and can invest in ENIAC.

Nebius Group

Nebius. Okay, this one is a little more…under the radar. Think of them as the boutique GPU concierge service. They buy Nvidia chips (see above) and turn them into ready-to-go computing clusters. Basically, they’re the people who make sure your AI overlords have enough processing power. They’ve had some serious growth, 355% year-over-year. That’s the kind of number that makes accountants weep with joy. Their current annual run rate is a modest $551 million, but they’re projecting $7 to $9 billion by the end of 2026. That’s…ambitious. It’s like saying you’re going to run a marathon after only walking around the block. But if they pull it off, investors could see a pretty significant return. I’m cautiously optimistic, mostly because I like the underdog. Plus, any company that can navigate the GPU shortage deserves a medal.

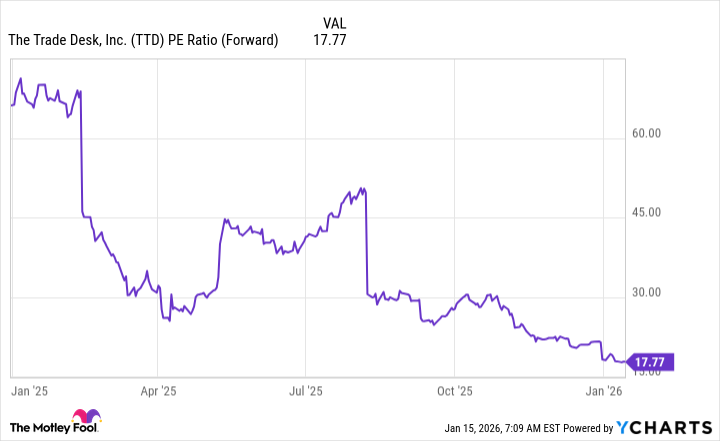

The Trade Desk

The Trade Desk. Let’s be real, 2025 wasn’t their best year. They were the worst performing stock in the S&P 500. It was a bit of a mess, to be honest. Their new AI-powered ad platform had some…issues. And the lack of political ad revenue didn’t help. It’s like showing up to a potluck with an empty casserole dish. But here’s the thing: they’re cheap. Trading at less than 18 times forward earnings, compared to the S&P 500’s 22.4. That’s a bargain. It’s like finding a designer handbag at a thrift store. If they can fix their platform issues and get back on track, this stock could really take off. They’ve consistently shown strong double-digit growth, and I’m betting they can do it again. It’s a value play, and frankly, I’m a sucker for a good comeback story.

So, there you have it. Three stocks that might actually make you some money in 2026. Disclaimer: I’m not a financial advisor. I just spend a lot of time looking at numbers and making sarcastic comments. Invest at your own risk. And if you lose all your money, don’t blame me. Blame the algorithms.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- EUR UAH PREDICTION

- Silver Rate Forecast

- DOT PREDICTION. DOT cryptocurrency

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

2026-01-20 05:03