As a seasoned financial analyst with over two decades of experience in traditional markets and the crypto sphere, I’ve seen my fair share of market events that have left even the most seasoned traders scratching their heads. Today’s expiration of $2.639 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts is one such event that demands attention.

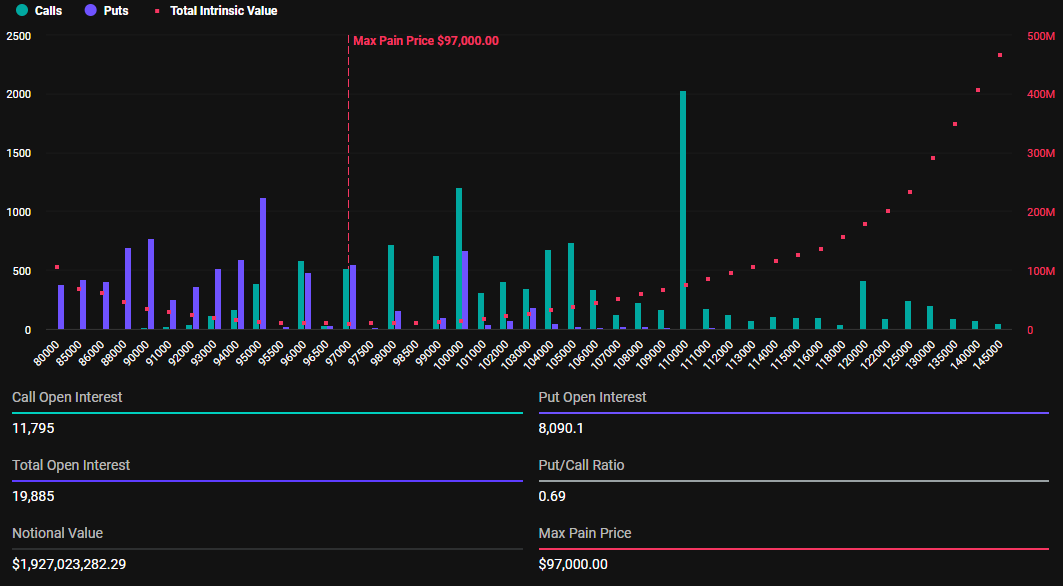

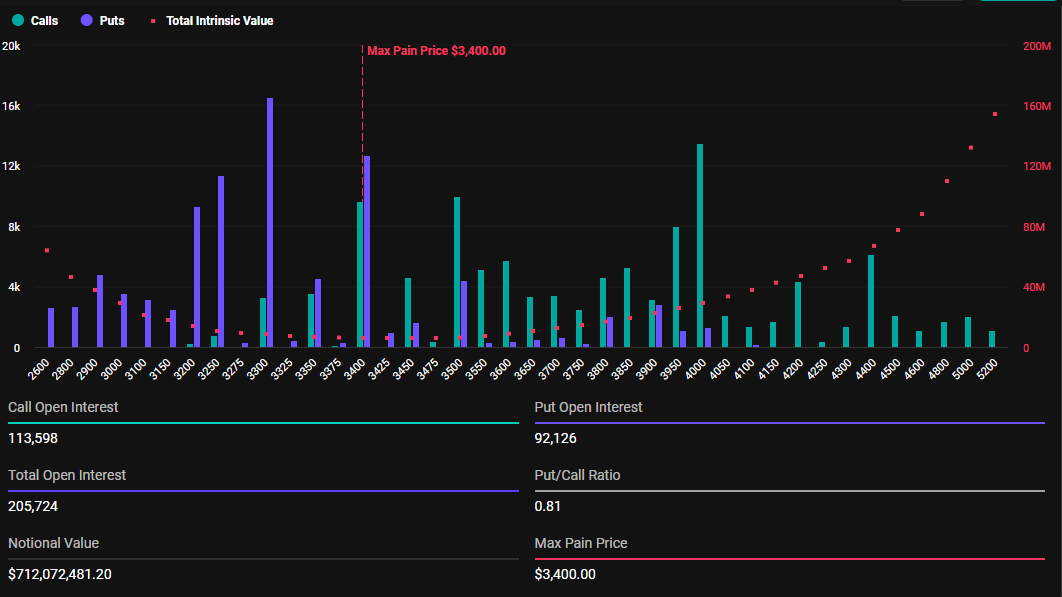

Having closely observed numerous options expirations in my career, I’ve learned to anticipate volatility as the norm rather than the exception. This particular expiration, with its staggering $1.9 billion worth of Bitcoin options and $712 million worth of Ethereum options, is no exception.

Given the recent volatility in both BTC and ETH prices, I believe that we could see this volatility extend or even intensify as these contracts expire today. The striking difference between last week’s and this week’s contract numbers for both Bitcoin (19,885 vs 88,537) and Ethereum (205,724 vs 796,021) is a clear indication that the market will be closely watching these expirations.

The bullish sentiment surrounding Bitcoin, as evidenced by its maximum pain point of $97,000 and put-to-call ratio of 0.69, combined with Ethereum’s similar outlook (maximum pain price of $3,400 and a put-to-call ratio of 0.81), is noteworthy. However, the strike prices could potentially cause some short-term fluctuations in both assets, which may create market uncertainty.

Traders and investors should brace themselves for potential volatility, as options expirations often lead to short-term price movements that can sway the overall market trend. In my experience, it’s essential to remain vigilant during such events and prepare for possible adjustments in one’s investment strategy.

That being said, I’ve also learned over the years not to underestimate the resilience of markets. After every storm comes a calm, and even in the face of potential volatility today, I expect the crypto markets to stabilize soon after this high-volume expiration.

Lastly, let me leave you with a little humor to lighten the mood: “Options trading is like trying to catch a greased pig while blindfolded – it’s unpredictable, messy, and sometimes, you end up smiling even when you lose.” Keep your eyes on the markets, but don’t forget to enjoy the ride!

Today, approximately $2.639 billion worth of Bitcoin (BTC) and Ethereum (ETH) options contracts are set to expire. This significant event might influence the immediate market trends, considering the volatile behavior displayed by these assets recently.

As a seasoned investor with over a decade of experience in the crypto market, I have witnessed its dramatic highs and lows, and learned to navigate through its volatility. With Bitcoin options valued at $1.9 billion and Ethereum at $712 million, it’s reasonable to anticipate that crypto markets may continue to see volatility as we move towards 2025. The expiration of these options could potentially lead to significant price movements in both BTC and ETH. I personally believe that the next few months will be crucial for determining the trajectory of the market, with the possibility of either a steady kickoff or an extension of volatility. It’s essential to stay informed and cautious as we approach this potentially pivotal moment in the crypto market.

First Crypto Options Expiry of 2025: Over $2.6 Options Expire

Today’s Bitcoin options expiration on Deribit includes 19,885 contracts, a significant drop compared to the 88,537 contracts seen last week. Similarly, for Ethereum, the expiring options amount to 205,724 contracts, a substantial decrease from the 796,021 contracts of the previous week. The difference can be attributed to the large number of contracts from last week that corresponded with the end-of-year options expiration.

In simpler terms, the highest potential price for options expiring with Bitcoin is set at around $97,000. There are more call (buy) options than put (sell) options in the market, with a ratio of 0.69. This suggests that investors have a mostly optimistic outlook towards Bitcoin, even though it’s currently finding it difficult to surpass the $100,000 mark.

Today’s Ethereum contracts expire with a maximum ‘distress price’ of $3,400 and a ‘options ratio’ of 0.81, which suggests a similar market perspective. When the options ratio is less than 1, it means more traders are wagering on price rises.

When it comes to options trading, the strike price plays a significant role in shaping market dynamics. Essentially, it’s the price point where the majority of options become valueless upon expiration, potentially causing substantial financial loss for traders.

Prepare yourself for potential market turbulence as option expirations can lead to temporary price swings, causing a sense of unpredictability. In essence, an asset’s price may move towards the optimal price that benefits option sellers, who are usually large financial entities or ‘smart money’.

As an analyst, I’m reporting that at the moment, Bitcoin is being traded at approximately $96,912, while Ethereum is exchanging hands for around $3,465, based on BeInCrypto data. If these cryptocurrencies trend towards their respective key levels, it could imply a modest price growth for Bitcoin and a slight decrease in the value of Ethereum, potentially leading to increased volatility in the market.

During the post-Christmas period, the level and pattern of volatility have remained consistent. Contrary to some predictions, the expiration of a large number of options at the end of December did not lead to the anticipated market fireworks in ETH or BTC. Instead, ETH’s volatility dropped by more than 5 points, while BTC maintained a similar, slightly steeper pattern it had since Christmas Day, according to Deribit.

Despite the likelihood of market fluctuations, it tends to regain stability swiftly once traders acclimate to the altered pricing landscape. Given the substantial trading activity happening today, it’s reasonable to anticipate a similar response, which could influence near-term market movements.

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- All 6 ‘Final Destination’ Movies in Order

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-01-03 09:13