In a turn of events that would make a cat laugh, the crypto markets took a tumble in the twilight hours of the American trading day on Monday. Bitcoin (BTC), the digital gold of the internet, decided to take a dive, and with it, millions in liquidations occurred. All this kerfuffle was due to the great man in the White House, Donald Trump, deciding to play hardball with tariffs against our neighbors to the north and south, causing a bit of a sell-off.

It appears that the president’s tariff tomfoolery is becoming a recurring theme, with Bitcoin showing a keen interest in the shenanigans of the macroeconomic world.

Bitcoin & Co. Take a Spill Over Trump’s Tariff Tiff

Trump, ever the punctual gent, declared that the US was ‘right on schedule’ with the tariffs on Canada and Mexico. According to Reuters, this came after a bit of a quiz on whether the tariffs would indeed be slapped on Canadian and Mexican goods once the agreed-upon deadline for a break arrives next week. Trump, in his infinite wisdom, reportedly expressed his belief that our neighbors and allies have been less than kind to the US.

“We’re on time with the tariffs, and it seems like that’s moving along very rapidly…We’ve been mistreated very badly by many countries, not just Canada and Mexico. We’ve been taken advantage of,” Reuters reported, quoting Trump at the White House.

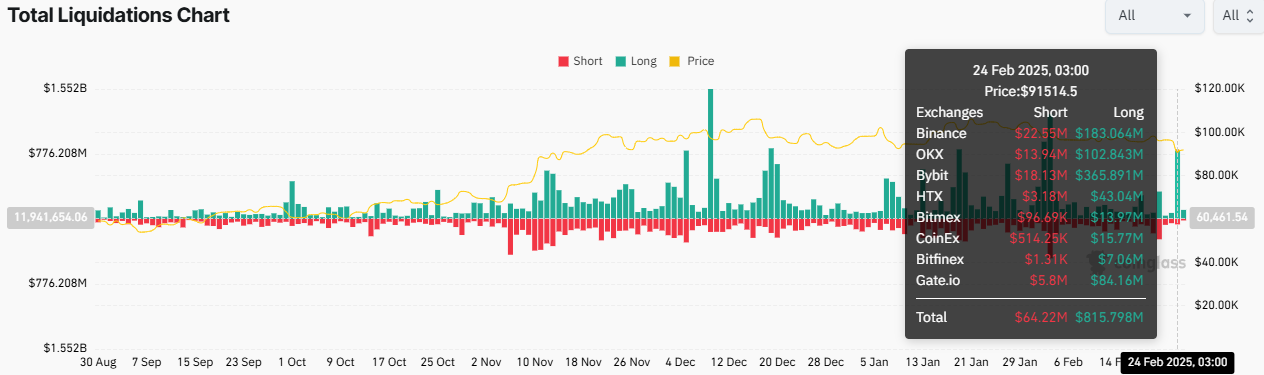

Hot on the heels of this report, Bitcoin’s price took a nose-dive, slipping below the $92,000 mark. Crypto markets followed suit, with the total market capitalization shedding up to 7% of its worth. Meanwhile, Coinglass data revealed that the crash resulted in nearly $1 billion worth of crypto assets being liquidated. A bit of a doozy, wouldn’t you say?

“In the past 24 hours, 299,006 traders were liquidated, the total liquidations come in at $918.18 million,” Coinglass indicated.

Coinglass data also showed that most of the positions that got rekt were longs, as Bitcoin’s price plummeted to $91,514. This isn’t the first time the Trump tariffs narrative has caused a stir in the crypto world.

Recall, if you will, that over $2 billion was wiped out from the crypto market in early February, leading to a historic liquidation event. As BeInCrypto reported, this incident followed President Trump imposing a 25% tariff on imports from Canada and Mexico. A real cliffhanger, that one.

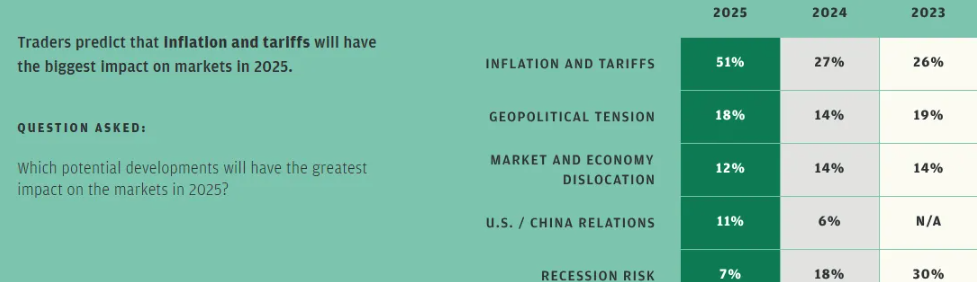

However, crypto markets found their second wind following reports of a reprieve on Trump tariffs. Bitcoin’s Coinbase Premium shot up to a local high in the aftermath of the pause three weeks ago. These events seem to be in line with a recent JPMorgan survey, which suggested that tariffs and inflation would be the top market influencers in 2025. How droll!

//beincrypto.com/wp-content/uploads/2025/02/Econ-7.png”/>

As of this writing, Bitcoin is trading at $92,047, marking a 3.4% drop since Tuesday’s session opened. Such is the whimsy of the crypto market, dear reader.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-25 08:53