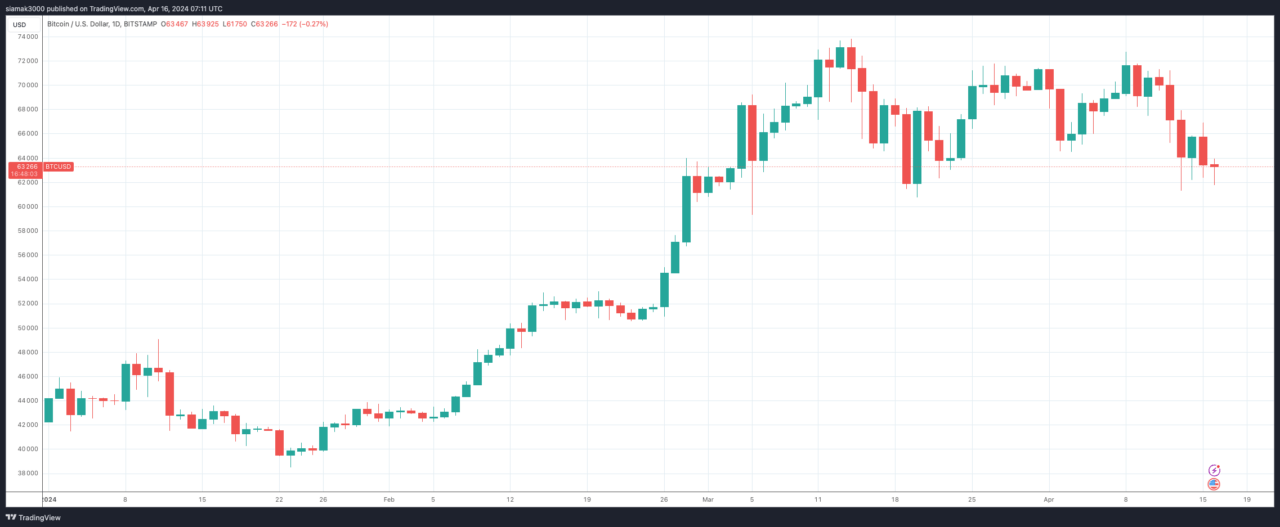

Markus Thielen, the founder of 10x Research and known for correctly forecasting Bitcoin‘s (BTC) bottom in November 2022 and its subsequent rise before the halving event, now holds a pessimistic view on risk assets such as tech stocks and cryptocurrencies. This change in perspective stems from growing anxieties over prolonged inflation and its potential repercussions on financial markets.

Based on a CoinDesk report released today, Thielen warned clients in a recent note that risk assets, including stocks and cryptocurrencies, are close to experiencing a significant price drop. Thielen expressed worry that unexpected and prolonged inflation is the main cause for concern. The bond market now anticipates fewer interest rate cuts than previously expected, which could make the investment climate more dangerous for assets sensitive to risk.

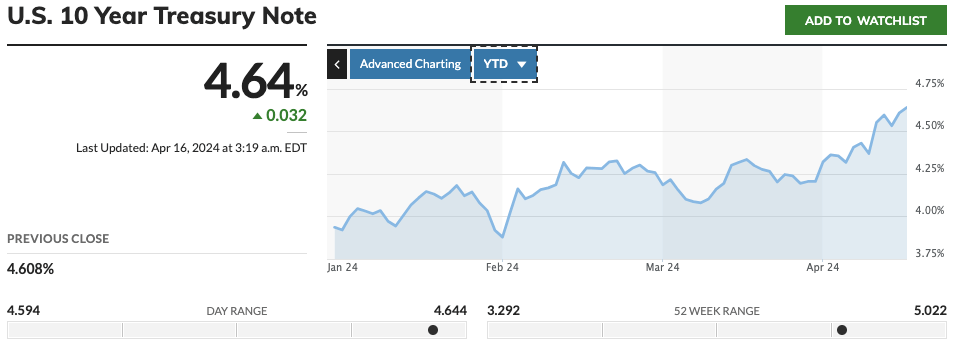

This month, the yields on 10-year U.S. Treasury notes in the bond market have risen to 4.642%, which is the highest they’ve been since November 2023.

Due to the increase in what’s commonly viewed as a safe investment’s return, more risky assets like tech stocks and cryptocurrencies become less alluring. Thielen pointed out that this shift towards higher bond yields, fueled by ongoing U.S. inflation, a robust labor market, and a strong economy, has noticeably decreased the appeal of these high-risk investments.

In response to his cautious viewpoint, Thielen stated, “We got rid of all our tech shares during the night because the Nasdaq is performing poorly and responding to rising bond yields. Currently, we’re just holding onto a few strongly believed cryptocurrencies.”

Thielen went into more detail, explaining that the significant increase in Bitcoin’s value from 2023 to the beginning of 2024 was largely driven by investors’ anticipation of interest rate decreases. However, this perspective is now being questioned, as indicated in a recent Wall Street Journal article by Nick Timiaros. According to Blake Gwinn, an expert in interest rates at RBC Capital Markets, the initial assumption included three rate reductions, with one in June being essential. If we don’t see a reduction by June, expectations will shift towards a potential decrease in December instead.

On January 10, the SEC in the United States gave its approval for eleven Bitcoin spot ETFs. This decision led to approximately $12 billion being invested in these funds, fueling a strong price surge. Lately, however, the amount of money flowing into these Bitcoin ETFs has significantly decreased. The average daily net investment in these funds now stands at zero.

Bitcoin ETF Flow – 12 April 2024

— BitMEX Research (@BitMEXResearch) April 13, 2024

When the anticipation surrounding Bitcoin’s quadrennial halving, which lessens the reward for mining new blocks and thereby slows down the addition of new Bitcoins into circulation, starts to fade, some market analysts, including Thielen, predict that any market correction could pick up speed. Thielen explains, “Following an initial surge of interest, investments in Bitcoin ETFs typically dwindle unless prices keep rising – a trend we haven’t seen since early March. With potential losses ranging from 2% to 17%, some investors may choose to remain on the sidelines.”

Currently, Bitcoin is priced at approximately $63,410 per unit, representing a 4.7% decrease in value over the last day.

In the past five-day period, the tech-heavy NASDAQ Composite Index is down 2.72%.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- 30 Best Couple/Wife Swap Movies You Need to See

- USD ILS PREDICTION

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Ncuti Gatwa Exits Doctor Who Amidst Controversy and Ratings Crisis!

- 9 Kings Early Access review: Blood for the Blood King

- Every Minecraft update ranked from worst to best

- Clair Obscur: Expedition 33 – All Act 3 optional bosses and where to find them

- Summoners War Tier List – The Best Monsters to Recruit in 2025

- 10 Shows Like ‘MobLand’ You Have to Binge

2024-04-16 10:43