One of North America’s largest steel producers, Nucor (NUE), stands out not just for its size, but for a unique trait – it’s recognized as a Dividend King. Currently, the stock seems to be in disfavor on Wall Street, which could present an attractive buying opportunity for long-term investors who view their holding period as ‘forever’. Here are some key points to consider.

What does Nucor do?

Nucor not only produces steel, but an essential aspect is the method it uses – electric arc mini-mills. Unlike traditional blast furnaces for primary steel production, this technology offers greater flexibility. This flexibility enables Nucor to adjust its output according to demand, thereby maintaining profit margins during various cycles in the steel industry.

It’s worth taking a look at the process of producing steel, as its demand and market prices can fluctuate based on economic conditions. Since steel plays a significant role in industries, these fluctuations are expected. However, this also means that the business itself can be unpredictable and the stock value may experience significant ups and downs due to these price swings.

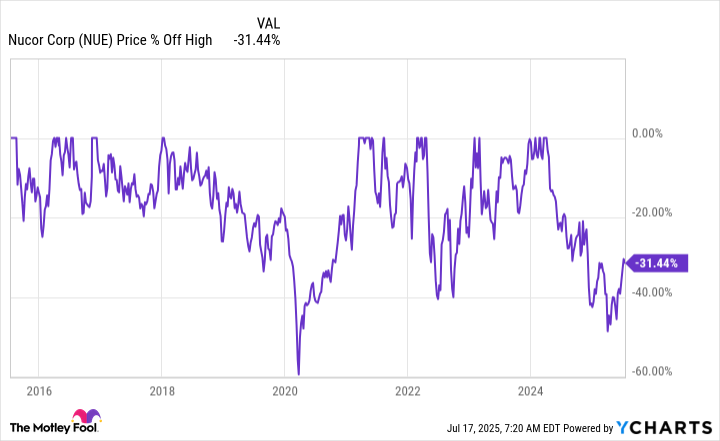

Currently, I’m witnessing the stock market, and it appears that we’ve seen a dip of approximately 30% from its highest points in 2024. This may sound significant, but it’s actually a step up from the over 40% drop it had experienced prior to a recent rally.

In both 2020 and 2022, there were significant drops of 40% or more. To put it simply, these decreases are part of typical market fluctuations. However, this doesn’t mean we should overlook the potential opportunities that might arise from such situations.

Nucor is a Dividend King

Regardless of the unpredictable nature of the steel industry, Nucor has consistently boosted its annual dividends for more than five decades straight – a feat not easily attained. A company doesn’t become a Dividend King haphazardly; it demands a robust business strategy that thrives in both favorable and challenging market conditions.

Typically, the aim of management is to achieve greater peaks and troughs in their business growth. They accomplish this by strategically investing in areas such as modernizing technology, diversifying product lines, and venturing into markets with higher profit margins.

With each stride forward in our company’s expansion, I find myself witnessing a corresponding surge in our ability to yield income and profits. This upward trend, over time, translates into greater peaks and valleys in our earnings, a testament to our ongoing growth trajectory.

In 2025, the company has approximately $3 billion set aside for capital expenditure, suggesting further expansion and potential increases in the dividend. However, it’s crucial to note that the dividend yield is relatively low at 1.7%. This isn’t a stock primarily chosen for income generation. Instead, it’s a choice for those seeking long-term investment in the steel sector, particularly through the most dependable dividend-paying stock within the industry.

You buy Nucor when Wall Street is putting it on sale

A cyclical stock like Nucor is best purchased when it’s not popular among investors. The ideal moment to invest is actually when the stock is unloved, a situation that holds true today.

Instead of wondering if it would have been wiser to purchase when the stock was more than 40% lower, consider this: Even a 30% decline is significant, but if you’re planning on holding Nucor for the long term, the price still presents an appealing value. The main point to emphasize is that this Dividend King has demonstrated resilience, showing that its business model can withstand various challenges from both the market and the economy.

Read More

- Gold Rate Forecast

- Top 15 Insanely Popular Android Games

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- Why Nio Stock Skyrocketed Today

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- EUR UAH PREDICTION

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

2025-07-22 05:31