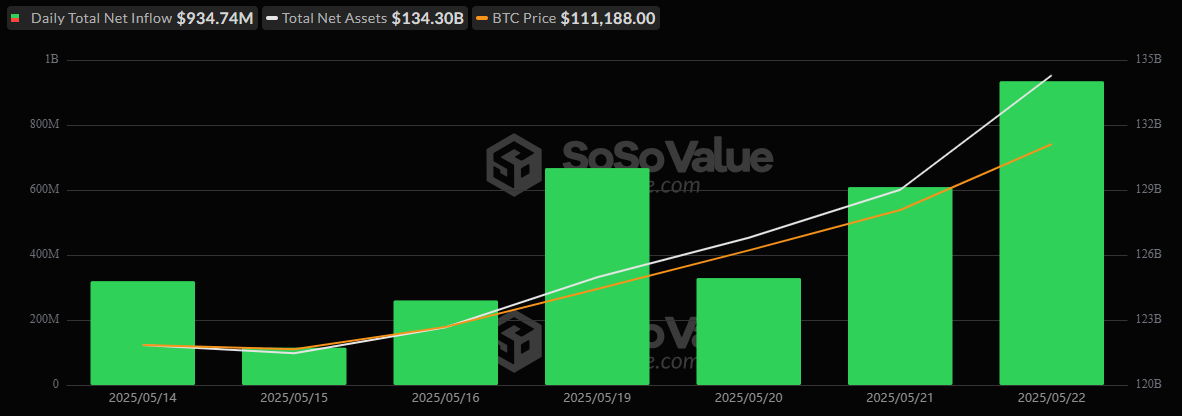

Ah, Bitcoin ETFs. A torrent of $935 million washing in, a veritable deluge! The seventh day, they say, of gains! One begins to suspect some Faustian bargain at play. Net assets, now a paltry $134 billion. A pittance, really. Ether ETFs, those poor relations, follow with a meager $111 million. So close to $10 billion, yet so far. One almost weeps. 😭

Bitcoin ETFs See Massive $935 Million Inflow As Ether ETFs Near $10 Billion in Assets

Institutional enthusiasm, you say? More like institutional obsession! These Bitcoin ETFs, extending their streak like a gambler clinging to a losing hand. A colossal $934.74 million, fueled by Blackrock’s insatiable hunger. One wonders, is it demand, or a carefully orchestrated illusion? 🤔

IBIT, that glutton, devouring $877.18 million. More than 93%! Such greed! Fidelity’s FBTC, a mere $48.66 million. A crumb, really. ARK 21shares’ ARKB, a pathetic $8.90 million. The others? Nothing! Not a single outflow! Unheard of! Trading volume, a staggering $5.39 billion! Net assets, $134.30 billion! Bitcoin ETFs, the new emperors of crypto exposure. But remember, empires fall. 😈

The ether market, a pale imitation of its master. Ether ETFs, five days of inflows. A paltry $110.54 million. Grayscale’s ETHE leads with $43.75 million. Fidelity’s FETH, a close second at $42.25 million. The Ether Mini Trust, a mere $18.86 million. Bitwise’s ETHW, a laughable $5.69 million. Total value traded, $697.46 million. Net assets, $9.33 billion. So near, yet so far from that $10 billion mark. Will they ever reach it? Perhaps not. 🙄

As both bitcoin and ether ETFs continue their dance with destiny, institutional conviction appears stronger than ever. But remember, pride comes before a fall. And the market? A fickle mistress indeed. 😈

Read More

- DC: Dark Legion The Bleed & Hypertime Tracker Schedule

- PENGU PREDICTION. PENGU cryptocurrency

- All 6 ‘Final Destination’ Movies in Order

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- 30 Best Couple/Wife Swap Movies You Need to See

- Clair Obscur: Expedition 33 ending explained – Who should you side with?

- Clair Obscur: Expedition 33 – Every new area to explore in Act 3

- All Hidden Achievements in Atomfall: How to Unlock Every Secret Milestone

- The Last Of Us Season 2 Drops New Trailer: Premiers April On Max

- ANDOR Recasts a Major STAR WARS Character for Season 2

2025-05-23 18:29