Like a tempestuous Russian winter, the crypto market has been a whirlwind of emotions, with prices plummeting and soaring in a dizzying dance. And yet, despite the recent declines, crypto inflows have reached a staggering $1.3 billion, a testament to the unwavering confidence of investors in this mercurial market.

But, my friends, the real story here is Ethereum, that plucky upstart that has been quietly outpacing Bitcoin in the shadows. Its inflows have almost doubled those of its more famous counterpart, a paradigm shift that has left many a pundit scratching their heads in wonder.

The Crypto Inflows: A $1.3 Billion Bonanza

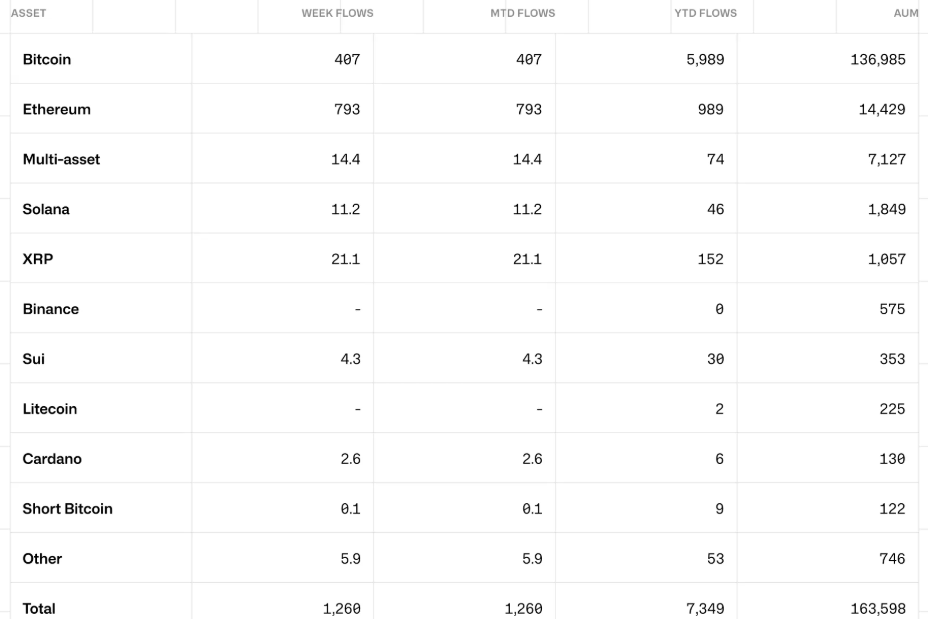

According to the latest CoinShares report, crypto inflows have reached a dizzying $1.3 billion, with Bitcoin seeing a respectable $407 million and Ethereum raking in a whopping $793 million. And what’s behind this surge, you ask? Ah, my friends, it’s all about the hype surrounding the upcoming Pectra upgrade.

Analysts are abuzz with excitement, predicting a bright future for Ethereum. As one sage observer noted, “Ethereum is still holding its uptrend support since May 2023. Last week, Ethereum ETFs had over $400 million in inflows. ETH big upgrades are coming next month. Trump is still buying and holding ETH. Mark my words; Once Ethereum goes above $4,000, it’ll pump like crazy.”

“Ethereum is still holding its uptrend support since May 2023. Last week, Ethereum ETFs had over $400 million in inflows. ETH big upgrades are coming next month. Trump is still buying and holding ETH. Mark my words; Once Ethereum goes above $4,000, it’ll pump like crazy,” one analyst observed.

This surge in crypto inflows follows a week of frenzied activity, with crypto investments seeing $527 million in inflows amidst the DeepSeek AI frenzy and Donald Trump’s tariffs on several countries. It’s a wild ride, indeed, but one that highlights the enduring appeal of digital assets to institutional and retail investors alike.

But, alas, not all is sunshine and rainbows. The market corrections over the past five trading sessions have seen the AUM (asset under management) of ETPs drop to $163 billion, a decline of around 10% from the all-time high of $181 billion established in late January.

Still, global ETPs remain the largest Bitcoin holder compared to any other entity, a testament to their enduring influence in the market.

//beincrypto.com/wp-content/uploads/2025/02/image-97.png”/>

Ripple CEO Brad Garlinghouse recently stated that an XRP ETF is inevitable, emphasizing the growing demand for structured investment vehicles that provide regulated exposure to the asset.

Similarly, Litecoin ETFs are gaining traction, with Canary Capital and Grayscale applying for their respective funds. Nasdaq has also filed to list a Litecoin ETF, further reflecting the expanding market for crypto investment products.

This surge in ETF filings aligns with broader industry trends, where institutional players seek regulated investment vehicles for alternative digital assets.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- SEGA Confirms Sonic and More for Nintendo Switch 2 Launch Day on June 5

- 30 Best Couple/Wife Swap Movies You Need to See

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

2025-02-10 18:44