Ah, the marvellous world of finance, where the absurd becomes the ordinary! Grayscale Investments, those clever chaps, have decided to sprinkle a bit of Wall Street magic on the humble Dogecoin and its cousin, XRP. Starting November 24, 2025, you too can join the circus and buy these coins through your regular brokerage. No more fumbling with wallets or private keys-just pure, unadulterated speculation! 🌭💸

According to the whispers in the exchange notices and regulatory filings, these funds will prance about under the tickers GDOG (how fitting for the canine coin!) and GXRP. Grayscale’s private-placement trusts are now shedding their mysterious cloak and stepping into the limelight as publicly traded products. Ta-da! 🎩✨

Grayscale’s Grand Leap into the Crypto Carnival

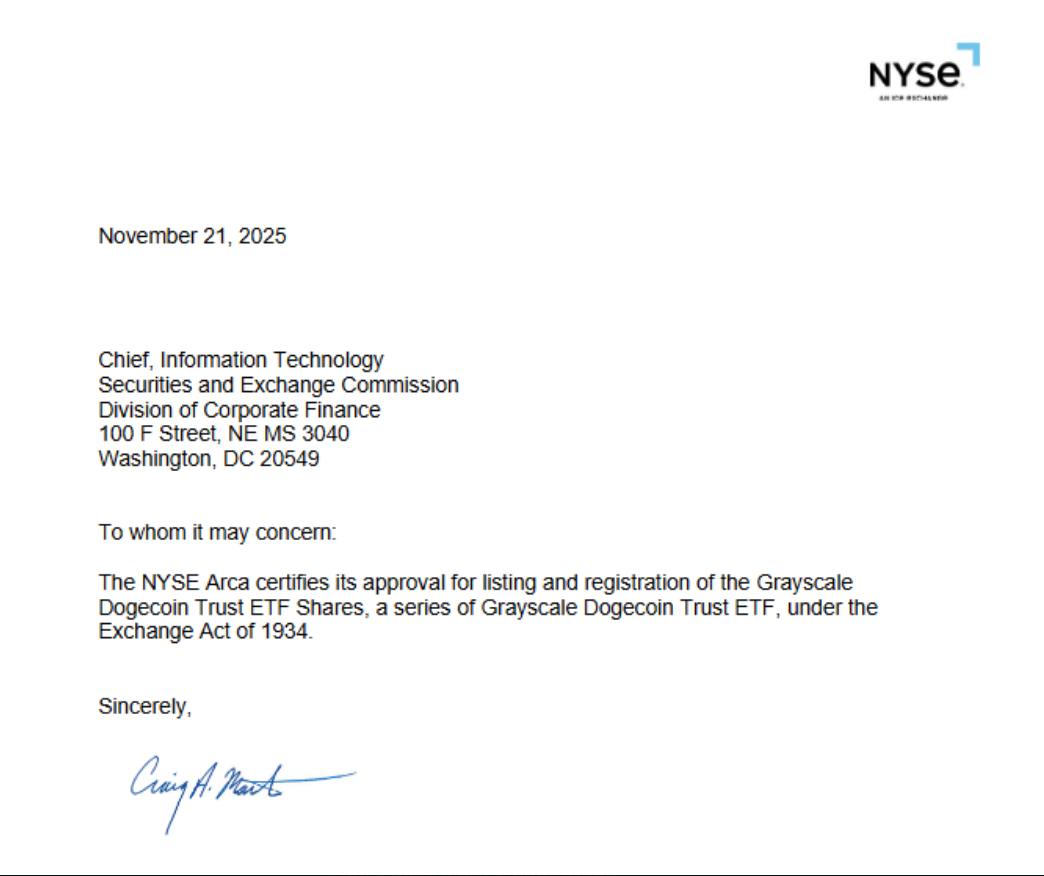

Word on the street (and in the SEC filings) is that both ETFs have been given the green light. The paperwork, as dry as a cracker but twice as important, has been filed with the US Securities and Exchange Commission. So, it’s official: the crypto circus is coming to town! 🎪🤹♂️

This move brings two of the smaller, yet wildly popular, cryptocurrencies into the mainstream. For the everyday investor, it’s like being handed a golden ticket to Willy Wonka’s factory-minus the Oompa Loompas, of course. 🏭🍫

“Grayscale Dogecoin ETF $GDOG approved for listing on NYSE, scheduled to begin trading Monday. Their XRP spot is also launching on Monday. $GLNK coming soon as well, week after I think.” – Eric Balchunas (@EricBalchunas) November 21, 2025

Market Frenzy Before the Big Top Opens

In the days leading up to this grand announcement, trading activity in related derivatives went bonkers. Dogecoin derivatives volume leaped by more than 30%, reaching a staggering $7.22 billion. XRP derivatives weren’t far behind, soaring 51% to $12.74 billion. Traders, it seems, were positioning themselves for the rollercoaster ride ahead. 🎢💹

Spot ETFs, while not guaranteeing higher prices, do open the door to a new crowd of investors. Brokers, retirement plans, and funds that previously shied away from crypto custody can now join the party. Will this boost liquidity? Only time will tell. Meanwhile, the crypto market has been feeling the pinch, with reports of a six-week downturn. Oh, the drama! 😱📉

Questions Linger Like a Bad Joke

Will investors bite? That depends on the nitty-gritty: product fees, custody details, and the conversion of trusts into ETF shares. Past crypto ETF launches have been a mixed bag-some were greeted with fanfare, others with a yawn. What truly matters is the flow of money once trading begins. High volume and tight spreads? A standing ovation. Low turnover and wide spreads? A polite golf clap. 👏💤

Analysts and investors will be watching like hawks, eager for clues. Will these ETFs attract the same speculative frenzy that’s been driving derivatives volume? Only the crystal ball knows for sure. 🔮🤔

The simultaneous listing of GDOG and GXRP is a landmark moment for mainstream crypto products. Structured as spot ETFs, they hold the underlying tokens via custodians, making it simpler for a broader audience to invest. Price risk? Still there. But hey, who doesn’t love a good gamble? 🎲💰

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Gold Rate Forecast

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- 9 Video Games That Reshaped Our Moral Lens

- Is Taylor Swift Getting Married to Travis Kelce in Rhode Island on June 13, 2026? Here’s What We Know

2025-11-23 05:59