Okay, so the economy just face-planted into a pile of weak jobs data, and Bitcoin decided to join the pity party. 🥴 Nonfarm payrolls added a measly 73,000 jobs in July—like, seriously, that’s fewer than the number of people who show up to a Taylor Swift concert. And the revisions for June and May? Uglier than a pair of Crocs at a black-tie event. 😬

So, logically, this should be great news for risk assets, right? Lower growth means the Fed might finally stop playing hard to get with rate cuts. Traders are now betting their last avocado toast that a September rate cut is 75% likely. Treasury yields dropped faster than my self-esteem after a bad Tinder date, and gold is basically doing a victory lap, up 1.5% and eyeing its all-time high. 🏆

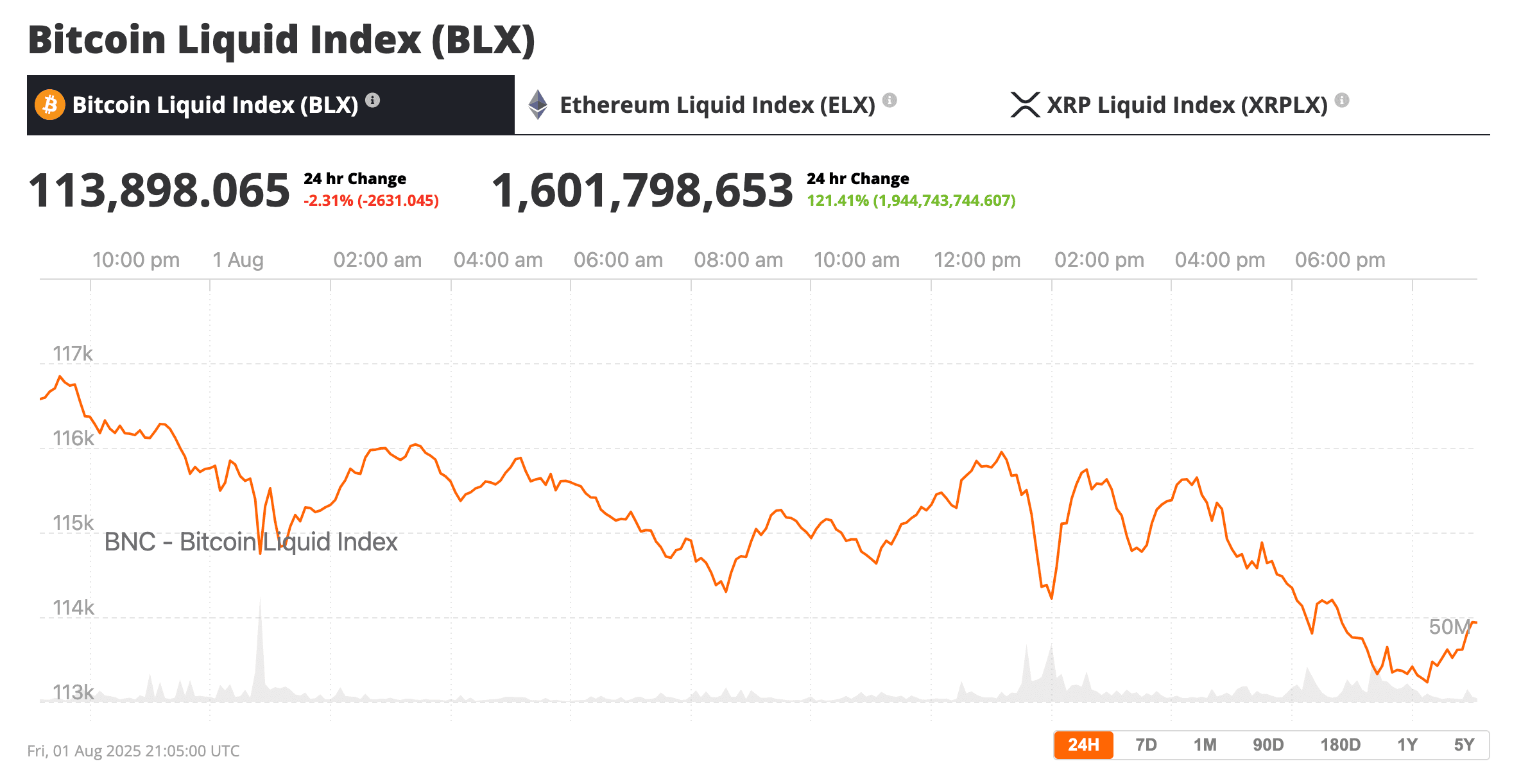

But crypto and tech stocks? They’re having an existential crisis. The Nasdaq plunged 2.5%, Bitcoin slid like it’s on a Slip ’N Slide, and Coinbase fell off a cliff—down 18% after an earnings report that made me want to hug my accountant. Riot Platforms lost 17%, which is just sad because they’re supposed to be the cool kids of Bitcoin mining. 😢

Traders are basically Schrödinger’s cat right now—they’re both bullish and bearish at the same time. One camp is like, “Weak jobs data? Rate cuts! Crypto rally!” But the other camp is sniffing recession like it’s a gas leak and selling everything that’s not nailed down. The Kobeissi Letter summed it up perfectly on X: “Either the labor market is in a recession, or someone spilled coffee on the data. 🤷♂️”

Oh, and let’s not forget the 258,000 jobs that just *poof* disappeared from the books. That’s not a rounding error—that’s a small town’s worth of jobs vanishing into thin air. 👻

Trump Blames Powell (Shocker)

Of course, Donald Trump took to Truth Social to blame Jerome Powell for being late to the rate-cut party, calling him a “disaster.” He also accused Dr. Erika McEntarfer, head of the Bureau of Labor Statistics, of data manipulation. Classic Trump—blame everyone else and hope no one notices the projection. 🤡

President Trump attacked Powell, source: Truth Social

Meanwhile, Powell’s stuck between a rock and a hard place—or, as I like to call it, “data dependency” and a market that’s more nervous than a chihuahua in a thunderstorm. ☔

Back to Bitcoin: Despite the dip, Bitfinex data shows buyers are nibbling like it’s a cheese plate at a wine tasting. The order book is stacked for a potential short squeeze, but price action is about as stable as my caffeine intake on a Monday. BTC is retesting support near $114K, with $116K as the battleground. 🏰

So, is the Fed about to save the day, or are we watching the economy unravel like a cheap sweater? Is the crypto bull run over? Probably not—this looks like a dip, but the market needs a good news catalyst more than I need a third cup of coffee. ☕

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- ETH PREDICTION. ETH cryptocurrency

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- The Weight of Choice: Chipotle and Dutch Bros

2025-08-02 00:50