Now, gather ’round, folks, and let me spin you a yarn about the digital asset that’s been makin’ waves in the crypto world. Yessir, I’m talkin’ ’bout XRP, and it seems there’s a heap of reasons to believe that this here currency is fixin’ to surge somethin’ fierce!

Ripple Expands Cross-Border Payment Network

Now, you might’ve heard that Ripple done gone and struck a deal with Unicâmbio, a top Portuguese currency exchange provider. This here partnership aims to bolster cross-border payments between Portugal and Brazil, further expandin’ Ripple’s reach in Latin America. And you know what that means, don’tcha? Yessir, it’s more folks usin’ RippleNet, which in turn means more demand for XRP, actin’ as a bridge currency in the remittance sector. The more folks adopt RippleNet, the higher the liquidity and market activity for XRP, and that’s just the kind of news that’ll get the bulls all riled up!

Now, let me tell ya, these integrations are just the kindlin’ that XRP needs to fuel demand. Unicâmbio wants to use Ripple’s payment solutions to provide speedier and more cost-efficient transactions for the people of both countries. And when more folks start usin’ Ripple’s payment solutions, well, that’s just the kind of news that’ll get the bulls all riled up!

On-Chain Metrics Indicate Positive Momentum

Now, you might’ve heard that Santiment, a blockchain intelligence firm, has reported a steady increase in the number of XRP holders throughout 2025. Active wallet addresses remain above the 2024 average, a sign of sustained user engagement. Additionally, the total supply of XRP held in profit has declined, suggesting reduced selling pressure. This metric indicates that investors are optin’ to hold their XRP rather than liquidate their holdings, which could contribute to a price rally in the coming weeks.

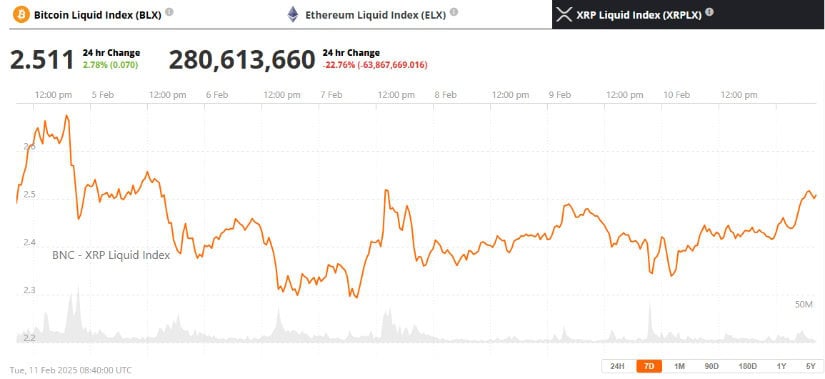

Moreover, technical indicators point toward a strengthenin’ bullish trend. The Relative Strength Index (RSI) for XRP/USDT is currently at 40 and slopin’ upwards, signaling increasing buying momentum. Similarly, the Moving Average Convergence Divergence (MACD) chart shows shortenin’ red histogram bars, indicating wanin’ negative momentum. If this trend continues, XRP could break past resistance at $2.52 and move closer to its previous high of $2.78.

XRP ETF Developments Gain Traction

Now, you might’ve heard that the race for an XRP spot ETF in the U.S. has intensified, with CoinShares filing for an XRP ETF with Nasdaq. This follows recent filings by the CBOE BZX Exchange on behalf of Bitwise, 21Shares, and Canary Capital, indicating growing institutional interest in the asset.

Nick Forster, founder of Derive.xyz, commented on the increasing ETF filings:

“There’s significant market anticipation surroundin’ XRP and other crypto ETFs. While regulatory challenges remain, a green light on any of these filings could trigger a wave of institutional inflows, potentially drivin’ XRP’s price upward.”

Despite the optimism, ETF approvals take time, and their impact on XRP’s short-term price action remains uncertain. However, the increasing number of applications suggests that institutional players see long-term potential in the digital asset.

Can XRP Reach Double-Digit Gains?

Now, with strong fundamentals in place, analysts believe XRP could rally nearly 14% in the short term and retest its February 4 high. Lookin’ further ahead, some speculate on XRP’s ability to reach $15 if widespread adoption accelerates.

Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) remains a crucial factor in shapin’ its market trajectory. A favorable ruling could significantly boost investor confidence and drive further gains.

As Ripple continues to expand its global network and regulatory clarity improves, the XRP price may be positioned for substantial growth. However, market conditions, adoption rates, and macroeconomic trends will play critical roles in determinin’ the asset’s long-term price trajectory.

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

- Every Minecraft update ranked from worst to best

2025-02-12 19:25