It’s often misunderstood that accumulating wealth relies on being a skilled stock picker. While choosing individual stocks can potentially lead to substantial returns, it’s important to remember that there are numerous alternative strategies for investors to capitalize on the growth of the overall stock market.

One method is utilizing Exchange-Traded Funds (ETFs). These ETFs embody a collection of stocks, offering investors a passive investment in particular sectors or concepts.

In the following section, I will explain two Exchange-Traded Funds (ETFs) offered by Vanguard that could potentially make individuals millionaires with minimal effort required.

1. Vanguard S&P 500 ETF

Instead of focusing on Warren Buffett’s renowned skill in choosing individual stocks, it’s worth noting that he frequently advises ordinary investors to invest in the S&P 500 index. The question is, how does one go about doing this in practice?

With the Vanguard S&P 500 ETF (VOO), you’re all set! This investment fund offers passive investment in the companies that make up the S&P 500, ensuring a wide range of diversification for investors. Moreover, since various industries react differently to news and economic changes, this setup also serves to lessen potential losses or downside risk.

What sets this Vanguard ETF apart from other S&P 500-based funds is that it is structured based on market capitalization. This implies that companies with larger market caps, like Nvidia, Microsoft, Apple, Berkshire Hathaway, and Eli Lilly, have a greater impact on the fund’s price fluctuations compared to smaller companies.

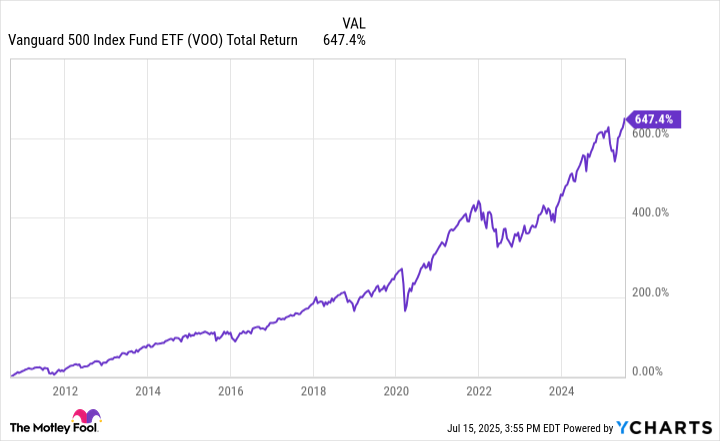

Since its launch back in 2010, I’ve noticed that the Vanguard S&P 500 ETF has been quite a performer, racking up a whopping total return of 647%. That translates to an impressive annual growth rate of approximately 14.5%.

Over a prolonged period, consistently investing $200 of mine each month could potentially swell substantially.

| Timeline | Long-Term Savings |

|---|---|

| 10 Years | $53,400 |

| 20 Years | $279,078 |

| 30 Years | $1,232,848 |

2. Vanguard Dividend Appreciation ETF

The Vanguard Dividend Appreciation ETF (VIG) is composed of companies that have consistently raised their dividend payouts for a decade or longer. It’s essential to recognize that being part of this index isn’t solely based on offering a high dividend yield. Rather, these are companies that have demonstrated the ability to maintain their dividend payments and, more importantly, the financial agility to boost them over the long term.

This fund appears to be an excellent addition to VOO, as it provides a distinctive blend of both growth and value stocks. These stocks, such as Visa, Broadcom, and Walmart, are reliable sources for generating dividend income.

Over the years, this investment fund has consistently earned an average yearly return of approximately 10%. This is slightly higher than the typical long-term return of the S&P 500 stock market index.

If these returns continue, a regular investment of $200 each month could potentially accumulate to around $450,000 over a span of 30 years.

Keep these ideas in mind

When picking an ETF, it’s essential to take into account the expense ratio. For instance, the expense ratios for VOO and VIG are 0.03% and 0.05%, respectively. This means that investors will spend less than a dollar, specifically $0.03 or $0.05, for every $1,000 they invest in these ETFs.

Regularly investing in VOO and VIG could potentially turn you into a millionaire. However, it’s crucial to regularly add to your investments over time, as accumulating a substantial savings of seven figures may take several decades.

In this fascinating exploration, I’ve discovered a crucial concept: accumulating wealth is a journey that demands time, self-control, and an abundance of patience. To me, these two Vanguard funds stand out as affordable and hassle-free solutions, offering the potential for substantial wealth creation over time.

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Wuchang Fallen Feathers Save File Location on PC

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Crypto Chaos: Is Your Portfolio Doomed? 😱

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

- The Best Single-Player Games Released in 2025

- Brent Oil Forecast

- ‘Bad Guys 2’ Tops Peacock’s Top 10 Most-Watched Movies List This Week Again

2025-07-23 12:30