Oh, Ethereum, you saucy minx! Your price rally hit a speed bump this week, dropping from a high of $3,387 on January 13 to the current $3,288. Why? Because the Market Structure Bill decided to crash the party like an uninvited uncle. 🥳💸

Ethereum (ETH) has taken a 33% nosedive from its August high, because, you know, the crypto market loves a good drama. 🎭 But don’t cry for it, Argentina-it’s got strong fundamentals! SoSoValue says ETH ETFs have raked in $584 million this year, bringing the total to $12.9 billion. BlackRock’s ETHA is sitting pretty with $11.7 billion. 💰

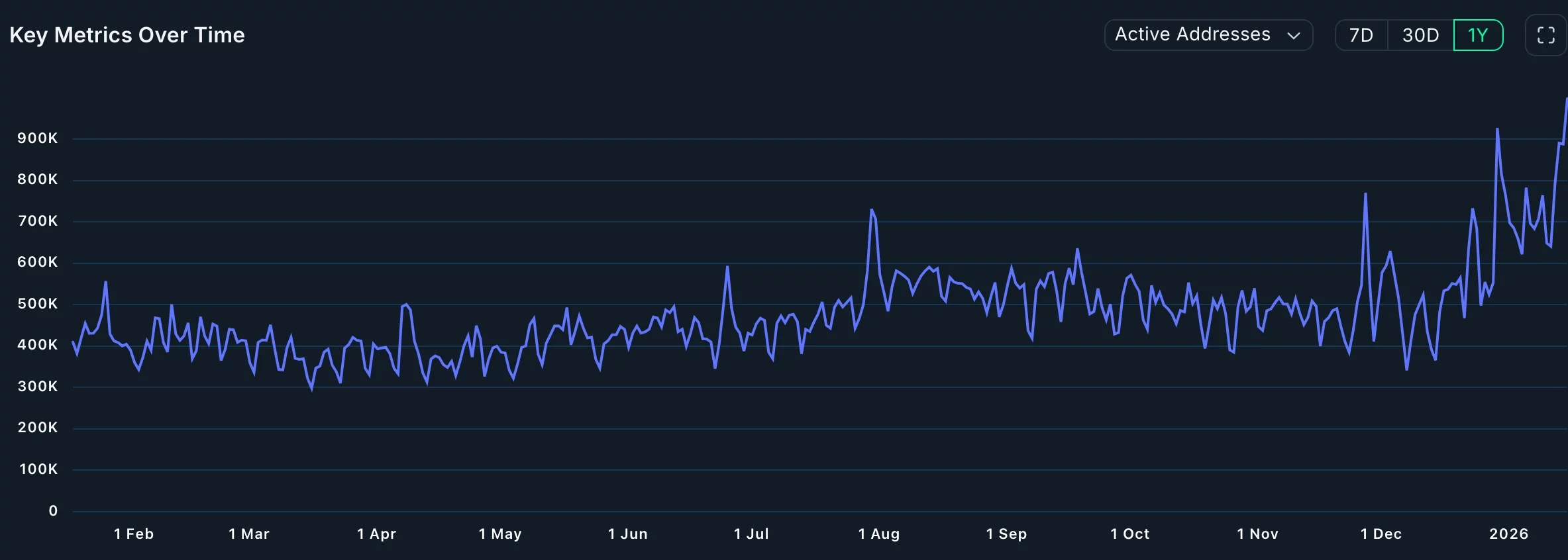

Ethereum’s network is the life of the party, with transactions up 30% to 58 million and active addresses jumping 64% to 13.1 million. 🎉 Check out this chart-it’s more exciting than a Mel Brooks movie! 🍿

Stablecoin transactions? Through the roof! $170 billion in supply and $977 billion in volume. That’s more action than a Blazing Saddles bar fight. 🤠

Investors are staking like it’s going out of style, earning 2.85% annually. The staking market? $118 billion and growing. BitMine’s staking its Ethereum hoard like it’s the Holy Grail. 🏆

Ethereum’s Technical Tango 💃

The daily chart shows ETH retreating from $4,946 in August to $3,290. It’s like it hit a wall-a 200-day Exponential Moving Average wall. Bulls? Losing steam. 🐂💨

Rising wedge pattern? More like a bearish trap. Add a bearish pennant and divergence, and you’ve got a recipe for a 20% drop to $2,623. But hey, if it breaks $3,500, it’s party time again! 🎈

Read More

- Top 15 Insanely Popular Android Games

- Did Alan Cumming Reveal Comic-Accurate Costume for AVENGERS: DOOMSDAY?

- ELESTRALS AWAKENED Blends Mythology and POKÉMON (Exclusive Look)

- Gold Rate Forecast

- EUR UAH PREDICTION

- New ‘Donkey Kong’ Movie Reportedly in the Works with Possible Release Date

- Core Scientific’s Merger Meltdown: A Gogolian Tale

- Why Nio Stock Skyrocketed Today

- 4 Reasons to Buy Interactive Brokers Stock Like There’s No Tomorrow

- The Weight of First Steps

2026-01-17 11:10