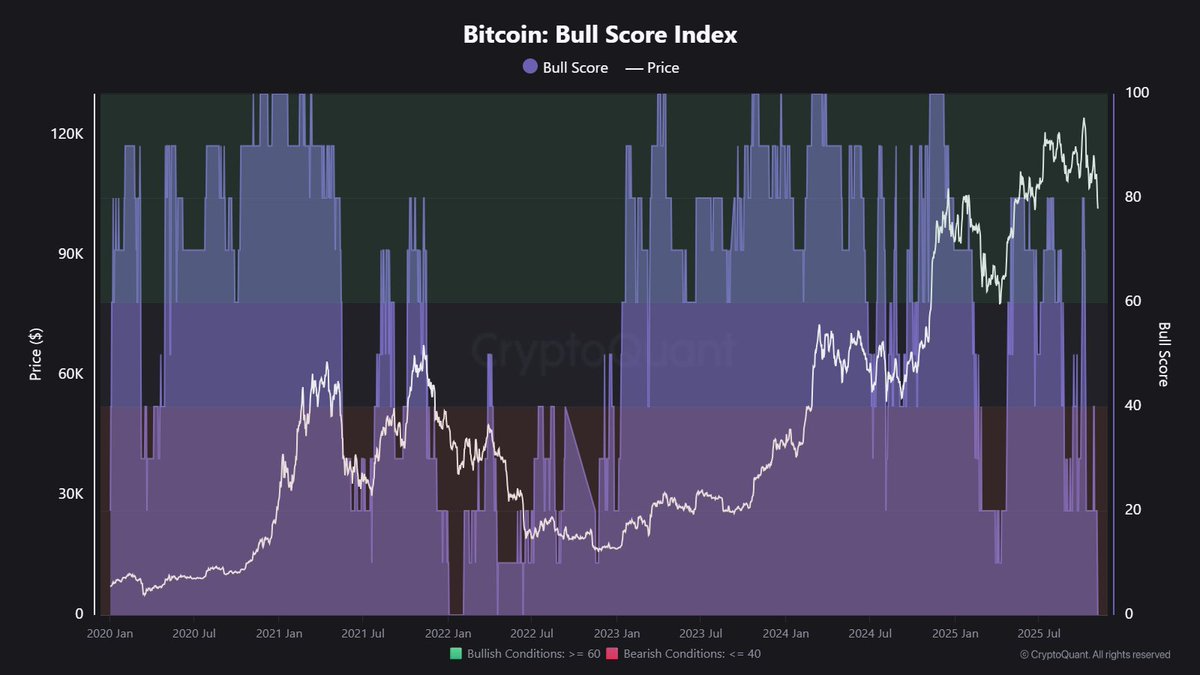

So, the universe has decided to throw a curveball at Bitcoin enthusiasts, and lo and behold, the Bull Score has plummeted to a resounding zero out of a possible ten. 🥳 Yes, you read that right-zero. The last time this happened was in January 2022, just before the bear market decided to hibernate for a while. Coincidence? Probably not. 🧐

According to the wizards at CryptoQuant, the Bull Score indicator hit rock bottom on Thursday. Analysts are now waving their arms frantically, shouting that immediate action is needed to prevent a prolonged slump. Because, you know, nothing says “fun” like a financial rollercoaster. 🎢

Bull Score: The Canary in the Crypto Coal Mine

The Bull Score, a metric so complex it makes the Hitchhiker’s Guide to the Galaxy look like a children’s book, is a composite of ten distinct on-chain and market indicators. These fall into four main categories: Network Activity, Volume, Investor Profitability, and Market Liquidity. Essentially, it’s the universe’s way of telling you whether to hodl or fold. 🃏

Here’s the kicker: a score below 40 screams “Bear Market!” while anything above 60 whispers sweet nothings about a Bull Market. Right now, it’s not just below 40-it’s in the basement, playing solitaire. 🕳️

As of November, all ten components of this metric are sulking below trend. The MVRV ratio and stablecoin liquidity, in particular, have taken a nosedive over the past month. It’s like they saw the edge of the cliff and thought, “Why not?” 🌊

When the MVRV ratio drops, it’s the universe’s way of saying, “Hey, investors aren’t making as much profit as they used to.” Depending on the context, this could mean Bitcoin is undervalued or that buyers are circling like vultures. 🦅

A declining MVRV means the market value is cozying up to the average cost basis of holders. In plain English, investors are either breaking even or nursing losses. Not exactly a party, is it? 🎉✖️

Now, while the score was equally glum during the 2022 bear market, the current situation is different. Bitcoin is hovering near $100,000, which is historically high. So, why the long face, Mr. Bull Score? 🤔

Well, it turns out ETF and corporate inflows have slowed down. It’s like the party ran out of snacks, and everyone’s wondering if it’s time to go home. 🍿

The bottom line? For Bitcoin to rally, new demand needs to show up. Otherwise, we might be looking at an early bear-market transition. So, buckle up, grab your towel, and don’t panic. Unless you want to. Panic can be fun too. 😱

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- Wuchang Fallen Feathers Save File Location on PC

- QuantumScape: A Speculative Venture

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- ETH PREDICTION. ETH cryptocurrency

- 9 Video Games That Reshaped Our Moral Lens

2025-11-06 22:08