Hark! What is this buzz about stablecoins and the US dollar‘s reign?

A certain Governor Christopher Waller, of the Federal Reserve, hath spoken of the potential of stablecoins to “maintain and extend” the mighty US dollar’s influence in the land of finance.

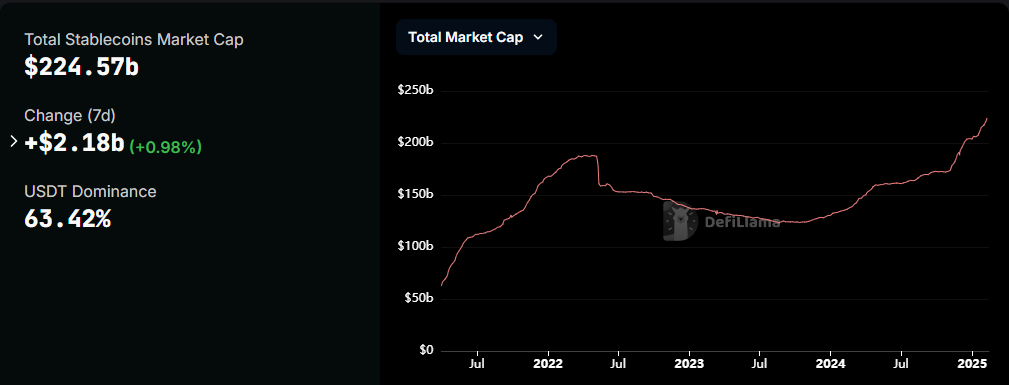

Stablecoins’ Swelling Market Capitalization

At a gathering in San Francisco, Waller did emphasize the need for a robust, all-encompassing regulatory framework within the US. He wishes to tackle the risks associated with stablecoins, ensuring they remain a vital part of the financial realm.

“The stablecoin market would benefit from a US regulatory and supervisory framework that addresses stablecoin risks directly, fully, and narrowly,” quoth Waller.

He also suggested that banks and non-banks should be allowed to issue regulated stablecoins, with clear guidelines on compliance and reserve requirements.

Lo and behold! The stablecoin market has been thriving, reaching a whopping $224.5 billion in February! This surge is a testament to stablecoins’ growing significance in the digital economy and their role in extending the reach of the US dollar beyond traditional financial institutions.

Yet, Waller cautions that stablecoins remain vulnerable to liquidity and run risks, thus the need for stringent oversight.

Stablecoins, those digital assets designed to maintain a steady value, often pegged to a specific currency like the US dollar, have seen their use cases expand significantly. However, Waller warns that fragmented regulations at the state and international levels could hinder their global scalability.

“The emergence of different global stablecoin regulatory regimes creates the potential for conflicting regulation domestically and internationally. This regulatory fragmentation could make it difficult for US dollar stablecoin issuers to operate at a global scale,” Waller didst say.

Regulation of Stablecoins: A Matter of Momentum

State regulators have been instrumental in shaping stablecoin policies, with several states already implementing or finalizing new laws. Senator Bill Hagerty, for one, introduced the GENIUS Act, which establishes a regulatory framework for payment stablecoins and enhances US dollar dominance.

“My legislation establishes a safe and pro-growth regulatory framework that will unleash innovation and advance the President’s mission to make America the world capital of crypto,” quoth Senator Hagerty.

As regulatory discussions continue at the state level, key figures in the crypto industry have weighed in on the role of stablecoins in the broader financial space. Trump’s crypto Czar, David Sacks, recently highlighted stablecoins’ potential to revolutionize global payments and financial inclusion.

“Stablecoins could potentially generate trillions of dollars’ worth of demands for US treasuries, which could lower long-term interest rates,” Sacks didst declare.

Indeed, the future of stablecoins seems bright, but their potential to extend the international role of the US dollar hinges on the successful implementation of a balanced and effective regulatory framework. 🤝

Read More

- Apothecary Diaries Ch.81: Maomao vs Shenmei!

- Mobile MOBA Games Ranked 2025 – Options After the MLBB Ban

- Gold Rate Forecast

- Batman and Deadpool Unite: Epic DC/Marvel Crossover One-Shots Coming Soon!

- Who was Peter Kwong? Learn as Big Trouble in Little China and The Golden Child Actor Dies at 73

- Hunter Schafer Rumored to Play Princess Zelda in Live-Action Zelda Movie

- 30 Best Couple/Wife Swap Movies You Need to See

- Netflix’s ‘You’ Season 5 Release Update Has Fans Worried

- Every Fish And Where To Find Them In Tainted Grail: The Fall Of Avalon

- Gachiakuta Chapter 139: Rudo And Enjin Team Up Against Mymo—Recap, Release Date, Where To Read And More

2025-02-13 16:02