Dearest reader, have you heard the news? Ethereum‘s supply has been growing at an alarming rate! It’s as if the coins are multiplying like rabbits in a perfectly manicured English garden! Alas, this abundance of Ethereum has not been met with equal enthusiasm from the investing community. The price of the coin has been struggling, much like a debutante trying to find a suitable suitor at a particularly dull ball. 😔

Ethereum’s Supply: A Whale of a Tale

In the past week alone, a staggering 12,353 Ethereum tokens have been added to circulation. This increase has brought the total circulating supply to a grand total of 120.51 million. Oh dear! One might think this would be a cause for rejoicing! Alas, it appears that Ethereum has become a bit too popular for its own good! This influx of coins has happened at a time when the demand for the network has diminished. It’s as if everyone suddenly remembered the charms of other coins, leaving Ethereum to languish in the shadows. 😥

The number of unique addresses participating in transactions involving Ethereum has fallen by a disheartening 4% in the past week. Surely, one can’t blame the poor coin for this! Perhaps its recent endeavors have been a bit too … “avant-garde” for some of its more traditional admirers? 😩

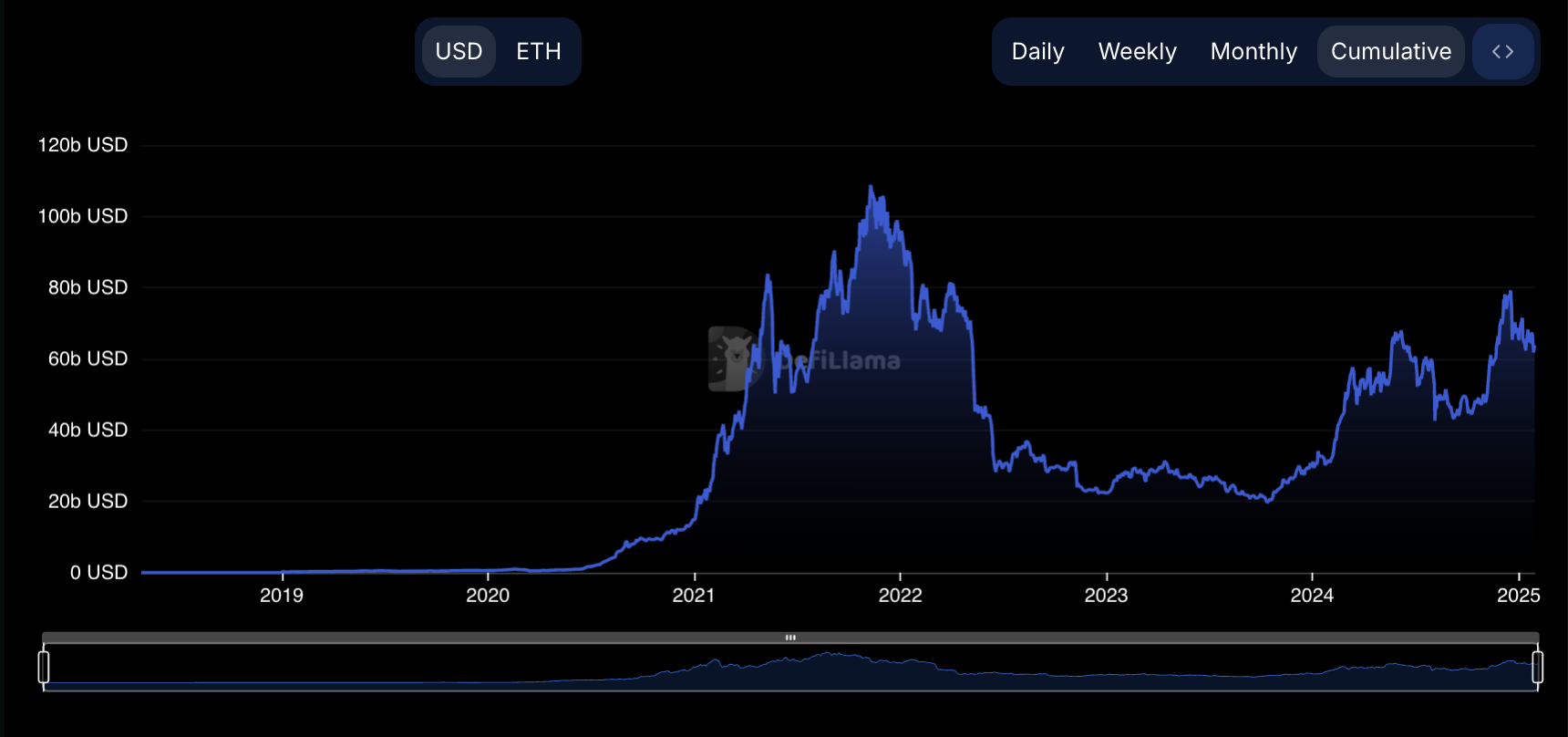

Furthermore, the total value locked (TVL) across Ethereum’s decentralized finance (DeFi) ecosystem has dipped by 4% during the same period. Alas, it appears that Ethereum’s DeFi endeavors have not been quite as successful as one might have hoped. The market’s attention, it seems, has drifted towards other pastures. 🤨

Will Ethereum Fall Below $3,000?

The decline in Ethereum’s popularity has had a direct impact on its price. The coin has suffered a 4% drop in the past week. Oh, the indignity! One can only imagine the disappointment felt by those who have held onto their Ethereum, hoping for a grander future. Their dreams may be shattered, but they are not without hope. 😊

A closer examination of the Ethereum/USD chart reveals that buying activity remains limited, with buyers seeming hesitant to commit to Ethereum’s future. Their caution is understandable, considering the recent events. Alas, the MACD indicator, that harbinger of market trends, suggests a bearish outlook. The MACD line is below the signal line, indicating that selling activity outpaces accumulation. It’s as if the market is whispering, “This is not the time to buy.” 🤐

With the market’s sentiment so somber, Ethereum’s price could potentially dip below $3,000, reaching as low as $2,945. But perhaps this is just a temporary setback! Should Ethereum witness a surge in demand, it could rise to a respectable $3,369! Only time will tell what fate awaits Ethereum. Until then, we must remain vigilant, dear readers, for the market’s whims are as unpredictable as the English weather. ☔️

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-01-29 16:49