Oh my, oh me! The financial markets have gone utterly BONKERS! It all began on that fateful day, April 2, when President Donald Trump unleashed his “Liberation Day” tariffs upon the world, sending stock values into a frantic free fall. And, alas, the cryptocurrency market wasn’t spared from this chaotic caper either! 🤪

Investors scrambled like headless chickens, causing major indices to post losses that would make even the grumpiest of grumps frown. Bitcoin and its altcoin pals took a dreadful dive, leaving many to wonder: Will crypto ever recover from this Trumpian tumult?

Trump’s Tariffs Trigger Market Mayhem 🌪️

Thursday, April 2, will be etched in the memories of stock market souls as a day of unmitigated gloom. The S&P 500 tumbled a whopping 4.84% (its worst drop since 2020), while the Dow Jones plummeted a staggering 1,679 points (-3.98%) to 40,545.93. The Nasdaq, poor thing, suffered a steep 5.97% decline to 16,550.61, as panic selling ran amok! 🏃♂️

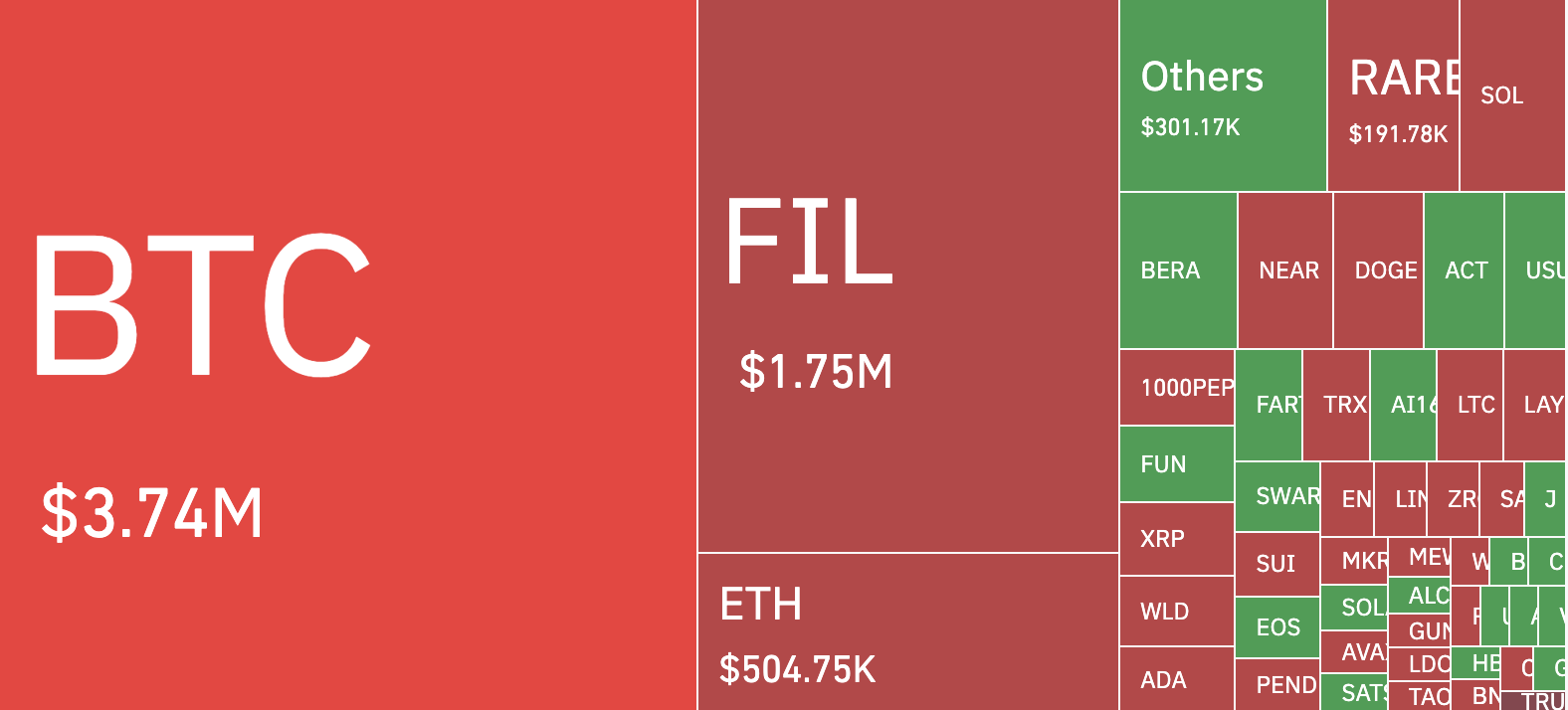

The crypto market, too, was caught in this maelstrom, with mass liquidations wiping out leveraged positions like a mischievous band of financial gremlins. A staggering 110,543 traders were liquidated in just 24 hours, with total losses amounting to a heart-stopping $242.12 million! 😱

As the market struggles to find its footing post-Liberation Day, the burning question remains: Will crypto stage a dramatic recovery, and if so, when?

Analysts Predict Bitcoin’s Next Levels Amid Trade War Jitters 🤔

In an exclusive chinwag with BeInCrypto, the inimitable Nic Puckrin, crypto analyst and founder of The Coin Bureau, offered a glimmer of hope amidst the chaos. Despite acknowledging the tariffs might trigger a price dip to $73,000 or a surge toward $88,000, Puckrin remained optimistic about Bitcoin’s long-term prospects. 🌟

“The good news, my friends, is that given the low trading volume and the crypto Fear & Greed Index still hovering around fear, this could indicate we’re at or very close to a market low. So, in the longer term, we can be fairly confident that BTC will rally from here – the question is only around timing,” Puckrin said with a sly smile.

Fellow crypto analyst Michaël Van De Poppe, in an April 3 X post, concurred with this bullish outlook. Poppe observed that BTC attempted to break out of its narrow range after the tariffs were announced, only to fall back within it, confirming $87,000 as a key resistance level. According to Van De Poppe, as long as BTC holds above $80,000, the uptrend remains intact, and another rally is on the cards! 🚀

Will History Repeat? BTC’s Potential Surge Amid Fresh Tariff Tensions 🕰️

Crypto analyst Ash Crypto took a fascinating trip down memory lane, examining BTC’s historical performance during past US-China trade wars. In May 2019, after Trump imposed tariffs on China, stocks plummeted, while BTC’s value skyrocketed from $3,500 to nearly $13,800 by June 2019! 🚀

“Bitcoin (BTC) appeared as a hedge against economic uncertainty, with both BTC and gold performing swimmingly well,” Ash explained, a hint of a smile in his voice.

With fresh tariffs now in play, might history repeat itself? If China retaliates, markets could witness a similar reaction, driving investors toward safe-haven assets like BTC. 🤞

However, there’s a twist this time around: the Federal Reserve’s stance. Unlike in 2019, when the Fed cut rates three times, injecting liquidity into the market, persistent inflation in 2025 might prevent similar rate cuts, potentially limiting BTC’s upside. 🤔

Read More

- Gold Rate Forecast

- Tom Cruise Bags Gold: Mission Impossible Star Lands Guinness World Record for Highest Burning Parachute Jumps

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Tom Hiddleston and Wife Zawe Ashton Announce Second Pregnancy, Know Couple’s Relationship Timeline

- Are Billie Eilish and Nat Wolff Dating? Duo Flames Romance Rumors With Sizzling Kiss in Italy

- Is Justin Bieber Tired of ‘Transactional Relationship’ with Wife Hailey Bieber? Singer Goes on Another Rant Raising Concerns

- Justin Bieber Tells People to ‘Point at My Flaws’ Going on Another Rant, Raises Alarm With Concerning Behavior

- INCREDIBLES 3 Will Be Directed by ELEMENTAL’s Peter Sohn, Brad Bird Still Involved

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Resident Evil 9: Requiem Announced: Release Date, Trailer, and New Heroine Revealed

2025-04-04 14:02