It seemed like the market had decided to take a little snooze amidst tariff-induced nightmares, but here we are—back in bullish territory like a toddler who just found their favorite toy again. Investors are buzzing about easing inflation, whispers of interest rate cuts, and the vastness of the U.S. economy, like kids on Christmas morning. The S&P 500 has strutted up nearly 8% this year, while our growth-stock darling, the Nasdaq-100, is shimmying with a 10% gain.

Got $1,000 burning a hole in your pocket and ready to dive in? Let’s lather on the grease and talk about two thrilling options: Shopify (SHOP) and On Holding (ONON).

1. Shopify: The Other E-commerce Giant

Now, if you’ve been living under a rock the size of a small car, you might be unaware that Amazon is the darling of U.S. e-commerce, clinging fiercely to a 38% market share like it’s the last cookie in the jar. Poor Walmart clings to a measly 6%. And then there’s Shopify—bless its heart—sitting in the corner, quietly providing tools for other sellers to build their empires. It may not sell products itself, but if you squint hard enough and factor in its gross merchandise volume (GMV), it’s having a party that’s getting real close to Amazon’s festivities. Imagine this: in Q1 2025, Amazon’s sales climbed just 5%, while Shopify’s GMV sprang up like a birthday surprise at 23% year-over-year, hitting $75 billion. Pretty cheeky, eh?

Ah, but here’s where it gets thrilling. E-commerce isn’t just surviving; it’s flourishing again as a slice of retail sales, and everyone seems to want a piece. Shopify, being the cool kid in this digital playground, is bound to thrive.

Oh, but it’s not just about selling stuff anymore! Shopify has transformed from a scrappy startup into a full-fledged suite of services like a Hogwarts for e-commerce—orders, payments, analytics, and marketing, all served with a side of magic. They’ve even cozied up to Amazon, making it easy-peasy for Shopify merchants to blast off into the selling universe. With Shop Pay—a shopping feature taking the world by storm—there’s a groovy 57% year-over-year increase in GMV for Q1. The crème de la crème of digital retailers are eyeing Shopify like they’re the prom queen.

Now, a word to the wise: this stock has shot up 20% this year and sure, it’s a high roller with a forward 1-year P/E ratio of 71 and price-to-sales ratio of 18. People are tossing money at it because they see the promise, and sure, market corrections might come swinging like an unexpected plot twist. But who’s brave enough to try predicting that? Spoiler alert: it’s nobody. If you nab a piece of Shopify now and sit on it for a while, well, you might just find yourself counting all those dollar bills later.

2. On Holding: The New Luxury Athletic Uniform

Now, let’s switch gears to On Holding, a burgeoning luxury athletic apparel brand that’s like that cool kid who just landed the lead role in the school play, emerging as a fierce competitor among the big names. Sure, they’re small potatoes right now with $2.8 billion in trailing 12-month revenue, but they’re growing faster than I can drink my third cup of coffee in the morning.

Starting with footwear, they launched a shoe so uniquely designed that it practically begs you to slip it on and prance around like you’re walking on clouds. Seriously, they call their flagship line “On Cloud.” It’s like they read my mind about what I want in a shoe! With shoes named Cloudsurfer, Cloudmonster, and other lovely metaphors, you know these folks charge a pretty penny—and their devoted fan base might just follow them to the ends of the earth.

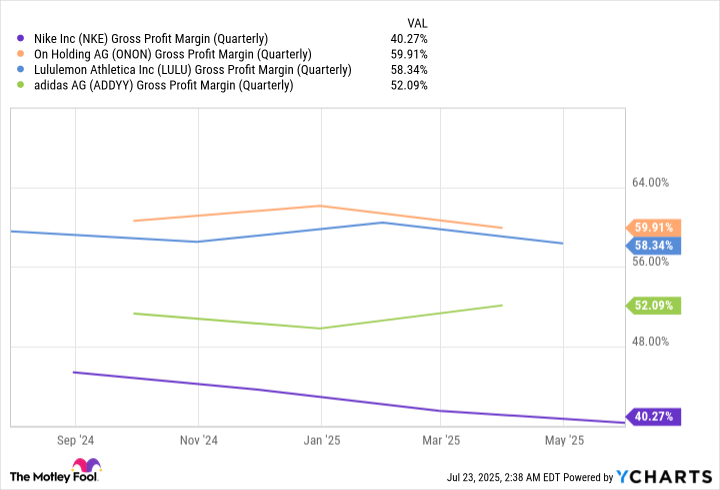

The affluent crowd they target? Oh, honey, they can handle the cost. That’s why On Holding continues to pump out impressive sales growth, while competitors whine about macroeconomic pains. Plus, with premium pricing, they’ve managed to secure the highest gross margins in the industry (59.9% in the first quarter!). Nike, Lululemon Athletica, and Adidas are all looking at On Holding like an underdog from a feel-good movie.

And let’s not beat around the bush; On Holding isn’t exactly bargain bin shopping. With a forward 1-year P/E ratio of 33 and a price-to-sales ratio of 12, they’re not a steal but hey, it could just be your ticket to outperforming the market over the next few years.

So there you have it, my fellow investors. Grab your popcorn (or snacks of choice) and watch these two stock stories unfold. After all, investing is just another form of storytelling, isn’t it? And who doesn’t love a twist? 🎬

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

2025-07-26 11:47