- Fidelity throws its hat into the SOL ETF ring, leaving BlackRock scratching their heads.

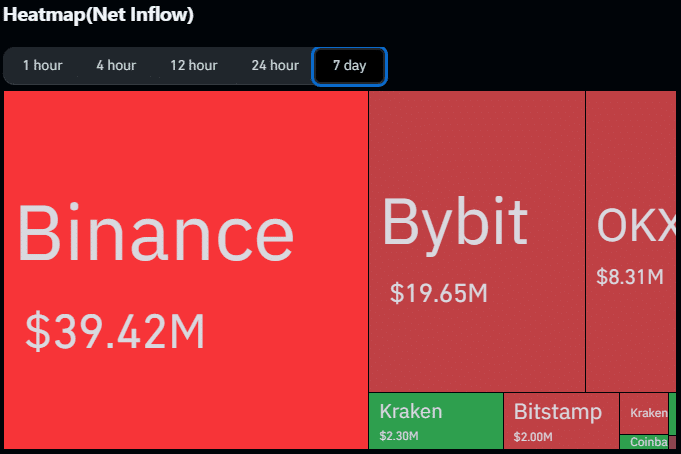

- $470M SOL vanished from exchanges like magic in just three weeks.

So, Fidelity, with its $15 trillion in assets, decides to join the cool kids in the Solana ETF race. Because, you know, everyone is doing it. 🙄

March25th, they file a19b-4 form with the SEC, like they’re applying for a VIP club membership through Cboe BZX. Fancy.

🔥 The Great SOL ETF Showdown 🔥

BlackRock’s still sitting on the sidelines, probably debating if this is just another fad. Meanwhile, Grayscale,21Shares, and the rest of the gang already RSVP’d. And the market’s like, “86% chance of approval? Sure, why not!”

February rolls around, and the SEC’s like, “Okay, fine, we see you,” and starts the240-day countdown clock. Franklin Templeton’s still playing catch-up, though. 🕒

Oh, and Fidelity registering a trust in Delaware? That’s their way of saying, “We’re in it to win it.” 😏

After the CME Futures debut, SOL’s the star of the show, with other altcoins like Litecoin and Dogecoin trying to get a piece of the ETF pie. But Nate Geraci’s betting the SEC won’t let just anyone in. 🎲

“I’m all for some altcoin ETFs, but let’s not get carried away. Advisors want a bit of everything, right? Broad crypto ETFs, that’s where it’s at.”

And the market? Speculators are all in, pulling $70M of SOL off exchanges like they’re prepping for a crypto winter. 🥶

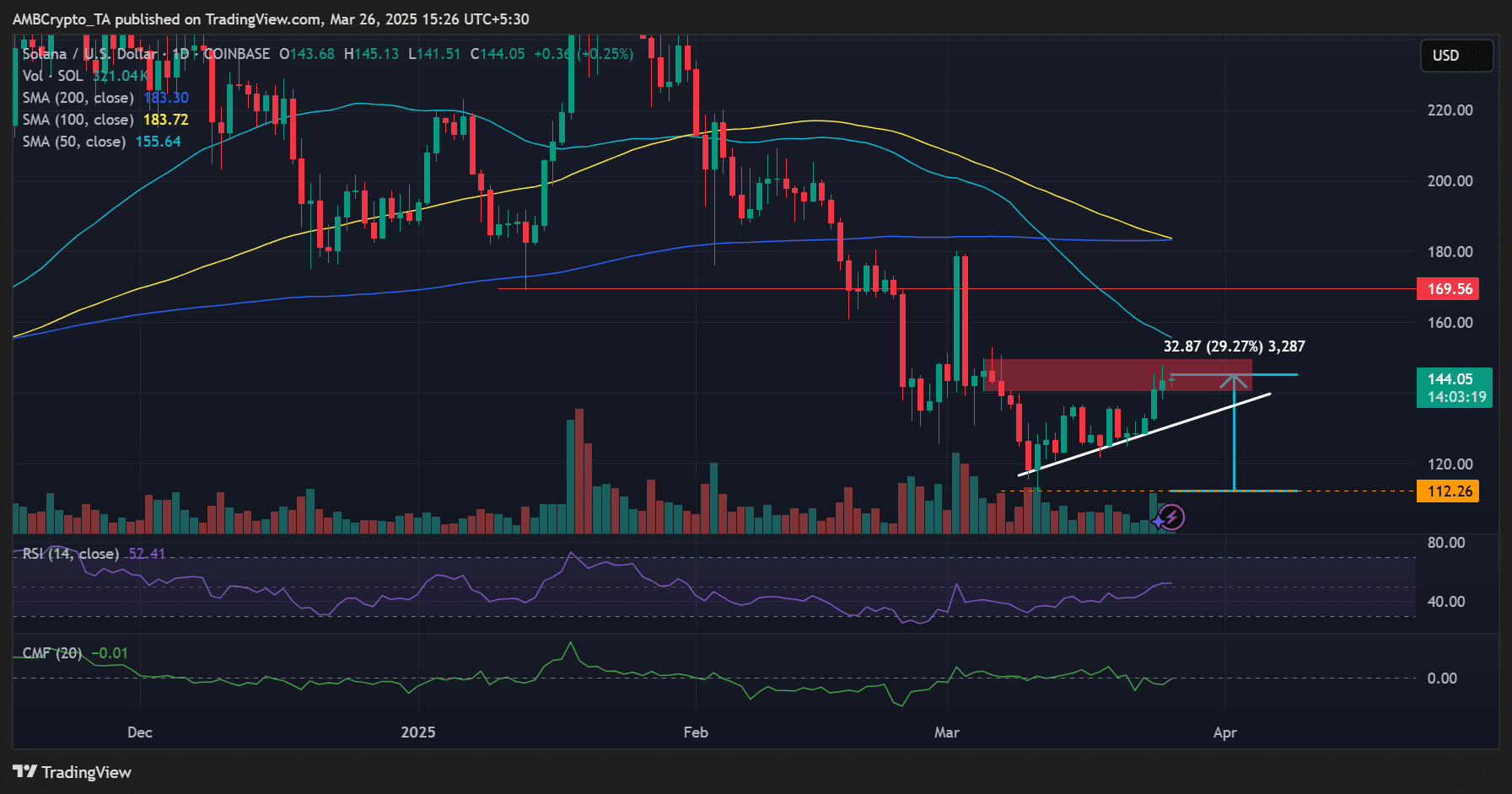

Coinglass data shows $470M SOL flying off exchanges in three weeks. SOL’s feeling the love, bouncing back30% from its March low. 💪

But, will the bulls break through the $150 barrier, or will the short sellers crash the party? Only time will tell. ⏳

Read More

2025-03-26 17:14