In the labyrinthine corridors of the financial gulag, where numbers whisper secrets and charts paint illusions, a spectacle unfolds. The markets, ever the capricious tyrant, have birthed a new drama. Behold:

What to know:

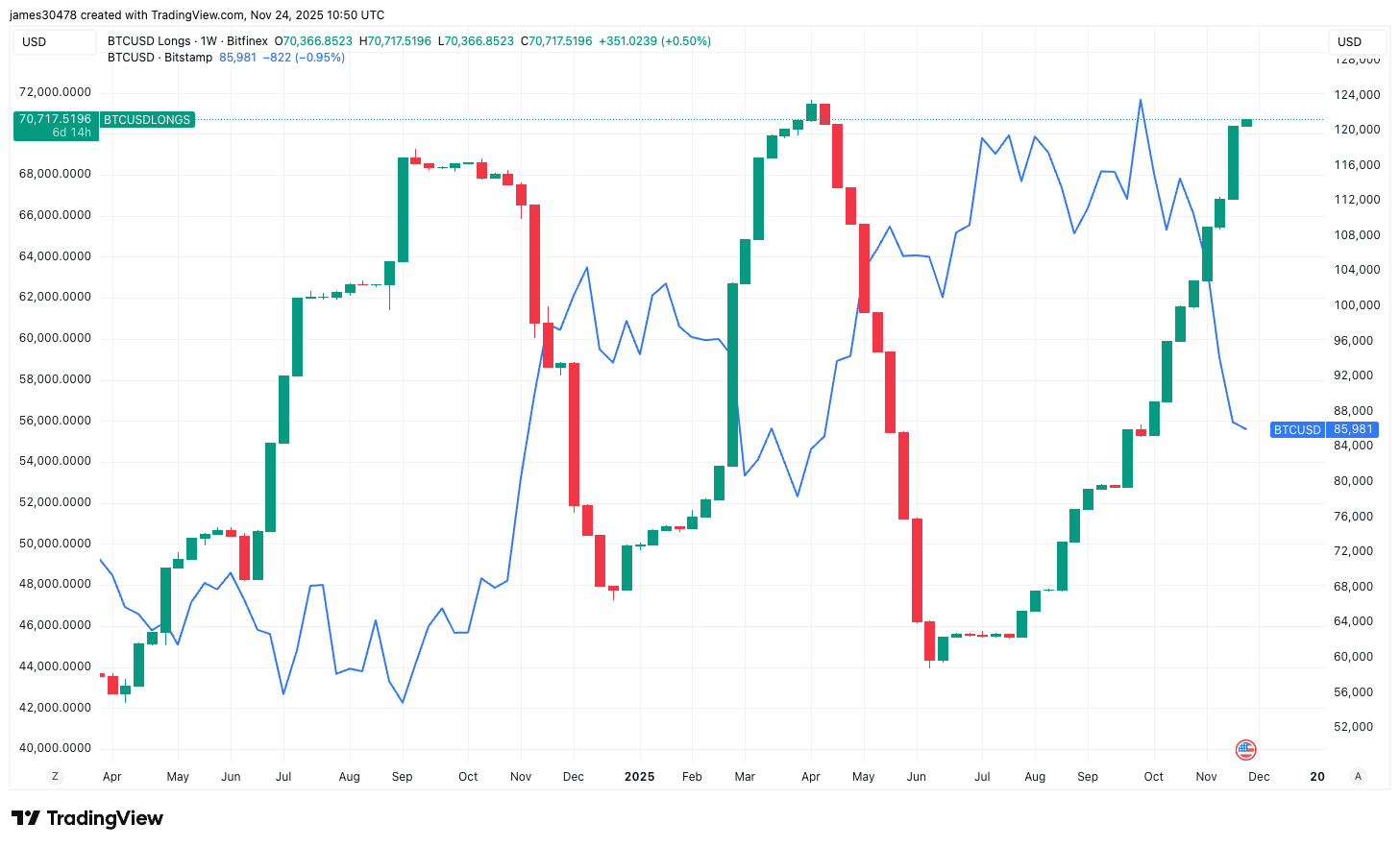

- Margin longs on Bitfinex, that den of speculative fervor, have swelled by 42% in three months, even as BTC, the digital Prometheus, has plummeted 26%. A testament to the unyielding greed-or is it hope?-of the trading proletariat. 🦈

- The position, now at the 70,000 BTC mark, has thrice kissed this level since 2024. Each prior embrace coincided with a market bottom, a fleeting moment of respite in the endless cycle of boom and bust. History repeats itself, first as tragedy, then as farce. 🎭

Bitcoin, that fickle deity of the digital age, has endured six weeks of decline in the past seven, tumbling from its October zenith of $126,500 to a mere $81,000, before clawing back to $85,000. A fall from grace, or a mere stumble on the path to glory? 🌋

Amidst this correction, the Bitfinex traders, those modern-day Sisyphuses, have doubled down, amassing 70,714 BTC in margin longs. From 50,000 BTC in August, their pile grows, a monument to either audacity or delusion. 🏗️

TradingView data, that cold, impartial observer, reveals a 42% surge in margin longs over three months, even as bitcoin has shed 26%. A paradox? Or merely the irrational exuberance of the faithful, clinging to their digital rosary beads. 🙏

This marks the third time since September 2024 that the Bitfinex whale, that leviathan of the markets, has ballooned its margin long position to 70,000 BTC. The previous two instances heralded market bottoms, moments of temporary reprieve in the relentless march of capitalism. Will history rhyme, or will the whale be harpooned by the market’s cruel hand? 🐋

The first occurrence was in August 2024, during the yen carry trade unwind, when bitcoin flirted with $49,000. The whale’s position shrank as bitcoin soared to $100,000 after President Trump’s electoral victory in November 2024. A triumph of timing, or mere coincidence? 🕰️

The second came in April 2025, during the tariff tantrum, when bitcoin dipped to $76,000, only to rebound to $120,000 by June as the whale trimmed its sails. Over five years, this creature has timed key reversals in the 2022 bear market and gradually lightened its load during the 2023 rally. A master of the game, or merely a lucky gambler? 🎲

And so, we stand at the precipice, watching as the whales gamble and the markets churn. Is this the dawn of a new bull run, or the final act of a tragic farce? Only time, that implacable judge, will tell. ⏳

Read More

- 2025 Crypto Wallets: Secure, Smart, and Surprisingly Simple!

- Gold Rate Forecast

- Brown Dust 2 Mirror Wars (PvP) Tier List – July 2025

- Wuchang Fallen Feathers Save File Location on PC

- Banks & Shadows: A 2026 Outlook

- The 10 Most Beautiful Women in the World for 2026, According to the Golden Ratio

- Gemini’s Execs Vanish Like Ghosts-Crypto’s Latest Drama!

- HSR 3.7 breaks Hidden Passages, so here’s a workaround

- QuantumScape: A Speculative Venture

- ETH PREDICTION. ETH cryptocurrency

2025-11-24 15:21