Is it wise to invest in a company with a high probability of failing to meet its full-year targets and potentially reducing its highly regarded dividend (currently providing a yield of 6.6%)? Generally, that’s not an appealing prospect for investors. However, in the case of UPS (UPS) and its forthcoming second-quarter earnings report due on July 29, it could be justified. Here’s the reasoning behind it.

The market doesn’t believe UPS will sustain the dividend

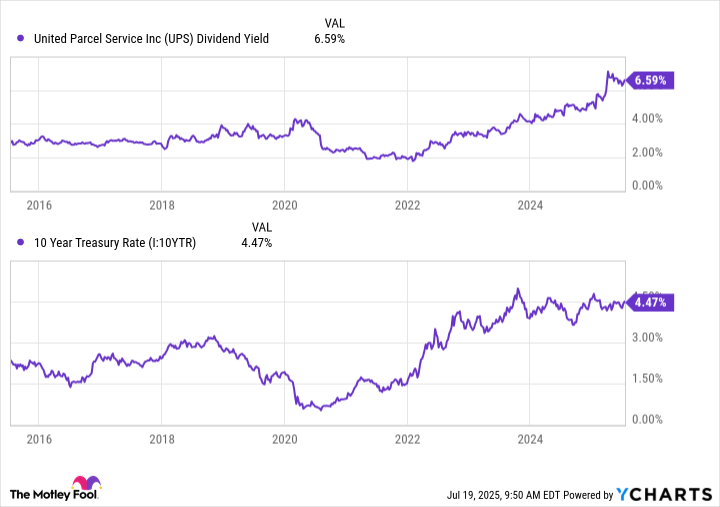

In terms easily understood, The return on dividends for UPS is approximately 6.6%, while the yield on a 10-year government bond is around 4.5%. Apart from the dip caused by the COVID-19 crisis in 2020, such a significant gap between the income generated by UPS and risk-free returns has never been seen before.

The market signals that it considers the dividend uncertain, perhaps even suggesting a potential reduction.

A silver lining

From my perspective, it seems that a dividend reduction could be beneficial for the company I’m observing, given its robust potential for growth in healthcare and small to medium-sized business sectors. As previously mentioned, this organization has been strategically investing in these areas. Moreover, the decision to scale back on low or unprofitable deliveries for Amazon by 50% from early 2025 to mid-2026 appears to be a prudent move aimed at enhancing overall profitability within its network.

This action would make cash available for investing in these activities, along with continuous tech upgrades to enhance its network. These investments could potentially be sped up. Moreover, it would lessen the apprehension regarding the stock and motivate investors to concentrate on its growth prospects instead of worrying about the longevity of its dividend payments.

Despite seeming unusual, if UPS lowers its full-year forecast due to worries about increased tariffs and trade disputes, trimming the dividend might actually be a beneficial decision. At the very least, investors should keep a keen eye on developments, regardless of whether they intend to invest before the earnings release.

Read More

- Building 3D Worlds from Words: Is Reinforcement Learning the Key?

- Securing the Agent Ecosystem: Detecting Malicious Workflow Patterns

- Gold Rate Forecast

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Mel Gibson, 69, and Rosalind Ross, 35, Call It Quits After Nearly a Decade: “It’s Sad To End This Chapter in our Lives”

- The Best Directors of 2025

- Games That Faced Bans in Countries Over Political Themes

- TV Shows Where Asian Representation Felt Like Stereotype Checklists

- 📢 New Prestige Skin – Hedonist Liberta

- Most Famous Richards in the World

2025-07-20 03:58