Oh, the marvellous mischief in the air! 🎩✨

- Bitwise, those cunning financial wizards, have whipped up an S-1 statement to conjure the very first U.S. spot-based ETF focused on Chainlink’s native token, LINK. 🧙♂️📜

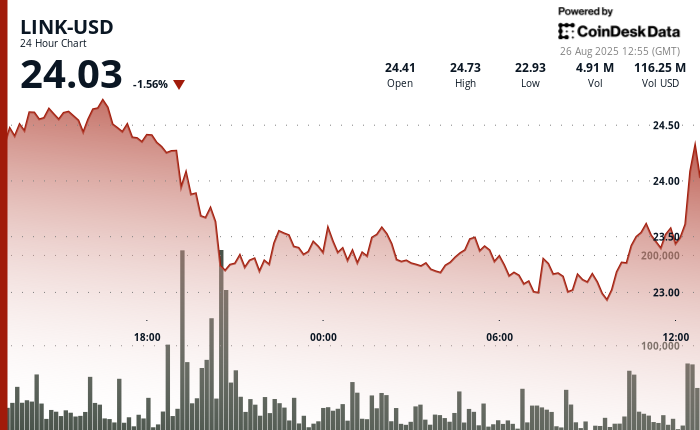

- LINK, the cheeky little rascal, bounced 5% from its overnight slumber on the news, but Coindesk Research’s technical analysis model says it’s still under the thumb of bearish pressure. 🐻📉

In this whimsical article

LINKLINK$23.89◢2.88%

BTCBTC$109,878.82◢2.15%

Ah, the digital asset managers at Bitwise! They’re up to their old tricks again, plotting to launch a spot-based exchange traded fund (ETF) focused on holding the native token of Chainlink. A first in the U.S., you say? How positively daring! 🎭💼

According to the S-1 registration statement filed with the U.S. Securities and Exchange Commission on Tuesday (those busy bees!), the Bitwise Chainlink ETF aims to dangle direct exposure to LINK in front of investors. And who’s the lucky custodian? None other than Coinbase Custody, of course! 🏦🔐

This fits into a broader trend of asset managers scrambling to launch altcoin-focused spot ETFs in the U.S., now that the regulatory winds have calmed under the Trump administration. All thanks to the success of those old timers, Bitcoin and Ether (ETH). 🌬️🤑

LINK, the mischievous minx, bounced 5% from its overnight lows on the news, but it’s still down 1.6% over the past 24 hours, according to CoinDesk data. Oh, the drama! 🎢📉

Despite the rebound, CoinDesk Research’s technical analysis model insists there’s sustained bearish pressure for LINK. The crypto market, it seems, is having a little consolidation siesta. 😴💤

LINK took a tumble over the past 24 hours, falling from a session peak of $24.81 to a low of $22.90. But lo and behold, a notable recovery effort appeared during 10:00-11:00 UTC, right as the ETF filing news hit. The price rallied from $23.02 to $23.54 on heightened volume of 3.35 million units. Could this be the start of a consolidation above the crucial $23.00 psychological threshold? Only time will tell! ⏳📈

The model whispers that reclaiming the $24.00 level is key to halting the bearish momentum, while the recent rebound suggests oversold conditions might be luring value-seeking investors. Bargain hunters, assemble! 🛍️💎

Technical indicators: the tea leaves of the crypto world 🍵🔮

- Price declined 4.67% from $24.61 to $23.46 during the last 24 hours from Aug. 25 12:00 to Aug. 26 11:00 UTC. 📉

- Trading range of $1.84 between a maximum of $24.81 and a minimum of $22.90. 🎢

- Volume surged to 6.58 million units, significantly above the 24-hour average of 2.29 million. 📊

- Strong resistance established around $24.30 with support near $23.00. 🚧

- Failure to reclaim $24.00 indicates continued bearish sentiment. 🐻

- Break below $23.40 support level suggests further downside risk toward $23.00. ⚠️

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- HSR 3.7 story ending explained: What happened to the Chrysos Heirs?

- Games That Faced Bans in Countries Over Political Themes

- Gay Actors Who Are Notoriously Private About Their Lives

- 9 Video Games That Reshaped Our Moral Lens

- ETH PREDICTION. ETH cryptocurrency

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- USD PHP PREDICTION

2025-08-26 17:37