As a seasoned crypto investor who has witnessed numerous market cycles and fluctuations, I can’t help but feel a sense of déjà vu when observing Solana’s current predicament. The plummeting TVL, dwindling user activity, and the drop in daily active addresses on the network are all too familiar signs that we have seen before with other promising projects.

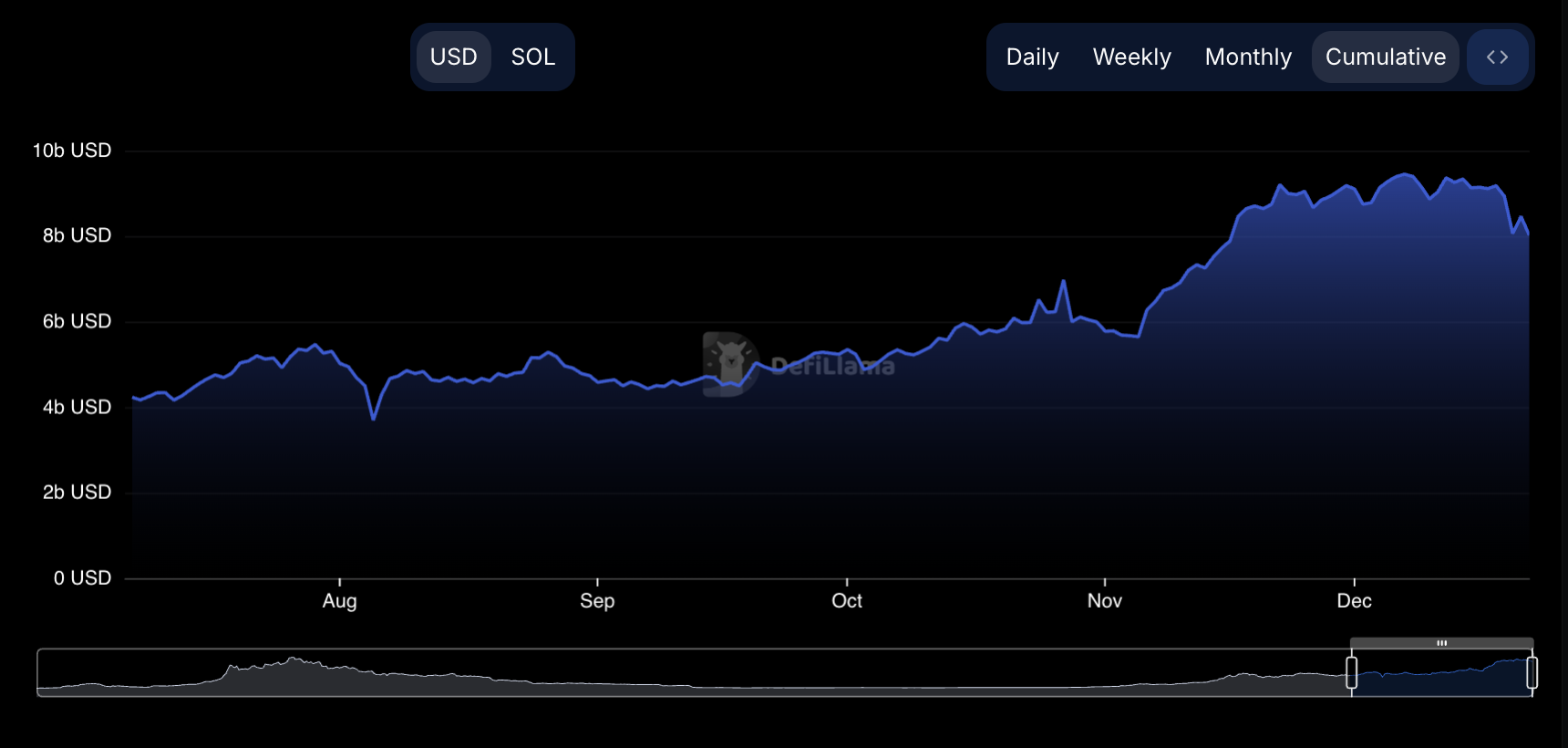

The amount of value locked within Solana’s network (Total Value Locked or TVL) has reached its lowest point this month, indicating a decrease in activity on the Layer-1 network. In fact, more than $1 billion has been taken out from Solana’s DeFi sector since the start of this month.

The significant decrease in Total Value Locked (TVL) could be due to a decline in the number of daily active addresses on the network. Such a trend suggests a shrinking user community and lessened on-chain interactions.

Solana’s TVL Plummets Amid Low Activity

As reported by DeFiLlama, the total value locked (TVL) on the Solana network stands at approximately $8.01 billion as of now. This figure marks a decrease of around 12% since December 1, translating to about $1.1 billion worth of assets leaving the system. Notably, the top DeFi protocol on Solana, Jito, has experienced a more significant setback with a 28% reduction in TVL over the past month. At present, Jito’s TVL stands at around $2.66 billion.

The decrease in Total Value Locked (TVL) on Solana aligns with the broader reduction in network usage during the specified timeframe. As reported by Artemis, daily user engagement on Solana has been decreasing since the beginning of this month. Over the last 21 days, approximately 5.37 million distinct addresses have executed at least one transaction on Layer 1, reflecting a 7% decrease in activity on the network.

Additionally, because Solana is experiencing low usage, its network earnings have also significantly dropped. This reduction in income has been exacerbated by SOL‘s poor performance, with its value decreasing by 28% over the past month. As per Artemis’ data, the network’s revenue has dipped by a notable 24% since December started.

SOL Price Prediction: A Shift In Market Sentiment Could Reverse Bearish Trend

An assessment of the SOL/USD one-day chart has revealed the coin’s negative Chaikin Money Flow (CMF), which confirms its low demand. As of this writing, this indicator is at -0.04.

An asset’s CMF measures its accumulation or distribution over a specified period, combining price and volume data. When the CMF value is negative, it indicates more market distribution (selling pressure) than accumulation (buying pressure), hinting at a sustained price decline. If SOL selloffs persist, its price may fall to $168.83.

But if the market’s mood switches from pessimistic to optimistic and purchasing resumes, this bearish prediction could be disproven. Under such circumstances, Solana’s (SOL) price might exceed the resistance at $187 and strive to go beyond $200.

Read More

- 30 Best Couple/Wife Swap Movies You Need to See

- PENGU PREDICTION. PENGU cryptocurrency

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- ANDOR Recasts a Major STAR WARS Character for Season 2

- In Conversation With The Weeknd and Jenna Ortega

- Scarlett Johansson’s Directorial Debut Eleanor The Great to Premiere at 2025 Cannes Film Festival; All We Know About Film

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

2024-12-22 23:46