In the grand temporal theater of 2025, gold and silver are playing the roles of both hero and villain-actors on the stage of those eager to gamble on the ever-elusive promise of wealth. Exchange-traded funds (ETFs), those clever vassals of modern finance, have become the preferred accomplices of the financially ambitious-offering the illusion of owning treasure without the discomfort of prying into a vault or wrestling with bullion. Among these, iShares Silver Trust (SLV +2.71%) and SPDR Gold Shares (GLD +0.11%) are performing their acts, each promising a different flavor of metallic success or disaster.

SLV, with the solemn purpose of mimicking the silver market, is a slender mirror reflecting the price fluctuations of that shiny, industrious metal. Conversely, GLD stands as the gilded ambassador of gold, a bullion-backed oracle offering purity and stability-at least in theory. With both funds enjoying the status of highly refined and liquid commodities, they are the favorite playgrounds for investors wishing to flirt with precious metals-sans the chore of storing or insuring. Yet beneath their glitter, a divergence in risk and historic performance whispers the truth: silver’s allure often comes with a frolicsome temperament, while gold remains the solemn elder, less prone to wild fashion.

Snapshot (cost & size)

| Metric | SLV | GLD |

|---|---|---|

| Issuer | iShares | SPDR |

| Expense ratio | 0.50% | 0.40% |

| 1-yr return (as of Dec. 19, 2025) | 126.9% | 66.8% |

| Beta | 1.39 | 0.49 |

| AUM | $34.1 billion | $146.9 billion |

Beta, that treacherous measure of volatility, computes how wildly these funds dance versus the S&P 500; a high beta might mean you’re riding a roller coaster while others pay for a merry-go-round ride. The 1-year return, meanwhile, marks the total gain-like the result of a poker game that’s yet to be fully counted.

Performance & risk comparison

| Metric | SLV | GLD |

|---|---|---|

| Max drawdown (5 y) | (38.79%) | (21.03%) |

| Growth of $1,000 over 5 years | $2,499 | $2,269 |

What’s Inside

GLD is the epitome of purity-fully backed by solid gold, which means it’s a straightforward affair: you trust a bar of gold to be worth a bar of gold. This venerable ETF has been strutting its stuff for over two decades, proudly claiming to be the pioneer of bullion-backed exchange-traded assets-no Pixies or spicy sector tilts, just the unadulterated allure of gold’s ancient charm. Inside its vaults lie the gleaming rewards of centuries, offering a calm, if somewhat conspicuous, assurance of wealth.

SLV, by contrast, embodies the restless spirit of silver-a metal that dances from industrial hallways to jewelry displays with equal fervor. With roots stretching back to 2006, it proudly bears the crown of the oldest silver ETF, concentrating solely on that luminous metal, unadorned and unadulterated. Both funds are essentially minimalist-holding only their respective metals-yet that simplicity invites a storm of market swings, especially where silver’s temperamental nature reigns supreme.

For the wise investor, a thorough guide to ETF strategies awaits-because in the world of riches, knowledge is the best hedge.

What This Means for Investors

In 2025, precious metals have become the glamour boys on Wall Street’s dance card. Gold reached its zenith in October, a shiny high note that resonated through financial corridors. Silver, not one to be outdone, is breaking its own records as I pen these words-an industrial metal with a penchant for surprise, trading on the fringes of volatility and opportunity. Such metals are the classic safe havens-much like the old fellow who secretly stocks away jam jars on a shelf-hedging portfolios against the chaos of geopolitics, falling interest rates, and the capricious whims of global central banks.

Demand for gold takes many forms: central banks hoarding, jewelry-mad consumers from India and China, and the cautious retail investor wishing to stake a claim in eternity. Silver’s appeal, however, is rooted in its versatile industrial role-showcased in electronics, solar panels, electric cars, and medical gadgets-making it both the fragile darling and the volatile tiger of markets. With gold’s market more capacious and liquid, silver’s wild side has kept it a tempting opportunity for those seeking thrill, profit, and the occasional heartbreak.

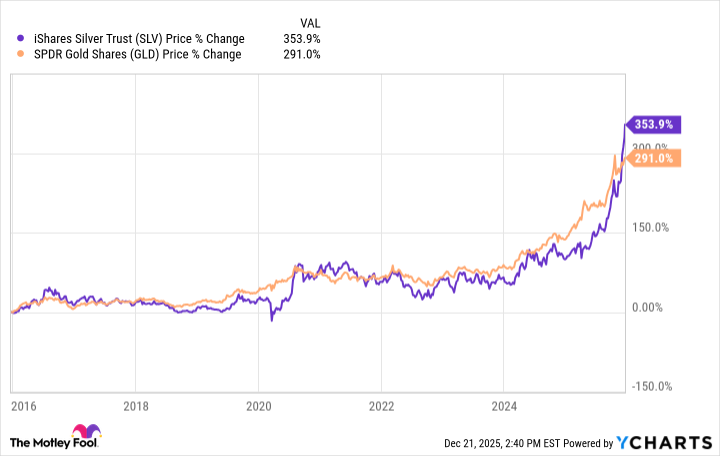

Long-term, both metals have raked in handsome returns-proof that even in their eccentricities, they deliver. Investors seeking entry points can choose to embrace physical bullion, corporate shares, or plasma their hopes through ETFs-each path paved with the shimmering promise of future gains.

Two titans-the SPDR Gold Shares ETF and the iShares Silver Trust ETF-offer the finest tickets to this metallic carnival. They store their treasure within guarded vaults, providing direct access yet indulgent in their liquidity and size, making it an easy choice for those who prefer their wealth in shiny, tangible packages. Smart gamblers may diversify-buying a smattering of both-because the long game favors those who can ride the undulations of the gold-silver jig.

Glossary of the Cryptic

ETF: The modern soap-opera of pooled investments, traded like stocks but with the soul of a mutual fund.

Expense ratio: The annual toll, payable in bits of your assets, for the privilege of investment.

Assets under management (AUM): The total fortune that a fund claims and caters to, often measured in billions.

Beta: Your investment’s wild child, measuring its mood swings compared to the broader market.

Max drawdown: The deepest plunge from peak to valley, the financial equivalent of a midnight fall into the abyss.

Liquidity: How easily your asset can be spirited away-ideally without stirring the market.

Commodity ETF: A liquid shortcut to owning tangible riches-gold, silver, or that peculiar commodity of your choice.

Sector tilt: When a fund favors a niche or industry, ignoring the broader parade.

Physical asset: The real thing-gold in the safe, silver in the vault-no digital trickery involved.

Total return: The grand sum of gains-price swings, dividends, interest-rolled into one glorious number.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Wuchang Fallen Feathers Save File Location on PC

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- 9 Video Games That Reshaped Our Moral Lens

2025-12-22 14:12