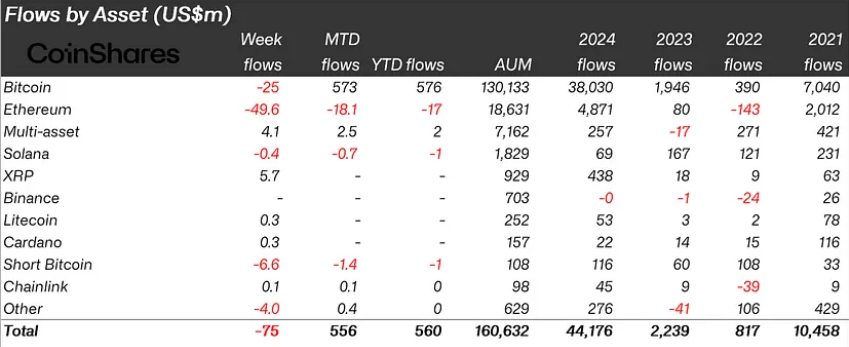

2025’s initial three trading days witnessed a significant surge in crypto inflows amounting to $585 million, signaling a robust start for the year. Conversely, the complete week, which encompassed the last two trading days of 2024, experienced net outflows totaling $75 million.

2024 saw an unprecedented increase in crypto inflows, ending at a whopping $44.2 billion – almost quadrupling the previous record of $10.5 billion from 2021.

Bitcoin’s Dominance and the Role of ETFs

According to the recent CoinShares analysis, the increase in these financial outcomes can be linked to institutional investors moving towards American investment options. More precisely, exchange-traded funds specializing in Bitcoin and Ethereum that are tied directly to spot markets have been capturing the attention of such institutional investors.

2024’s ending brought in a staggering global inflow of $44.2 billion, nearly four times greater than the previous record set in 2021 with its $10.5 billion inflow. The report indicated that this surge was primarily driven by the debut of US spot-based ETFs, all of which accounted for a massive $44.4 billion in investments.

In 2024, Bitcoin spearheaded investment trends, drawing in a significant $38 billion. This represented approximately 29% of the total assets managed, a noteworthy achievement primarily attributed to Bitcoin Exchange Traded Funds (ETFs).

These financial tools have played a crucial role in establishing Bitcoin as a viable investment option for both institutional and individual investors by providing them with a controlled and user-friendly method to invest. According to BeInCrypto’s reports, Bitcoin ETFs are projected to expand their influence significantly by 2025, possibly attracting even more funds as the demand for secure and compliant crypto investment options continues to escalate.

Jan van Eck, the CEO of VanEck, is encouraging investors to boost their investments in Bitcoin and gold up until the year 2025. He emphasized that Bitcoin, specifically, provides a significant shield against inflation, uncertainties in fiscal policies, and global tendencies towards de-dollarization.

Altcoins Struggle to Gain Traction

The report points out that Ethereum witnessed a strong comeback towards the end of 2024, amassing approximately $4.8 billion in investments by year-end. This influx accounted for 26% of Assets Under Management (AuM), signifying a 2.4 times multiplication from the previous year and an astounding 60 times growth compared to 2023.

Similar to how Bitcoin’s growth was boosted by the increasing demand for Bitcoin ETFs, the escalating popularity of Ethereum ETFs has contributed significantly to its expansion. According to BeInCrypto’s report, Ethereum ETFs established a new high in December as institutional interest surpassed $2 billion.

In 2024, altcoins received a total of $813 million, which is only 18% of the total assets under management (AuM). This suggests that while there’s continued interest in non-Bitcoin and non-Ethereum digital assets, their significance pales in comparison to the substantial influence of Bitcoin and Ethereum.

As a researcher, I’ve noticed that investors seem to favor assets with a proven track record and robust structure. To illustrate this, BlackRock has announced its intent to concentrate on Bitcoin and Ethereum, postponing any plans for an altcoin Exchange-Traded Fund (ETF) in the near future.

According to reports, Jay Jacobs, who leads BlackRock’s ETF division, stated that we are merely scratching the surface when it comes to Bitcoin and Ethereum. A small percentage of our clients currently own these cryptocurrencies (IBIT and ETHA), which is why we are primarily focusing on them rather than launching new Exchange-Traded Funds for other altcoins at this time.

Regardless, the persistent growth of cryptocurrency ETFs appears set to assume a pivotal position in shaping the market. Experts within the industry foresee that aside from drawing new investments, these investment tools are expected to boost market stability by offering a controlled access channel for institutional investors.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-06 17:10