In the current market scenario, Artificial Intelligence (AI) investment remains a significant trend. A large sum of capital is being channeled towards enhancing AI manufacturing capacities, and certain stocks are reaping rewards from these investments.

Among my preferred picks are Nvidia (NVDA) and Taiwan Semiconductor Manufacturing (TSM). It’s anticipated that these two will witness significant expansion in the upcoming years, positioning them as my top recommended AI stocks for purchase at the moment.

Nvidia

Nvidia produces Graphics Processing Units (GPUs), which are exceptional at managing heavy computational tasks due to their ability to perform numerous calculations simultaneously and link together to boost their effectiveness even further. When assembled in clusters, these GPUs can form massive AI computing systems, with some containing over 100,000 Nvidia GPUs each, making them powerful machines for training artificial intelligence models.

It seems that in 2025, AI hyperscalers plan to invest unprecedented amounts on constructing data centers. Given the intricate and time-consuming nature of building these facilities, which can take years from conception to operation, it’s likely that this significant investment in data centers will continue for several years. This prolonged spending trend could mean that Nvidia’s strong sales of GPUs for data centers are here to stay.

More recently, Nvidia received encouraging news from the U.S. administration. Previously, in April, Nvidia’s export permit for H20 chips was rescinded. These chips were engineered to comply with export limitations to China, and the cancellation of the export license was projected to result in a $8 billion loss in sales during the second quarter. Despite anticipating $45 billion in overall revenue, this development was a significant setback. However, Nvidia disclosed that it is reapplying for an export permit and has been assured by the U.S. government of its approval. This will undoubtedly boost Nvidia’s sales and allow it to maintain its remarkable growth trajectory.

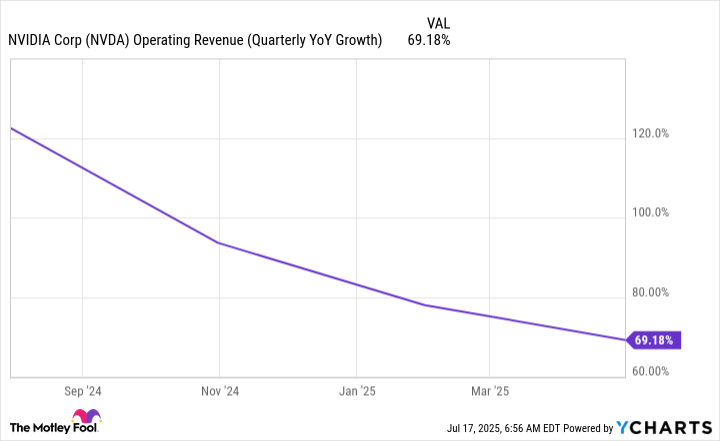

Although H2O chips won’t influence Q2’s sales totals directly, they might affect Q3’s data significantly. Initially, Nvidia predicted a 50% increase in revenue for Q2. However, if projected H2O sales were taken into account, the growth would have been approximately 77%. This suggests that Nvidia’s sales may not be decelerating as rapidly as anticipated, highlighting the remarkable expansion in the AI sector.

It’s advisable that investors consider Nvidia as a prime choice for artificial intelligence investments, given its ongoing prominence in the field. In my opinion, it would be prudent for every investor to include some level of investment in Nvidia.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing Company (TSMC) produces Nvidia’s chips because Nvidia doesn’t have the capacity to make them on their own. Alongside Nvidia, TSMC also works with tech giants like Apple and Broadcom. Given that almost every company leveraging advanced technology is now partnering with TSMC, this suggests a strong standing for its market position.

Taiwan Semiconductor has solidified its dominance in several significant ways. To begin with, it doesn’t compete against its customers by selling chips directly to consumers; instead, it functions as a chip foundry exclusively. Secondly, it consistently stays ahead of the curve in terms of cutting-edge chip technology, ensuring clients can rely on Taiwan Semiconductor for long-term partnership rather than frequently switching foundries to access new technologies. Lastly, Taiwan Semiconductor boasts top-tier manufacturing processes that deliver class-leading yields, a fact exemplified by its 90% yield at the 3nm (nanometer) chip node, significantly outperforming Samsung’s reported 50%.

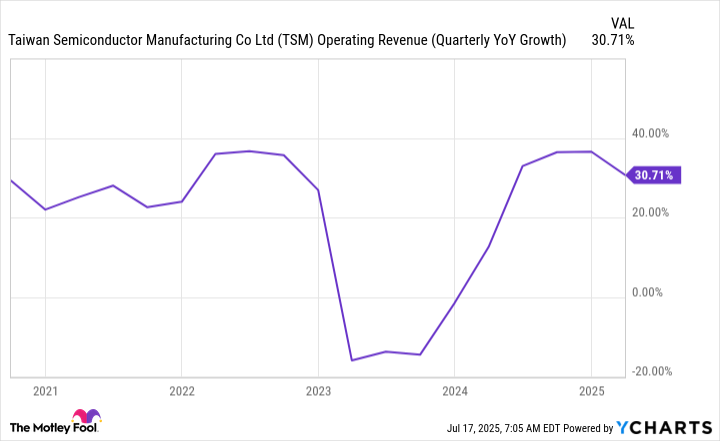

Due to Taiwan Semiconductor Manufacturing Company’s dominant position in the semiconductor industry, many of its clients frequently place orders well ahead of time. This advance notice gives management a clear perspective on upcoming trends, enabling them to make confident projections, like their prediction at the beginning of 2025. For the five-year period starting from 2025, they anticipate that revenue from AI-related products will increase by an impressive 45% per year, on average (Compounded Annual Growth Rate or CAGR). Although TSMC caters to a variety of clients beyond those focused on AI, the company still projects its overall revenue to expand at a rate close to 20%, also expressed in terms of CAGR.

It’s simply astonishing to see such remarkable expansion, underscoring the fact that Taiwan Semiconductor is an essential addition for anyone investing in AI technology.

Two noteworthy choices for investments in the artificial intelligence sector are Taiwan Semiconductor and Nvidia. Both companies foresee significant expansion, creating an excellent chance for investors to surpass the market average during the subsequent five years.

Read More

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- The Weight of First Steps

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-22 13:55